Li Chang urges "measures to stabilize the stock market"...

Bloomberg "announcement possible as early as this week"

The Chinese government is reportedly considering a stock market stimulus package worth approximately 370 trillion won, which could be announced as early as this week.

Bloomberg News reported on the 22nd (local time), citing sources, that Chinese authorities are reviewing a plan to mobilize about 2 trillion yuan (approximately 370 trillion won) from offshore accounts of state-owned enterprises to establish a Securities Market Stabilization Fund. It is explained that this fund will be used to purchase mainland stocks through the Stock Connect program linking the mainland and Hong Kong stock markets.

Sources also stated that at least 300 billion yuan of domestic funds have been allocated for investing in onshore stocks through China Securities Finance Corporation and Central Huijin Investment. Central Huijin Investment is a sovereign wealth fund established in December 2003.

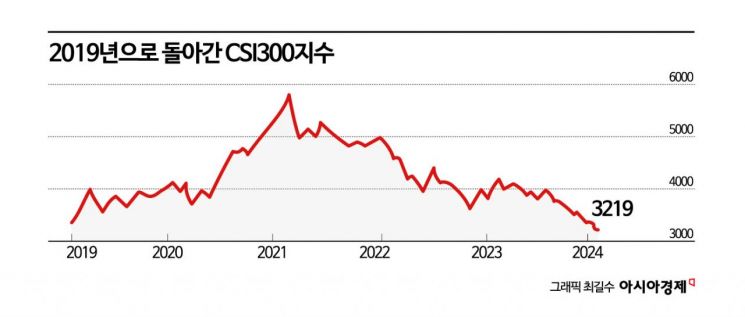

Bloomberg added, "Officials said the government is considering other options as well and may announce some of them this week after approval from the top leadership. However, the plans are subject to change, and the China Securities Regulatory Commission did not respond to requests for confirmation." It further noted, "This review reflects the urgency of Chinese authorities to prevent continued selling pressure, as the CSI300 index has fallen to its lowest level in five years. Calming domestic individual investors, who have been hit by a prolonged real estate slump, is also considered key to maintaining social stability."

Following this news, the Hong Kong Hang Seng Index rose more than 3%, and the CSI300 successfully reversed its previous day's 1.56% decline to an upward trend. The 10-year government bond yield increased by 0.01 percentage points to 2.5%.

However, Bloomberg pointed out, "It is uncertain whether these measures will be sufficient to end the downward trend," noting that "the real estate crisis, depressed consumer sentiment, sharp decline in foreign investment, and loss of corporate confidence after years of uncertain policy decisions are exerting strong downward pressure on both the economy and financial markets." It added, "Authorities have also been reluctant to implement major stimulus measures that many stock investors demand."

Meanwhile, this plan spread shortly after Premier Li Chang of China chaired a State Council executive meeting on the same day, ordering authorities to take stronger and more effective measures to stabilize the sluggish stock market and investor confidence. At the meeting, Premier Li emphasized, "We must further improve the fundamental system of the capital market, pay more attention to the balance between investment and financing, actively enhance the quality and investment value of listed companies, and increase the entry of medium-sized enterprises. We should inject long-term funds into the market to strengthen intrinsic stability and enhance capital market supervision to create a standardized and transparent market environment."

Li Weiqing, manager at JH Investment Management, said, "This statement confirmed that top policymakers consider this issue important. However, it is difficult to say whether people will start buying immediately." Marvin Chen, a strategist at Bloomberg Intelligence, evaluated, "The potential support package should be able to prevent short-term declines and stabilize the market until the Lunar New Year, but without additional measures, reversing market sentiment will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.