Platform Launch on the 19th... First Introduction of Auto Insurance and Polyp Insurance

Sequential Release of Indemnity, Savings, and Pet Insurance

The Financial Services Commission announced on the 18th that it held a meeting at the General Insurance Association located in Jongno-gu, Seoul, to review the service ahead of the launch of the insurance product comparison and recommendation platform.

At the meeting, Financial Services Commission Chairman Kim Ju-hyun checked the preparation status for the insurance comparison and recommendation platform set to launch on the 19th. He directly demonstrated the automobile insurance comparison and recommendation service and examined potential inconveniences consumers might experience when using the service. Chairman Kim said, "The financial authorities have set enhancing consumer welfare through fair competition as a key policy direction and have introduced comparison and recommendation services for the three major financial product platforms: loans, deposits, and insurance," adding, "Insurance products are closely related to daily life but have high information asymmetry, so the service utility perceived by consumers is expected to be significant."

Chairman Kim urged the fintech and insurance industries to strengthen mutual cooperation with the mindset of being one team from the perspective of innovation for consumers. Park Sang-jin, CEO of Naver Financial, and Kim Jong-hyun, CEO of Kucon, who attended the meeting, responded that since the platform is the contact point where insurance companies and consumers meet, they will enhance the comparison and recommendation functions to enable consumers to use the service more conveniently and strengthen cooperation with insurance companies by handling various insurance products.

Representatives from four insurance companies?Seo Guk-dong, CEO of NH Insurance; Lee Sung-jae, CEO of Hyundai Marine & Fire Insurance; Pyeon Jeong-beom, CEO of Kyobo Life Insurance; and Kim Jae-sik, CEO of Mirae Asset Life Insurance?also promised to work hard to launch follow-up products such as indemnity insurance and savings insurance to help activate the platform.

The insurance comparison and recommendation platform is a service that compares online insurance products from multiple insurance companies and recommends suitable insurance products through platforms operated by 11 fintech companies designated as innovative financial service providers in July last year. Since being designated as an innovative financial service, the insurance and fintech industries have formed a consultative body and signed a business agreement in November last year to prepare for the service launch. During the consultation process, data was standardized (using standard APIs) to enable efficient system development for small and medium-sized platform companies. As a result, various small and medium-sized fintech companies can now also launch comparison and recommendation services.

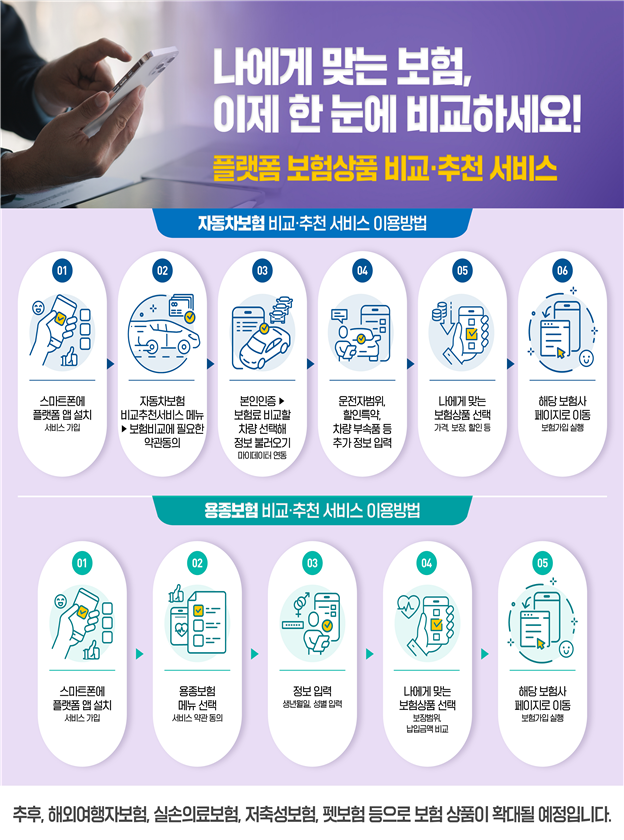

From 9 a.m. on the 19th, automobile insurance and cancer insurance comparison and recommendation services will begin. The automobile insurance comparison and recommendation service, which has about 25 million subscribers, will involve seven fintech companies and ten general insurance companies handling online automobile insurance. The cancer insurance comparison and recommendation service will involve one fintech company (Kucon) and five life insurance companies.

The seven fintech companies launching first have conducted verification of comparison and recommendation algorithms according to the additional conditions of the innovative financial service. Measures to prevent consumer damage and unfair competition that may occur during service operation have also been prepared.

Through the platform insurance product comparison and recommendation service, consumers can compare products from multiple insurance companies at once based on various criteria (such as lowest premium and maximum coverage) and receive personalized product recommendations. They can also check and compare detailed information on insurance riders. This is expected to enable consumers to subscribe to products more suitable for themselves at lower prices.

In addition to automobile insurance and cancer insurance, various insurance product comparison and recommendation services for indemnity insurance, savings insurance, travel insurance, pet insurance, credit insurance, and others are expected to be launched within the year.

A Financial Services Commission official stated, "The financial authorities will closely monitor the service usage during the operation period, thoroughly analyze the impact on the recruitment market, consumer protection, and fair competition, and review directions for institutional improvements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)