Loss ratios of small and medium non-life insurers improved, but results vary by company

Intense competition in auto insurance this year with win-win finance and platform launches

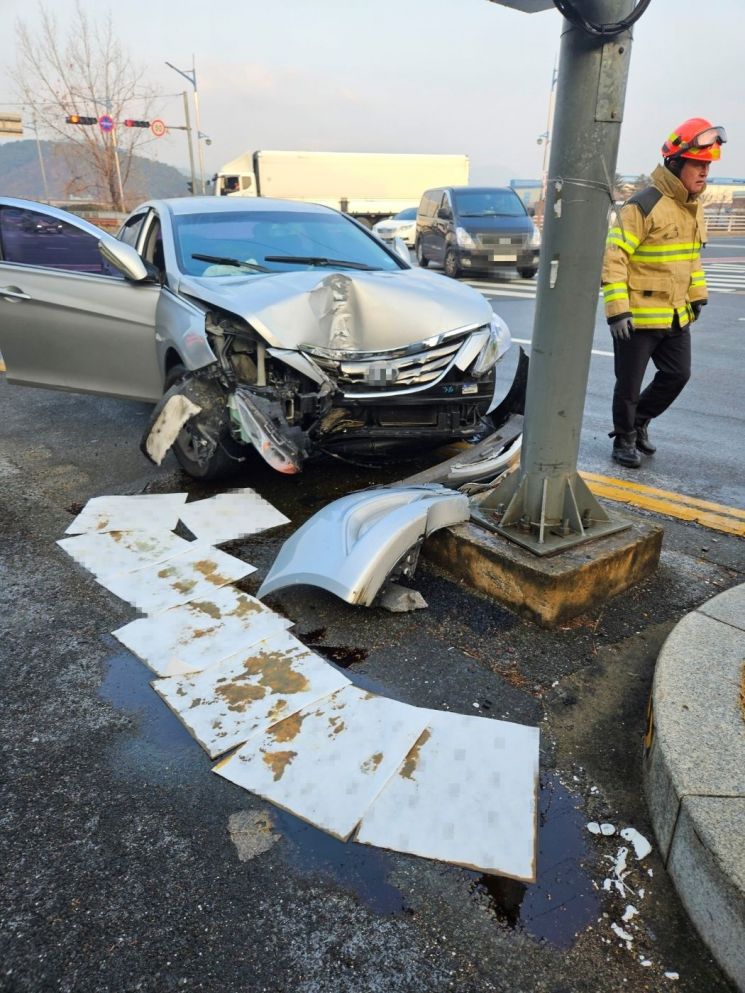

The loss ratio of automobile insurance for major non-life insurance companies has shown a slight improvement.

According to the non-life insurance industry on the 22nd, the automobile insurance loss ratio of four major non-life insurers?Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, and KB Insurance?averaged 80% last year (simple average of the four companies), down 0.4 percentage points from the previous year (80.4%). The loss ratio is the ratio of insurance claims paid to premiums received. Since about 20% of automobile insurance premiums are spent on operating expenses (such as premium calculation and fault ratio verification), the industry generally considers a loss ratio of 80% as the breakeven point.

Samsung Fire & Marine Insurance, which holds the largest market share in the industry, had a loss ratio of 81% last year, improving by 0.7 percentage points compared to the previous year (81.7%). During the same period, Hyundai Marine & Fire Insurance’s loss ratio decreased from 80.3% to 79.6%, and DB Insurance’s from 79.4% to 79.2%. KB Insurance’s loss ratio remained the same at 80.2%. These four insurers account for nearly 85% of the automobile insurance market. A representative from a major non-life insurer explained, "Last year, damage from natural disasters such as typhoons and heavy rain was relatively low," adding, "Usually, there are many vehicle accidents caused by black ice in December, but last year, the temperature was higher than usual, reducing related accidents."

Among the five small and medium-sized non-life insurers excluding the automobile insurance 'Big 4,' the loss ratio improved by 2.1 percentage points from 90.3% in 2022 to 88.2%. However, results varied by company. MG Insurance’s loss ratio dropped by 10 percentage points from 115.8% to 105.8%. Lotte Insurance also improved from 87.8% to 82%. On the other hand, Meritz Fire & Marine Insurance (79.1%→80.9%), Hanwha General Insurance (79.6%→81.2%), and Heungkuk Fire & Marine Insurance (89.4%→91.4%) saw their loss ratios increase. Except for Meritz Fire & Marine Insurance, most small and medium-sized insurers are not making significant profits from automobile insurance.

Automobile insurance has been a 'gye-reuk' (a burdensome yet indispensable product) to non-life insurers, causing about 9 trillion KRW in losses from 2010 to 2020. The only times non-life insurers made a profit from automobile insurance were in 2017 and during the three years of the COVID-19 pandemic. For small and medium-sized insurers, automobile insurance is a product they cannot avoid selling even at a loss.

The automobile insurance market situation remains challenging this year as well. Under government pressure for 'win-win finance,' major non-life insurers have decided to reduce automobile insurance premiums by about 2.5% this year. Samsung Fire & Marine Insurance and KB Insurance plan to lower personal automobile insurance premiums by 2.6% starting from new and renewal contracts in mid-February. Hyundai Marine & Fire Insurance and DB Insurance plan to reduce premiums by 2.5%. Meritz Fire & Marine Insurance intends to cut premiums by 3%, while Hanwha General Insurance and Lotte Insurance plan to reduce them by 2.5% and 2.4%, respectively.

Price competition between major and small-to-medium non-life insurers is also expected to intensify on the insurance comparison and recommendation platform launched on the 19th. The platform’s commission fee of about 3% is not insignificant. Additionally, starting this year, the hourly labor cost for automobile insurance repair fees will increase by 3.5% compared to the previous year, potentially increasing the loss per accident. This is expected to have a negative impact on loss ratio improvement.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)