Sparkling Wine Imports Reach $100 Million

Low Alcohol and Carbonation Reduce Burden

Consumption Surges with Premiumization of Taste

"Watching the white bubbles rise seems to relieve some of the stress accumulated throughout the day."

# Office worker Han Jun-woo wraps up his day by having a glass of sparkling wine either before or after dinner after work. The refreshing sound of bubbles rising in the glass and the pleasant sensation of the bubbles tickling and breaking softly in his mouth are the reasons he keeps reaching for sparkling wine. Han said, "It has a relatively low alcohol content and carbonation, so even my wife, who doesn't usually drink, can enjoy it without feeling burdened," adding, "Champagne tends to be pricey, so we usually drink it on weekends or when we have more leisure time, while on weekdays we mostly drink Cava or Prosecco in the 10,000 to 20,000 KRW range."

While the domestic wine market, which grew rapidly during the COVID-19 pandemic, is currently stagnating due to weakened consumer sentiment and the rising popularity of whiskey highballs, sparkling wine is persevering and continuing its growth, having surpassed $100 million in import value for the first time ever. Its relatively low alcohol content and refreshing carbonation make it less burdensome to drink, and as consumer tastes become more sophisticated, the average purchase price has increased, which is cited as the cause.

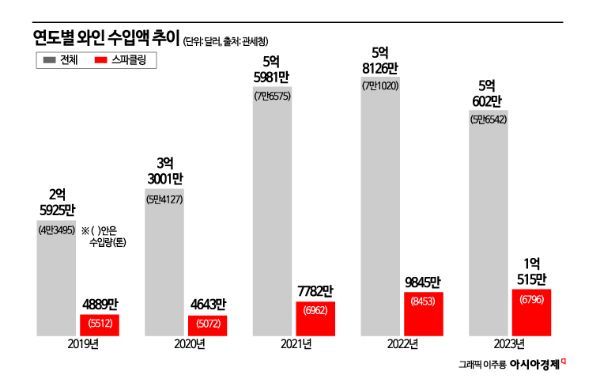

According to export-import trade statistics from the Korea Customs Service on the 19th, last year’s domestic wine import value was $506.02 million (approximately 679 billion KRW), down 12.9% from the previous year ($581.26 million). The import volume decreased even more sharply, recording 56,542 tons, a 20.4% drop from 71,020 tons in 2022. While the overall wine import scale shrank, sparkling wine showed a different trend. Last year, the import value of sparkling wine in Korea was $105.15 million (about 142 billion KRW), up 6.8% from the previous year ($98.45 million). Compared to $46.43 million (about 62 billion KRW) in 2020, the figure more than doubled in three years.

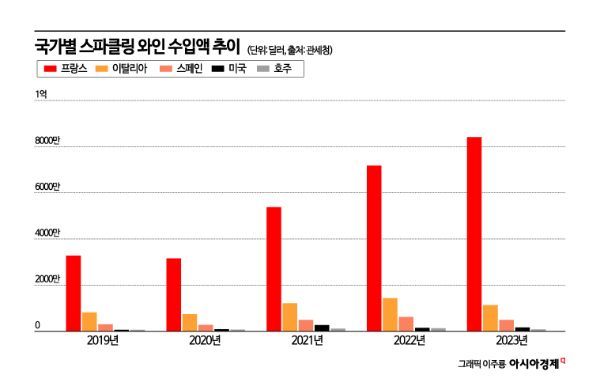

By country of origin, France, represented by Champagne, ranked first with $84.12 million (about 113 billion KRW), accounting for over 80% of the total import value. Considering that French wine accounts for about 40% of the total wine import value, the preference for French sparkling wine is overwhelming. Italy, which produces Spumante, ranked second with $11.29 million, Spain, the producer of Cava, was third with $4.92 million, followed by the United States ($1.68 million) and Australia ($790,000).

The reason sparkling wine continues to perform well amid the sluggish wine market due to weakened consumer sentiment and changing preferences is its low entry barrier. Unlike regular still wine, sparkling wine contains carbonation and emphasizes a refreshing style, making it a wine that domestic consumers, accustomed to beer and carbonated drinks, can enjoy without burden. In particular, the sweet sparkling wine ‘Moscato d’Asti’ from the Piedmont region of Italy, with its relatively low alcohol content and sweetness, has been regarded as an introductory wine and has led the domestic sparkling wine market since the 2010s.

The sophistication of domestic alcoholic beverage consumers’ tastes is also cited as a cause of growth. Last year, the import volume of sparkling wine was 6,796 tons, a 19.6% decrease from the previous year (8,453 tons) despite the increase in import value. This indicates that the price per bottle is rising. Experts agree that as wine experience accumulates and tastes become more refined, preference for premium sparkling wines with complex flavors inevitably increases. The epitome of premium sparkling wine is Champagne, and the recent increase in imports of French sparkling wine is connected to this trend. Among sparkling wines, only those produced by the traditional method in the Champagne region of France are called Champagne.

With the domestic wine market expected to find it difficult to achieve a dramatic rebound this year following last year, the industry expects sparkling wine to continue its growth. Sparkling wine aligns with the recent trend of enjoying alcohol lightly, and as the domestic wine market matures, consumer tastes are becoming more segmented.

However, the tendency for prices to be divided between high-end and mid-to-low-end is expected to intensify. A representative from Ayang FBC explained, "Champagne is perceived as glamorous and luxurious, making it a popular item for various celebrations and social media postings," adding, "As wine becomes more popular, more people are choosing Champagne as a drink for special occasions." A representative from Kumyang International also said, "Although Champagne’s popularity is increasing every year, production volume is expected to decrease due to abnormal weather, leading to price increases," and predicted, "Demand for sparkling wines like Franciacorta or Cava, which can substitute Champagne but are reasonably priced, will also increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)