Global Semiconductor Sales Fell 11.1% Last Year

Memory Sales Dropped 37%, Showing Largest Decline

NVIDIA Enters Top 5 for First Time Thanks to AI Semiconductor Impact

SK Hynix Drops Two Ranks from 4th to 6th Place

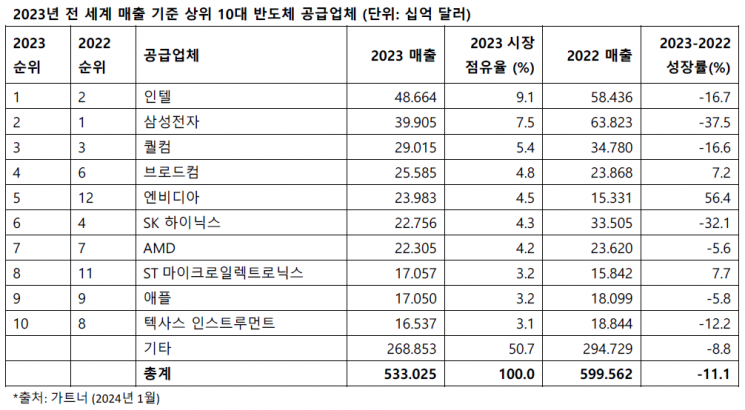

Samsung Electronics ranked second in global semiconductor sales last year, falling behind the US company Intel. US-based Nvidia entered the top 5 for the first time as its sales surged due to the impact of artificial intelligence (AI) semiconductors.

According to market research firm Gartner on the 17th, Samsung Electronics' semiconductor sales last year amounted to $39.95 billion, a 37.5% decrease compared to the previous year. Samsung's semiconductor market share last year was 7.5%, dropping one rank from first to second place.

Intel also saw its sales decline by 16.7% year-on-year but recorded $48.664 billion in sales, capturing a 9.1% market share and securing the top spot. Although it had been ranked second behind Samsung Electronics since 2021, Intel reversed the rankings again after two years.

Amid a downturn in the semiconductor industry last year, global semiconductor companies faced difficulties, with Samsung Electronics’ sales decline being more pronounced than Intel’s. This is likely because Samsung focuses on memory semiconductors, which are more affected by economic conditions, whereas Intel centers on system semiconductors (non-memory).

In fact, while global semiconductor sales last year ($533.025 billion) decreased by 11.1% compared to the previous year, memory sales dropped sharply by 37%. By memory product category, DRAM sales fell 38.5% to $48.4 billion, and NAND flash sales decreased 37.5% to $36.2 billion.

On the other hand, non-memory sales declined by only 3% year-on-year. Gartner VP analyst Jo Unsworth said, "Unlike memory suppliers, most non-memory suppliers experienced relatively favorable pricing conditions last year," adding, "The strongest growth driver was non-memory demand for AI applications."

From third place onward, US companies Qualcomm, Broadcom, Nvidia, SK Hynix, and US-based AMD ranked in order.

In Nvidia’s case, sales surged 56.4% year-on-year to $23.983 billion last year, pushing its ranking from 12th in 2022 to 5th last year. Its market share was 4.5%. Gartner explained that Nvidia entered the top 5 for the first time ever due to the AI semiconductor effect.

SK Hynix’s sales last year ($22.756 billion) fell 32.1% year-on-year, recording a 4.3% market share and dropping two ranks from 4th to 6th place. Due to its nature as a memory company, the sales decline was relatively larger, similar to Samsung Electronics.

Gartner VP analyst Allen Priestley explained, "Although the semiconductor industry cycle restarted last year, the market experienced a difficult year as memory sales recorded the worst decline ever," adding, "The weak market conditions negatively affected several semiconductor suppliers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.