[K-Convenience Store Global 1000th Store Era]④

CU and Emart24 Expand Nationwide After Entry

K-Food Popularity with Hallyu Wave: Cupbap, Tteokbokki, and More

About an hour's drive north from Kuala Lumpur International Airport brought us to the heart of Kuala Lumpur (KLCC·Kuala Lumpur City Centre), the capital of Malaysia. Passing by the city's symbol, the Petronas Twin Towers, a familiar signboard appeared. It was CU, a convenience store brand operated by BGF Retail. The shelves were filled with Korean ramen, snacks, and beverages. From the signboard to the products, it looked like a Korean CU store transplanted directly. What was different was seeing a local woman wearing a hijab eating Samyang Foods' 'Buldak Bokkeum Myun' at a small table inside the store. A CU official said, "Currently, we operate stores only in major cities including Kuala Lumpur," but added, "In the future, this scene will be found in all cities."

CU store located inside Gardens Mall, a mega shopping mall in Kuala Lumpur, Malaysia. Even on the day the reporter visited, many locals continued to visit. Photo by Seongpil Jo. @gatozz

CU store located inside Gardens Mall, a mega shopping mall in Kuala Lumpur, Malaysia. Even on the day the reporter visited, many locals continued to visit. Photo by Seongpil Jo. @gatozz

K-Convenience Stores Land in Malaysia Riding the Korean Wave

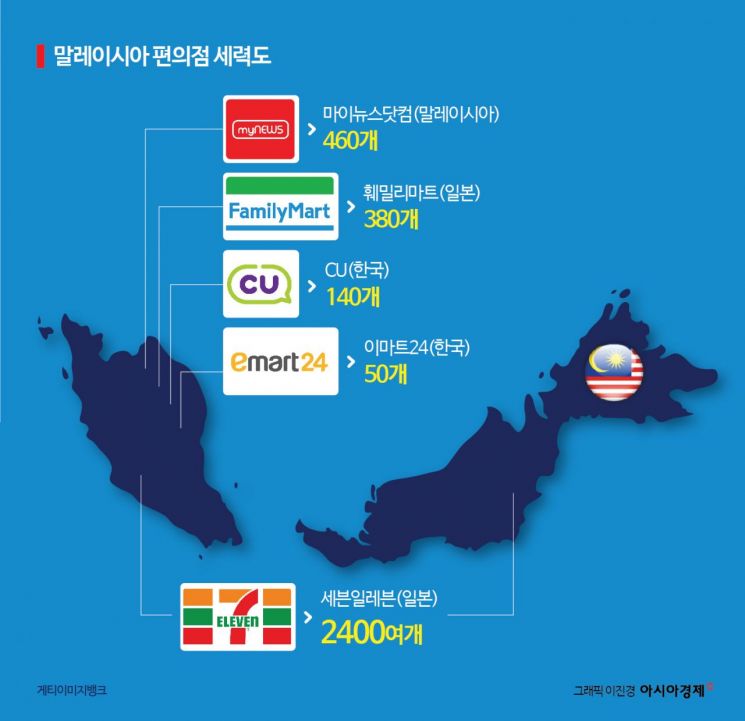

K-convenience stores have spread throughout Malaysia, starting from downtown Kuala Lumpur. Currently, CU has 140 stores and Emart24 has 50, totaling 190 stores. Both CU and Emart24 began opening stores in Malaysia from 2021. They signed master franchise contracts (MFC - a system where local companies are granted brand usage rights, store opening, and business operation rights in exchange for royalties) with local distributors to officially enter the Malaysian market. CU started slightly earlier, opening its first store in April of that year, followed by Emart24 two months later in June.

CU's entry into Malaysia as the first Korean convenience store was initiated by the courting of Malaysian convenience store company MyNews Holdings. Operating convenience stores under the brand MyNews.com locally, MyNews Holdings struggled to close the gap with the industry leader Seven-Eleven and reached out to BGF Retail, the operator of CU.

MyNews Holdings chose CU influenced by the Korean Wave (Hallyu) fever that began among the local youth. As K-pop and dramas gained popularity, interest in Korean food and culture featured in the content grew. Additionally, with the sky routes closed due to COVID-19 making travel to Korea impossible, MyNews Holdings decided to capture demand from those wanting to experience Hallyu by directly transplanting K-convenience stores. The attempt was successful. In April 2021, at the opening of the CU store, dozens lined up to taste K-food, creating a remarkable scene.

The Korean Wave also played a role in Emart24's entry into Malaysia. Although CU planted the flag first, it was insufficient to meet the local consumers' demand for Korean food and culture sparked by the Korean Wave. Malaysian food and dairy company United Frontiers Holdings noticed this and proposed a master franchise contract to Emart24. By accepting this offer, two K-convenience store brands were established in Malaysia.

A view of the Emart24 St. Mary store in Kuala Lumpur, Malaysia. K-food such as tteokbokki and cupbap are gaining popularity among locals. Photo by Seongpil Jo. @gatozz

A view of the Emart24 St. Mary store in Kuala Lumpur, Malaysia. K-food such as tteokbokki and cupbap are gaining popularity among locals. Photo by Seongpil Jo. @gatozz

'Winning Move' K-Food Truly Worked

In domestic convenience stores, tobacco and alcoholic beverages account for the majority of sales. Both categories make up 30-40% each, meaning about 80% of a store's revenue comes from tobacco and alcohol. However, the situation is different in Malaysia. Malaysia is recognized as a representative Muslim cultural region in Southeast Asia, with Muslims making up over 60% of the population (about 20 million). Muslims, following Islamic law, avoid not only alcohol but also foods containing alcohol. While tobacco is not prohibited, its sales proportion is significantly lower compared to Korea. Even in stores with the highest tobacco sales, the sales share is in the low 20% range, about half of that in Korea. This is why K-convenience stores entering Malaysia opened with a different approach than domestic stores.

