Hyundai 760,000 Units · Kia 560,000 Units

Domestic Market Share 73% Record High

Popular Mid-to-Large Sedan Grandeur, etc.

Korea GM, Renault, etc. Poor Sales

Imported Cars Also Decline in Sales

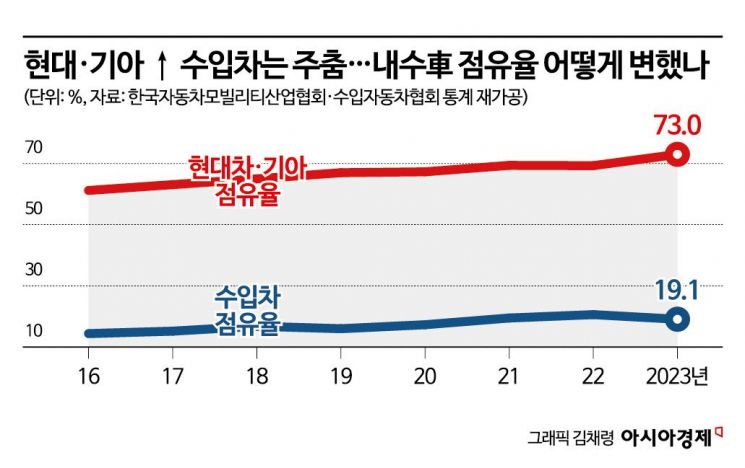

Last year, Hyundai Motor Company and Kia Motors' market share in the domestic passenger car market exceeded 70% for the first time. This is the highest level ever recorded based on annual sales volume, including imported cars.

According to provisional data on last year's domestic sales volume compiled by the Korea Automobile Mobility Industry Association on the 12th, Hyundai sold 762,077 units (including Genesis). Kia sold 565,826 units. Considering that the total domestic passenger car sales, including imported cars, amounted to 1,504,455 units last year, the combined market share of Hyundai and Kia is 73.0%.

This means that three out of every four passenger cars sold domestically are models from Hyundai and Kia. The previous highest market share was 69.4% in 2021. In terms of sales volume alone, 2020 was the highest with nearly 1.12 million units sold.

As the parts supply shortage that hampered production during the COVID-19 period eased, production and supply returned to their proper track. Additionally, new models of traditionally best-selling vehicles such as the mid-to-large sedan Grandeur, SUVs Sorento and Santa Fe, and the multipurpose vehicle Carnival were released with appropriate time intervals.

The Grandeur has established itself as a representative sedan, selling over 100,000 units despite the recent surge in popularity of recreational vehicles (RVs). It is the first time in three years since 2020 that a single domestic finished car model has sold more than 100,000 units. The availability of various models of eco-friendly vehicles, including electric and hybrid cars, which have steadily increasing demand, is also cited as a factor that boosted market share.

Domestic automakers such as Korea GM, KG Mobility, and Renault Korea Motors faltered, ceding market demand to Hyundai and Kia. Korea GM launched the successor to the compact SUV Trax in the first quarter of last year and introduced the Trailblazer in the second half, but sales of other imported models were sluggish. Although overall sales slightly increased, considering the base effect caused by the absence of new models in recent years, the results are unsatisfactory.

Until a few years ago, Korea GM had a variety of domestic models and easily sold over 100,000 units annually in Korea alone. Last year, it sold less than 40,000 units. However, it is consoling that export volumes to the North American market increased significantly due to favorable responses there. KG Mobility and Renault Korea Motors saw sales decline compared to the previous year. The absence of new models caused considerable dissatisfaction at frontline sales sites. Since various new models are expected this year, attention is focused on whether a rebound will occur in the second half.

Market share of imported cars, including Tesla, also declined. Imported car sales volume first decreased in 2019 and shrank again after four years. The market share of imported car brands in the domestic passenger car market steadily increased after surpassing 10% for the first time in 2012, exceeding 20% in 2022 after ten years. However, it retreated after just one year, leading the industry to watch closely whether the size of the imported car market in Korea will stabilize at this level.

German brands with high domestic demand, including BMW, Mercedes-Benz, Volkswagen, and Audi, all saw sales decline compared to the previous year. This is attributed to the pent-up demand during the COVID-19 period being somewhat resolved from the second half of 2022, combined with reduced purchasing power for relatively expensive imported cars due to economic recession and high interest rates.

The industry expects Hyundai and Kia's strong performance in the domestic passenger car market to continue for the time being. They have expanded options by diversifying their lineup of eco-friendly and high-end models, which have recently seen a sharp increase in demand. An industry insider said, "Since finished car sales inevitably depend on new models and their influence is expected to increase in the used car market as well, it seems highly likely that this trend will continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)