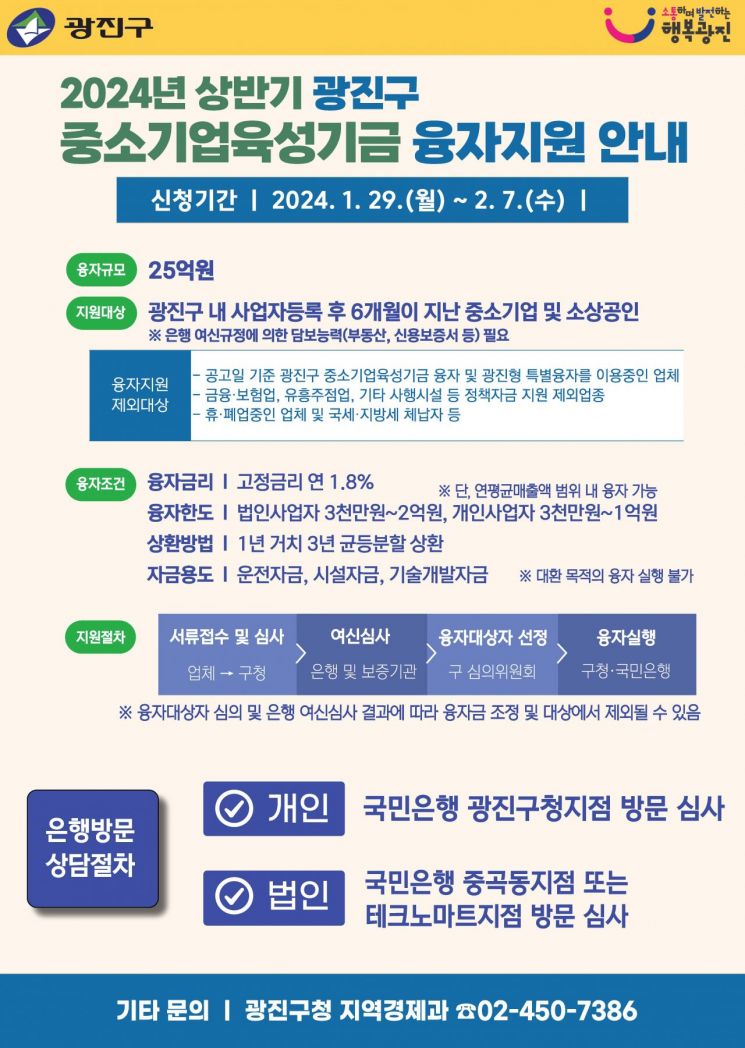

Applications open from January 29 to February 7, with 2.5 billion KRW loan support in the first half... Targeting small and medium enterprises and small business owners registered in Gwangjin-gu for over 6 months as of the announcement date

Gwangjin-gu (District Mayor Kim Kyung-ho) is implementing the "2024 First Half Small and Medium Enterprise Development Fund Loan Support" to reduce the financial burden on small and medium-sized enterprises (SMEs) and small business owners and to promote business growth.

The district will provide loans from the Small and Medium Enterprise Development Fund totaling 2.5 billion KRW in the first half of this year.

Above all, a fixed interest rate of 1.8% per annum, which is lower than the market rate, will be applied to support stable management. Corporate businesses can borrow between 30 million KRW and 200 million KRW, while individual businesses can borrow between 30 million KRW and 100 million KRW. However, loans are only available within the range of the average annual sales.

The funds can be used for operating capital, facility funds, or technology development funds, and repayment is to be made in equal installments over three years after a one-year grace period.

Eligible applicants are SMEs and small business owners who have registered their business in Gwangjin-gu for more than six months as of the announcement date, January 22. Additionally, applicants must have collateral capability according to bank credit regulations, such as real estate or credit guarantees.

Businesses currently using loan support products, those that are temporarily closed or out of business, those with overdue national or local taxes, and certain industries such as finance, insurance, entertainment bars, and other gambling facilities are excluded from support.

The application period is from January 29 to February 7. Those wishing to apply should prepare the loan application form, business plan, and other required documents and visit the Regional Economy Division. Further details can be found in the announcement section on the Gwangjin-gu Office website.

Kim Kyung-ho, Mayor of Gwangjin-gu, said, "We hope this will be of great help to SMEs and small business owners struggling due to the economic downturn," and added, "We will do our best to provide various supports to stabilize management and improve the business environment for SMEs and small business owners."

The district is also promoting the "Gwangjin-type Special Loan" for small business owners who cannot receive loans from the Small and Medium Enterprise Development Fund due to lack of credit or collateral.

The loan limit is up to 70 million KRW, and the district will support 2% interest for two years after the loan is executed. Interested parties can consult by phone and then visit the Gwangjin branch of the Seoul Credit Guarantee Foundation to proceed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)