[K-Convenience Store Global 1000th Store Era]②

CU·GS25·Emart24

Over 1,090 Overseas Stores

Domestic convenience store brands are accelerating their entry into overseas markets. As the market has reached a saturation point to the extent that there is a convenience store on almost every block, they are turning their eyes overseas to find new growth engines.

Exterior view of GS25 Store No. 250 located in downtown Ulaanbaatar, Mongolia. GS25 decorated its exterior by creating its own emojis.

Exterior view of GS25 Store No. 250 located in downtown Ulaanbaatar, Mongolia. GS25 decorated its exterior by creating its own emojis. [Photo by Minji Lee]

According to the convenience store industry on the 15th, the three domestic convenience store companies?CU operated by BGF Retail, GS25 by GS Retail, and Emart24, an Emart affiliate?have about 1,090 stores overseas as of this date. CU has expanded into Mongolia and Malaysia; GS25 into Vietnam and Mongolia; and Emart24 into Malaysia, Singapore, and Cambodia. They are expanding their reach into Southeast Asia and Central Asia, regions with promising economic growth prospects and large young populations. With growing interest in K-content, there is also significant local demand to partner with domestic convenience stores.

Based on the number of stores, CU is the most aggressive in overseas expansion. CU entered Mongolia (about 380 stores) in 2018 and Malaysia (140 stores) in 2021, securing around 500 stores to date. As early as the first quarter of next year, it plans to plant its first flag in Kazakhstan. In June last year, CU signed a master franchise agreement with 'Shinlain,' the largest ice cream company in Central Asia, and has been preparing for store openings for over six months. This will make CU the first global convenience store operator to enter Kazakhstan. Considering that more than half of the population is under 30 and there is growing demand for nearby shopping, the demand for convenience stores is expected to be substantial.

GS25 has entered Vietnam (2018) and Mongolia (2020). It is closely chasing CU, having achieved its 500th global store by the end of last year. GS25 is experiencing both direct investment (Vietnam) and master franchise (Mongolia) methods. Direct investment involves establishing a joint venture and investing own capital, which offers higher profitability but is a typical 'high risk, high return' approach since investment costs cannot be recovered if it fails.

In Vietnam, GS25 partnered with the local Son Kim Group, investing 30% equity to establish a joint venture, and has opened 245 stores so far. In Mongolia, it signed a master franchise agreement with Digital Concept, a subsidiary of the Shonkolai Group, and opened 273 stores. While direct investment like in Vietnam entails bearing the full cost of store openings, resulting in slower expansion compared to Mongolia, if the break-even point (BEP) is surpassed, it is expected to yield greater profits than master franchising.

Emart24, a latecomer in the domestic convenience store market, has entered Malaysia (June 2021), Singapore (December 2022), and Cambodia. It is more aggressive in targeting Southeast Asia than CU and GS25. It currently operates 48 stores in Malaysia and 3 stores in Singapore. Its goal is to open an additional 300 stores within five years in each country. It plans to open stores in Cambodia in the first half of next year, aiming for 100 stores within five years. Emart24's strategy is to attract consumers by leveraging the high preference for Korean products, using popular Korean instant foods as a medium.

The overseas expansion process has not been without difficulties for convenience store companies. CU opened the door to overseas business by entering Iran in 2017 but had to close within about a year. The Iranian Entekhab Investment Group, which had signed the contract, refused to pay franchise fees due to U.S. sanctions on Iran's economy.

Vietnam entry also faced setbacks when the local operator withdrew from opening convenience stores due to the COVID-19 variable in 2020, forcing CU to pull out. GS25 also attempted to enter Malaysia but faced disagreements with the KK Group, with which it had a master franchise contract, resulting in failure.

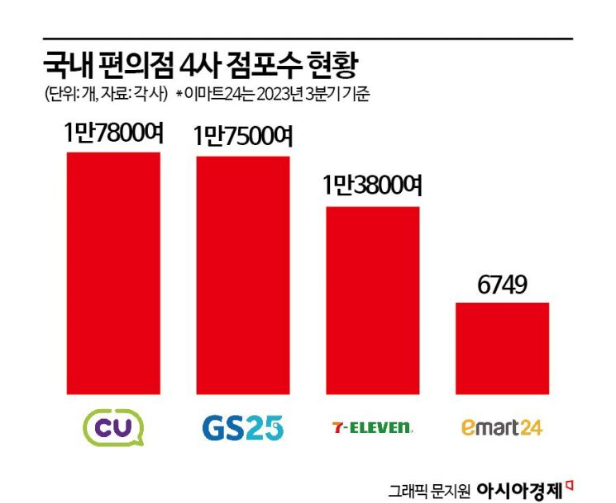

The reason these convenience stores have turned their eyes overseas is due to increasingly fierce domestic competition. As single-person households increased, the number of consumers visiting convenience stores grew, and the market rapidly expanded, leading to a proliferation of convenience store brands. Since the first store opened in 1989, domestic convenience stores have grown exponentially over 35 years, now expanding to about 55,000 stores. The number of stores is similar to Japan, known as the convenience store kingdom. Considering Japan's population is about twice that of Korea, the number of stores per capita is much higher here. CU and GS25, which form the two-strong structure in the domestic convenience store industry, have about 17,000 stores each, Seven Eleven has about 14,000 stores, and Emart24 has about 6,750 stores.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.