Lexington Partners Raises $23 Billion

Expands Assets Under Management Amid Rising Demand

Anticipation of Peak in Secondary Market

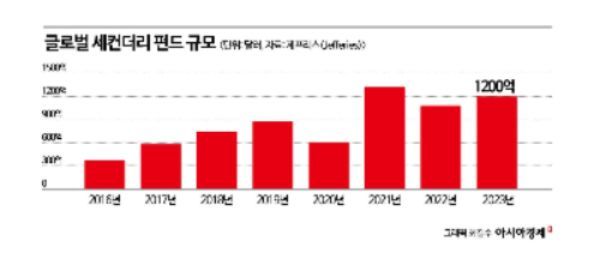

Massive funds are pouring into secondary funds that buy undervalued startup shares. This is interpreted as due to expectations that the impact of interest rate cuts will be reflected only in the second half of the year, leading to anticipation that the secondary market will peak this year. Secondary funds refer to funds that purchase difficult-to-sell company stocks from institutional investors such as private equity funds and venture capital (VC) at discounted prices.

According to the global investment industry on the 18th, Lexington Partners, a secondary fund manager, recently announced plans to raise $23 billion for a secondary fund from institutional investors. Initially targeting $15 billion, it is analyzed that the fund size was significantly expanded due to strong demand.

StepStone, one of the top 10 global VCs, is also reportedly raising tens of billions of dollars to form a secondary fund. StepStone has raised a total of $1.25 billion so far for this purpose and is said to have set a target more than twice that amount. A VC industry insider said, "This means that a high level of new capital has recently been flowing into the secondary market."

Secondary funds are especially attracting attention in the current high-interest-rate era. As economic uncertainty has caused IPO and M&A deal volumes to dwindle, many companies cannot receive proper valuations. The interests of existing investors needing liquidity and new investors who can purchase startup shares at cheap prices have aligned.

Tom Callahan, CEO of Nasdaq Private Market, emphasized, "The main exit strategies for VCs are usually IPOs and M&As, but recently these have not occurred much," adding, "This ultimately creates a tremendous opportunity to buy companies at discounted prices through secondary funds."

Nevertheless, last year, the secondary market was not as active as expected due to a large gap between the desired prices of buyers and sellers. Callahan pointed out, "For the past two years, VC firms have been demanding prices about 30% higher than what buyers hoped for." However, Marcus New, CEO of trading platform InvestX, said, "As the impact of high interest rates continues, the valuation gap has started to narrow, which has led to an increase in the supply of shares for sale recently."

Many Wall Street experts predict that the secondary market is likely to peak this year. This is because IPO and M&A deal volumes are expected to increase only after the second half of the year when the effects of interest rate cuts are reflected in the market. Marcus New, CEO, said, "Before the IPO market recovers, those trying to enter the (secondary) market can acquire shares at low prices."

Hans Swildens, founder of Industry Ventures, said, "Company valuations will be adjusted in earnest this quarter," adding, "There may be price declines across the market, and if that happens, deal volumes are expected to surge." He added, "The coming months will be the best time in the past 50 years to purchase this type of security."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)