Implementation of Differentiated Indemnity Insurance Premiums in July

Check Discounts and Surcharges via Website and App

Service Scheduled from May

The Financial Supervisory Service announced on the 19th that it will establish a non-reimbursable insurance claim inquiry system in preparation for the fourth-generation non-reimbursable insurance premium differentiation system to be implemented in July.

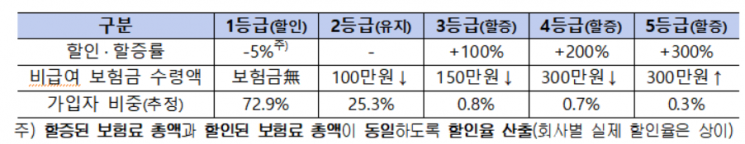

The non-reimbursable premium differentiation system classifies policyholders into 1 to 5 grades based on the amount of non-reimbursable insurance claims received during the one year prior to premium renewal, and discounts or surcharges the non-reimbursable (special contract) premiums accordingly. It was introduced to prevent excessive medical shopping by some insured individuals.

If no non-reimbursable actual loss insurance claims were received during the year, the premium will be discounted. If the amount is less than 1 million KRW, the existing premium remains unchanged. For amounts between 1 million KRW and less than 1.5 million KRW, the premium is surcharged by 100%; between 1.5 million KRW and less than 3 million KRW, surcharged by 200%; and 3 million KRW or more, surcharged by 300%.

4th Generation Actual Loss Insurance Non-Covered Insurance Premium Differentiation System.

4th Generation Actual Loss Insurance Non-Covered Insurance Premium Differentiation System. Photo by Financial Supervisory Service

All surcharge amounts will be used as funds for premium discounts. The discount and surcharge grades will be maintained for one year after renewal. Upon premium renewal after one year, the premium will be recalculated based on the pre-discount and pre-surcharge premium.

However, this differentiation system does not apply to medical expenses related to designated special diseases (such as cancer, heart, cerebrovascular, and rare incurable diseases) and to elderly long-term care recipients in grades 1 and 2.

The Financial Supervisory Service is establishing the claim inquiry system to help consumers manage their non-reimbursable medical usage rationally in accordance with the implementation of the differentiation system.

Once the system is established, fourth-generation actual loss insurance subscribers will be able to check non-reimbursable premium discount and surcharge details anytime on individual insurance company websites or applications (apps). The service is scheduled to launch in May.

The main inquiry items include the cumulative amount of non-reimbursable insurance claims received, premium discount and surcharge levels, the remaining non-reimbursable claim amount until the next surcharge level, and necessary documents for applying for discount or surcharge exemptions. A Financial Supervisory Service official stated, "We plan to revise the insurance supervision business implementation rules in April to introduce the non-reimbursable insurance claim inquiry system," adding, "We will continue to improve the system to enhance consumer convenience related to the system implementation, inquiry system establishment, and operation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.