Raising Funds by Selling Housing and Financial Assets

Financial Strain Due to Consecutive Investment Failures

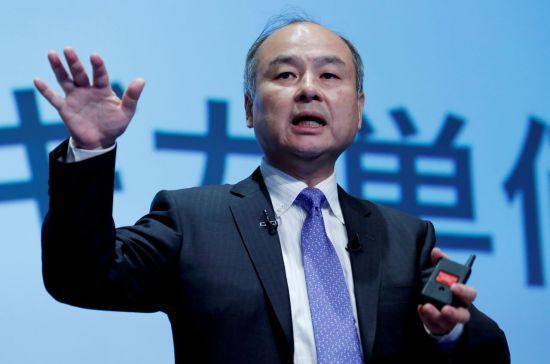

SoftBank Chairman Masayoshi Son reportedly secured a large loan using a luxury mansion he purchased 11 years ago in California, USA, as collateral. This is presumed to be a measure to secure funds after consecutive investment failures depleted his capital.

The British financial media outlet Financial Times (FT) reported on the 14th (local time) that it confirmed records showing a company called 'SV Project,' registered in Delaware, USA, pledged Son's mansion as collateral to obtain a loan worth 10 billion yen (approximately 92 million dollars at the time) from Japan's Mizuho Bank in 2019.

SV Project is a nominee corporation Son used when purchasing the mansion in 2013. Son bought the mansion for a staggering 117.5 million dollars (about 155 billion won). Financial publications such as the US magazine Forbes reported at the time that it was "the highest-priced residential real estate transaction in US history." However, the current value of the mansion is said to be only 23 million dollars (about 30.3 billion won). The luxurious residence spans 9 acres (approximately 36,422 square meters) and has four floors. It is equipped with an elevator and a bowling alley. Son even undertook extensive remodeling of the mansion after purchasing it.

Chairman Sohn's Ultra-Luxury Residence in California Captured on Google Maps

Chairman Sohn's Ultra-Luxury Residence in California Captured on Google Maps [Image Source=Google Maps]

When Son purchased the mansion, SoftBank had successfully raised tens of trillions of won in investment funds from the Middle East and had successfully launched the Vision Fund, a venture capital (VC) fund worth 100 billion dollars (about 131 trillion won).

However, SoftBank and the Vision Fund faced headwinds due to successive investment failures. For example, the US shared office company WeWork, in which SoftBank invested trillions of won, saw its market capitalization plummet after its initial public offering (IPO), and eventually filed for bankruptcy protection last year. The losses Son incurred from the WeWork bankruptcy are estimated to be 11.5 billion dollars (about 15 trillion won).

With worsening financial conditions, Son has been selling not only the mansion but also financial assets. In the second half of last year, when the British semiconductor design company ARM Holdings was listed on the US Nasdaq, he sold a large amount of Alibaba shares. It is also reported that he personally took out loans to establish the 'Vision Fund 2.' FT reported that as of September last year, Son's personal debt exceeded 5 billion dollars (about 6.6 trillion won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)