Last Year ELS Issuance Amount 62.8 Trillion Won...8.9% Increase

Decrease in ELS Issuance Amount Based on H Index Underlying Assets

Last year, the issuance amount of equity-linked securities (ELS) based on the Hong Kong H Index slightly decreased. This is interpreted as a result of reduced investment demand for these products due to defaults occurring in H Index-linked ELS and others. On the other hand, supported by the bullish trend in the Japanese stock market, the issuance amount of ELS based on the Nikkei 225 (NIKKEI225) surged by 155%.

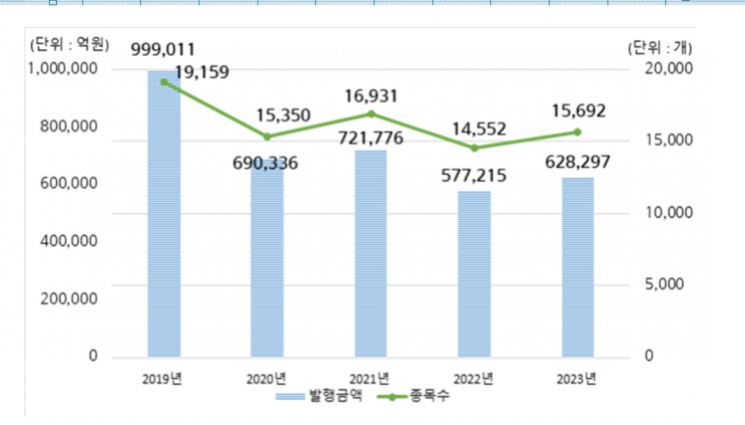

According to the Korea Securities Depository on the 22nd, the issuance amount of ELS last year was 62.8 trillion KRW, an 8.9% increase compared to the previous year (57.7 trillion KRW).

By issuance type, public offerings accounted for 94.2% (59.1989 trillion KRW) of total ELS issuance, while private placements accounted for 5.8% (3.6308 trillion KRW).

The public offering amount increased by 9.8% from the previous year (53.9166 trillion KRW), whereas the private placement amount decreased by 4.6% compared to the previous year (3.8049 trillion KRW).

ELS based on indices, including overseas indices, accounted for 51.3% (32.2008 trillion KRW) of total issuance, while ELS based on domestic individual stocks accounted for 38.3% (24.0556 trillion KRW).

For ELS based on the overseas index S&P 500, 27.9354 trillion KRW was issued, a 10.6% increase from the previous year. During the same period, ELS based on the EUROSTOXX50 index saw issuance of 25.6 trillion KRW, a 2.9% increase. The scale of ELS issued based on the NIKKEI225 was 11.172 trillion KRW, showing a 155.7% increase compared to the previous year. As the Japanese stock market showed strength, demand for ELS products based on the Japanese index increased, which appears to have led to the rise in ELS issuance linked to the Nikkei.

ELS based on the HSCEI (Hang Seng China Enterprises Index) had an issuance amount of 5.3973 trillion KRW last year, a 1.3% decrease from the previous year (5.466 trillion KRW). During the same period, ELS based on the HSI (Hang Seng Index) saw issuance decrease by 22.3%. The reduction in issuance amounts of H Index-linked ELS is attributed to the decline in Hong Kong and Hong Kong stock indices, which led to decreased investment demand for ELS.

ELS issuance based on the domestic index (KOSPI 200) was 18.3 trillion KRW, a 15.7% decrease compared to the previous year (21.7 trillion KRW).

By issuing company, Meritz Securities had the largest issuance amount of ELS at 7.0444 trillion KRW. The top five companies including Meritz Securities (Mirae Asset, Hana, Korea Investment, Shinhan Investment) had a combined ELS issuance amount of 30.6045 trillion KRW, accounting for 48.7% of total ELS issuance.

The redemption amount of ELS was 66.6654 trillion KRW, a 49.2% increase from the previous year (44.7 trillion KRW). Early redemption accounted for the largest share at 56.1% (37.4 trillion KRW), followed by maturity redemption (27 trillion KRW, 40.4%) and mid-term redemption (2.3 trillion KRW, 3.5%).

By redemption type, maturity redemption amounted to 26.9557 trillion KRW, accounting for 40.4% of total redemption. Early redemption and mid-term redemption were recorded at 37.4125 trillion KRW (56.1%) and 2.2972 trillion KRW (3.5%), respectively.

As of the end of last year, the outstanding balance of unredeemed ELS issuance was 67.1 trillion KRW, a 5.3% decrease compared to the previous year (70.9 trillion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.