Paid Broadcasting to OTT Viewing Shift

So-Called 'Code Cutting' Phenomenon Becomes Reality

TV Viewing Half the Time of Phone Usage

The so-called 'cord-cutting' phenomenon, where users cancel paid broadcasting services and move to new platforms such as online video services (OTT) that do not require codes, is becoming a reality. A survey found that one out of three paid broadcasting users is considering cord-cutting.

The mobile communication research firm Consumer Insight surveyed about 20,000 paid broadcasting users from September to October last year, asking about their intention to cut the cord and the reasons behind it, and compared their characteristics.

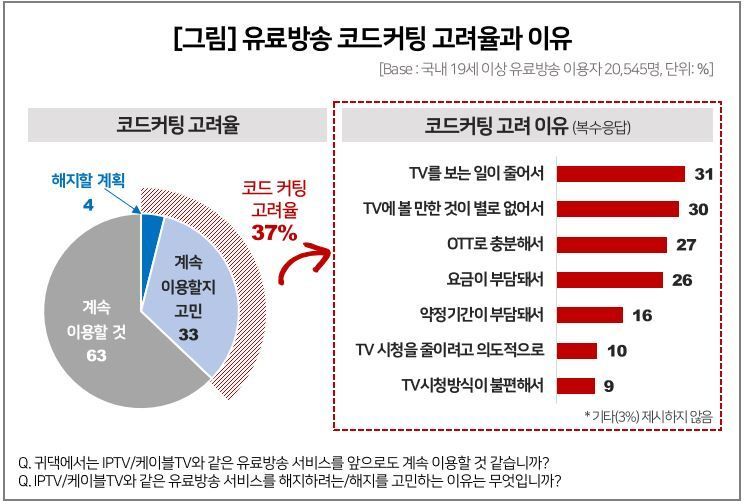

The cord-cutting consideration rate refers to the percentage of respondents who answered "I am considering whether to continue using" or "I plan to cancel" to the question, "Do you think you will continue to use paid broadcasting services such as IPTV or cable TV in the future?"

The survey results showed that 37% of paid broadcasting users, including cable and IPTV users, were considering cord-cutting. Four percent planned to cancel, and 33% were considering it. This means that more than one in three users are weighing the option of canceling paid broadcasting.

By broadcasting type, cable TV users had a higher consideration rate at 41% compared to IPTV users at 36%. By gender, women (39%) were more likely than men (36%) to consider cord-cutting. By age group, those in their 30s had the highest rate at 42%, followed by those in their 20s and 40s (each 39%), and teenagers at 38%. Those in their 50s (34%) and 60s and older (31%) had relatively lower rates.

The reasons for considering cord-cutting (multiple responses allowed) were similar in level: △ watching TV less often (31%) and △ not much worth watching on TV (30%), followed by △ sufficient OTT content (27%) and △ burden of fees (26%). Among the age group with the highest intention rate, the 30s, "sufficient OTT content" stood out at 36%.

One in three paid broadcasting users have reduced their TV viewing time enough to consider canceling their subscription, while their OTT viewing time, such as Netflix, is increasing.

One in three paid broadcasting users have reduced their TV viewing time enough to consider canceling their subscription, while their OTT viewing time, such as Netflix, is increasing.

The decrease in TV viewing is a trend driven by the rise of new media such as smartphones, games, and OTT. In fact, the average daily TV viewing time was 2.0 hours, which was far less than half of the average smartphone usage time (4.8 hours). Of the TV viewing time, 28% was spent watching OTT. The proportion of VOD viewing was 9%, and the proportion of live broadcast viewing, the original function, was 63%.

The three IPTV companies are increasing partnerships with OTT providers to attract OTT viewers back to TV. They offer services that allow users to browse multiple OTT channels at once, compare prices, and enjoy AI-based curation.

A Consumer Insight official said, "With the widespread use of smart TVs that can watch OTT as long as there is an internet connection, viewers who mainly watch OTT have less reason to pay monthly fees to maintain paid broadcasting," adding, "It seems difficult to compete with the OTT trend, which allows users to choose almost unlimited content from various genres without restrictions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)