When CU and Emart24 opened stores in Malaysia, a key difference was the inclusion of a ready-to-eat food corner represented by 'street food.' Every store set up a ready-to-eat food corner next to the cash register. This was confirmed at CU's Lohas KL store located in KLCC. The ready-to-eat food corner next to the register sold tteokbokki, odeng, fried chicken, corn dogs, and more. Jung Hyun-seok, team leader of BGF Retail Malaysia TFT, said, "Korean ready-to-eat foods are overwhelmingly popular, accounting for over 40% of total sales," adding, "K-hot fried chicken, rose tteokbokki, and K-cheese corn dogs are representative top-selling products."

An information sign about Cupbap installed inside the Emart24 St. Mary store in Kuala Lumpur, Malaysia. Cupbap is one of the best-selling products at this store. Photo by Seongpil Jo @gatozz

An information sign about Cupbap installed inside the Emart24 St. Mary store in Kuala Lumpur, Malaysia. Cupbap is one of the best-selling products at this store. Photo by Seongpil Jo @gatozz

Emart24's St. Mary store also created a ready-to-eat food corner next to the register, selling cup rice and tteokbokki. Among these, cup rice is considered Emart24's flagship ready-to-eat product. Although it looks like the cup rice commonly seen in Korea, the taste is spicier and saltier, making it more stimulating. Lim Baek-hyun, head of Emart24's overseas business team, said, "To replicate the cup rice eaten in Korea, we use Japanese rice similar to Korean rice instead of local fragrant rice," adding, "Initially, we worried the taste was too strong, but Malaysians like spicy and salty flavors, so now it ranks in the top 5 best-selling foods."

Additionally, Emart24 recently introduced a 'ramen station' in some stores, adopting a ramen cooker used along the Han River in Korea. This space displays Korean ramen alongside the cooker. In one store, after installing the ramen station, cup noodle sales increased by 40%. At Emart24's first Malaysian store in Bangsar South, the ramen station shelves were 'empty' shortly after weekday lunch hours, indicating strong sales.

FamilyMart, a Japanese convenience store chain in Malaysia, is famous for its oden. At one time, there were long lines of people waiting to taste the oden. Photo by Seongpil Jo @gatozz

FamilyMart, a Japanese convenience store chain in Malaysia, is famous for its oden. At one time, there were long lines of people waiting to taste the oden. Photo by Seongpil Jo @gatozz

Japan Still a High 'Wall'

Although K-convenience stores are steadily expanding their presence in Malaysia, Japanese convenience stores are considered a mountain to overcome. In terms of store numbers, they trail behind Seven-Eleven, and in sales, behind FamilyMart. Especially FamilyMart is regarded as the strongest competitor due to its store operation concept similar to K-convenience stores. In fact, near Emart24's first Bangsar South store, FamilyMart sells fried foods and odeng at a ready-to-eat food corner next to the register.

Odeng, in particular, is a 'cash cow' food that has established FamilyMart's current status in Malaysia. Lim Baek-hyun, head of Emart24's overseas business team, said, "Although Emart24 and CU also sell odeng, in Malaysia, the image of odeng is strongly associated with FamilyMart."

Another negative factor is that Seven-Eleven recently began changing its store concept. Seven-Eleven, the largest convenience store operator in Malaysia with about 2,400 stores since its first store opened in 1984, had traditionally focused on tobacco and processed food sales like Korean convenience stores. However, recently, it has been increasing stores with ready-to-eat food corners similar to K-convenience stores and FamilyMart. If Seven-Eleven, which has an overwhelming number of stores following FamilyMart's concept, maintains similar store concepts, it could pose a significant threat to the expansion of K-convenience stores.

Inside view of a FamilyMart store in Kuala Lumpur, Malaysia. Numerous K-food items, including Samyang Buldak Bokkeummyeon, are displayed. Photo by Seongpil Jo. @gatozz

Inside view of a FamilyMart store in Kuala Lumpur, Malaysia. Numerous K-food items, including Samyang Buldak Bokkeummyeon, are displayed. Photo by Seongpil Jo. @gatozz

Another disadvantage in competition is that CU and Emart24 handle Korean food such as Korean ramen and snacks, which they prominently promoted upon entering Malaysia, in local convenience stores. Until now, K-food was exclusive to Korean stores, but as the Korean Wave increased K-food's popularity, local companies also began supplying these products. Accordingly, K-convenience stores are once again considering differentiation strategies and products.

Despite these challenges, CU and Emart24 are steadily expanding their stores. Malaysia serves as a base for expansion into neighboring Southeast Asian countries. Just as GS25 is knocking on the doors of neighboring countries starting from Vietnam, Malaysia is a forward base for CU and Emart24. In fact, Emart24 has expanded into Singapore and Cambodia after entering Malaysia. An Emart24 official said, "We will continue to consider and execute expansion into various countries." A CU official also stated, "We plan to make Malaysia a logistics and product supply hub for the Southeast Asian market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)