'Hedged' Korean Asset Purchases See Increased Demand for 'Contractual Purchases'

As of the 23rd, 34 Complexes Nationwide Designated as 'Safe Complexes'

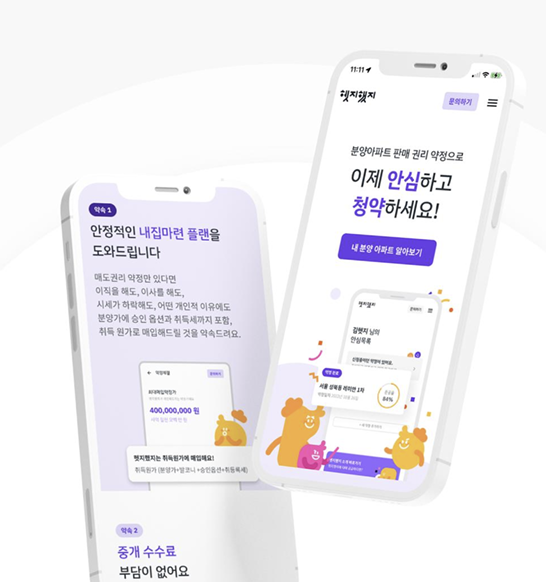

As the real estate market cools down, more buyers and developers are using the ‘contract purchase’ service that allows selling an apartment at the time of move-in after winning a subscription. If the price drops or cash liquidity worsens at the time of move-in after winning the subscription, the apartment can be sold at the acquisition cost, leading to a gradual increase in users.

According to Korea Asset Purchase, which provides the Safe Purchase Contract service (‘Hedgehaetji’), as of the 23rd, there are 34 Safe Contract complexes nationwide. Safe Contract complexes are recruited only within 30 days from the date of the legitimate contract when the initial subscription winners actually sign the contract, so the number of complexes changes frequently. However, recently, Safe Contract complexes have been continuously increasing in Seoul and the metropolitan area. Representative examples include Imun I-Park Xi, Cheonggye Riverview Xi, Cheolsan Xi Briere, and Sangdo Prugio Clavenue.

The main demand for Safe Purchase Contracts is divided into two groups: general buyers and suppliers (developers). Buyers join directly and pay fees, or developers pay the fees on their behalf. When a buyer who has completed the legitimate contract after winning the subscription applies for membership, Korea Asset Purchase reviews whether the sale price is appropriate and the risk is low to decide whether to approve the purchase contract. If approved, the buyer pays a fee and can sell the apartment to Korea Asset Purchase at the acquisition cost at the time of move-in. The service fee ranges from 0.5% to 1.5% of the sale price, with an average fee of 0.4%. Fees vary depending on the complex or unit number.

Although fees vary depending on apartment prices, the fact that buyers can sell subscription apartments at fees cheaper than brokerage commissions also acts as a factor attracting buyers to the service. In Seoul, the real estate brokerage commission rate is 0.4% for properties priced between 200 million KRW and less than 900 million KRW, and 0.5% for those between 900 million KRW and less than 1.2 billion KRW. A Korea Asset Purchase official explained, "Purchased apartments are either sold or operated as public-type private rental housing before being sold. Since a legal representative signs the sales contract, no additional brokerage commission is incurred."

Developers aiming to boost initial subscription rates are also joining. Offering the opportunity to exercise the purchase claim right at the time of move-in can reduce buyers’ anxiety more than promotions such as giveaways, paybacks, or discounted sales. From the developer’s perspective, increasing the initial subscription rate improves cash flow and reduces risks such as construction delays.

No Hyun-min, director of Korea Asset Purchase, said, "The initial subscription rate is important for developers, and as some sites are undervalued depending on market conditions, inquiries about purchase contracts have recently increased. Since we have a limit on what we can handle, we will thoroughly manage the situation to prevent excessive occurrences of purchase claims." It is expected that the first complexes to exercise purchase claims among those subscribed to the purchase contract service will appear from 2026.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.