KOSPI Construction Industry Index Falls 4% in One Month

Shinsegae, GS, Hyundai, Daewoo Stocks Decline Consecutively

Brokerages Lower Target Prices for Construction Companies One After Another

Investor sentiment toward construction stocks, which are facing worsening earnings and the added risk of project financing (PF) defaults, shows no signs of recovery. Construction stocks, which had a surprise rebound following President Yoon Seok-yeol's remarks on easing reconstruction and redevelopment regulations, have failed to gain momentum even after the commencement of Taeyoung Construction's workout (corporate financial restructuring). The securities industry advises investing in construction stocks that have a diverse revenue portfolio rather than focusing solely on construction this year.

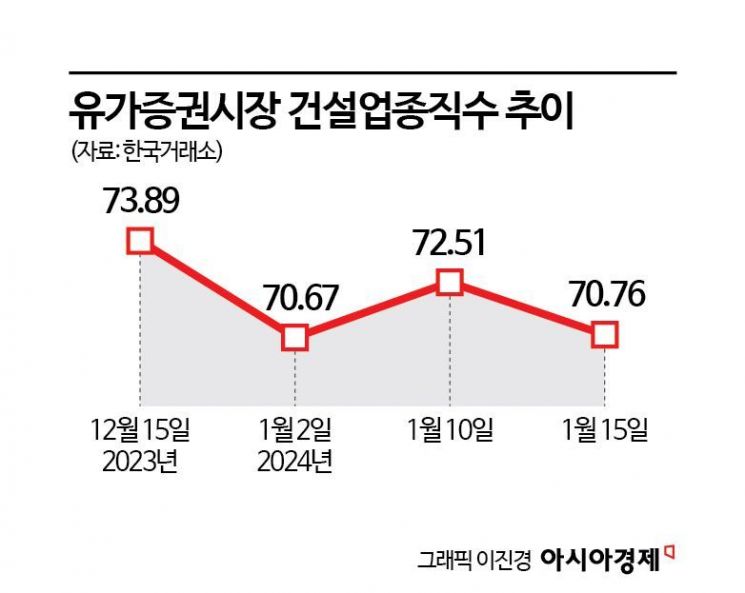

According to the Korea Exchange on the 16th, the construction industry index on the KOSPI market fell 4.2% over the past month. The construction industry index had been on an upward trend throughout November last year due to expectations of a U.S. interest rate cut but began to decline from the end of last year when rumors of Taeyoung Construction's imminent workout application spread in the market. It briefly rose on the 10th when President Yoon declared he would ease redevelopment and reconstruction regulations but turned downward again after the start of Taeyoung Construction's workout.

Individual stock prices are also sluggish. Shinsegae Construction fell 14% over the recent one-month period (December 15 to January 15), while other construction stocks such as GS Construction (-6.6%), Daewoo Construction (-5.8%), and Hyundai Construction (-5.2%) also showed downward trends.

For construction stock prices to recover, the real estate market must revive, but the outlook for this year from housing developers is bleak. According to the January Apartment Pre-sale Outlook Index for Housing Developers by the Korea Housing Industry Research Institute, the metropolitan area scored 73.4. This marks a three-month consecutive decline following 91.8 in November and 78.5 in December last year. The contraction in housing demand is due to increased financial costs from sustained high interest rates, loan regulations, and rising pre-sale prices. As a result, if pre-sale schedules are delayed or pre-sale performance is poor, it becomes difficult to recover the project costs invested in building houses, increasing the financial burden on construction companies.

The market's concern that the PF default crisis originating from Taeyoung Construction might spread to other construction companies is also cooling investor sentiment toward construction stocks. Although financial authorities have stated that Taeyoung Construction's crisis is unlikely to spread across the construction industry, the subsequent price trends of major construction stocks suggest that market concerns have not dissipated.

The securities industry also recommends a cautious approach to investing in construction stocks. On the 15th, Korea Investment & Securities downgraded its investment opinion on the construction sector to neutral, stating that PF restructuring related to construction companies will begin in earnest.

Researcher Kang Kyung-tae of Korea Investment & Securities explained, "With Taeyoung Construction starting its workout, restructuring of PF sites related to construction companies will begin in earnest. We plan to maintain a neutral sector opinion until the PF site restructuring is completed and the private housing construction cycle resumes."

The securities industry has lowered stock prices or adjusted investment opinions to neutral for construction-related stocks. Meritz Securities downgraded its investment opinion on GS Construction, while Kyobo Securities cut Daewoo Construction's target price by 16.5%, from 6,000 won to 5,000 won. Shinhan Investment Corp. lowered Hyundai Construction's target price from 53,000 won to 49,000 won, citing weak fourth-quarter earnings.

On the contrary, some opinions suggest that the current sluggish stock performance may be an opportune time for bottom-fishing. However, they advise selecting companies with high profit growth rates and low contingent liabilities to minimize the risk of financial deterioration.

Researcher Jang Moon-jun of KB Investment & Securities said, "Instead of increasing or decreasing the weight of specific stocks, investors should focus on companies that show cycles completely different from the industry. For example, invest in companies with assured profit growth this year and next, or those that do not solely focus on construction but demonstrate an evolution in their business models."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.