Fintech Companies Compete with Discounts from Service Launch

Jongsosonbo Insurance Leads with Competitive Auto Insurance Pricing

"Sign up for car insurance on our platform and get discounts."

"Even with the same special coverage, our insurance is the most affordable."

An insurance comparison and recommendation platform involving 40 insurance companies and 11 fintech firms officially launched at 9 a.m. on the 19th. Following loans and deposits, the platform system for the three major financial products has been completed. Consumers are expecting increased benefits as price competition among insurance products and service competition among platforms unfold.

The insurance comparison platform uses various data to easily recommend multiple insurance company products to consumers. Eleven fintech companies, designated as innovative financial service providers last July, operate the platform in partnership with life and non-life insurance companies.

Starting today, car insurance and cancer insurance comparison and recommendation services are available. The car insurance comparison and recommendation service, with 25 million subscribers, involves 7 fintech companies and 10 non-life insurers handling online car insurance. The cancer insurance comparison and recommendation service includes 1 fintech company (Cocoon) and 5 life insurers. Various insurance product comparison and recommendation services such as indemnity, savings, travel, and pet insurance are expected to launch within the year.

Fintech companies have already entered service competition by offering tens of thousands of won worth of their own points or discount coupons. BankSalad returns up to 30,000 won (2% of the premium) to customers who sign up for car insurance through its platform. Fink also provides up to 30,000 won in Fink Money when checking and signing up for car insurance. Since car insurance price comparison is conducted by entering vehicle information, the service also includes the ability to check the current market value of the vehicle simultaneously. Habit Factory simplified coverage selection options into basic, practical, and premium categories so users can easily choose coverage. Big tech companies like Naver Pay and Kakao Pay updated their applications to coincide with the platform launch and introduced customized services linked with their big data and technological capabilities.

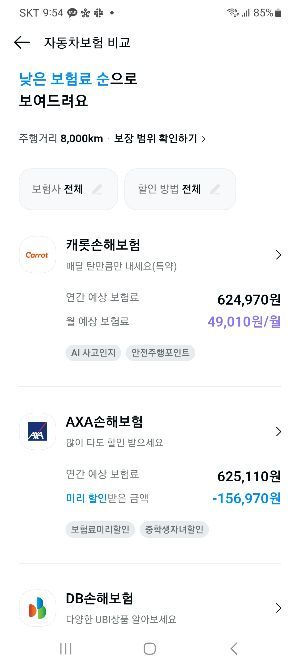

A screen showing a car insurance recommendation on KakaoPay's insurance comparison and recommendation platform on the 19th.

A screen showing a car insurance recommendation on KakaoPay's insurance comparison and recommendation platform on the 19th. [Photo by KakaoPay]

Accessing the Kakao Pay platform to receive car insurance recommendations and sorting by price revealed that products from small and medium non-life insurers were prominently displayed at the top. These companies secured considerable price competitiveness compared to large non-life insurers on this insurance comparison platform. Large non-life insurers applied platform rates (PM) to their premiums when listing products on the platform, whereas small and medium insurers set direct channel (CM) rates identical to those on their own websites. The premium rate is the ratio of the insurance premium to the insured amount. Insurers calculate premium rates differently depending on the sales channel, such as face-to-face, CM, or telemarketing (TM). CM premiums are the cheapest.

The financial authorities plan to closely monitor the service going forward, analyze market impact and consumer protection, and review directions for system improvements. Kim Joo-hyun, Chairman of the Financial Services Commission, held a review meeting ahead of the platform launch the day before and said, "Insurance products are closely related to daily life but have high information asymmetry, so the perceived service utility for consumers will be significant." He urged, "Both the fintech industry and the insurance industry should strengthen mutual cooperation with the mindset of being one team from the perspective of innovation for consumers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.