- Construction Cost Index Rises 3.04% Year-on-Year

- Demand Concentrates on Existing Office Facilities Amid Supply Shortage

As construction material costs soar to unprecedented levels, an office supply shortage is anticipated, leading to expectations that demand will concentrate on existing office facilities.

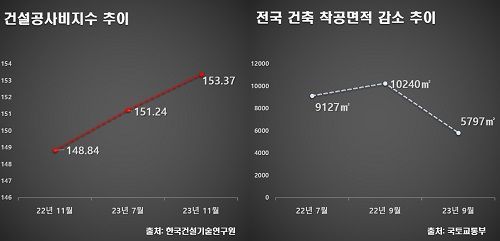

According to the Korea Institute of Civil Engineering and Building Technology, the Construction Cost Index in November 2023 recorded 153.37, a 3.04% increase compared to the same month last year. The Construction Cost Index tracks changes in construction costs, including materials, labor, and equipment.

The prices of various materials, including key raw materials, have been steadily rising. Major raw materials such as thermal power (4.6%), nuclear power (4.6%), and cement (2.57%), as well as electrical wires and cables (1.31%), metal packaging containers (0.91%), screws and iron wire products (0.12%), have all increased compared to the previous month, contributing to the rise in construction costs.

Labor cost increases are also impacting construction costs. According to the Korea Construction Association, the average monthly wage in the construction industry in the second half of last year was 265,516 KRW, up 3.95% compared to the first half of last year. It is expected to increase by another 1.99% in the first half of this year compared to the second half of last year.

With rising construction costs signaling a red light for the construction industry, supply is naturally decreasing. In fact, according to the Ministry of Land, Infrastructure and Transport, the total building start area nationwide in the third quarter of last year was 16.279 million square meters, a 44.2% decrease compared to the same period the previous year. The start area for commercial buildings, which include office facilities, decreased by 47.3% year-on-year.

These factors also suggest that the sale prices of offices to be supplied in the future will rise. According to Real Estate R114, the average sale price of knowledge industry centers in 2022 was 14 million KRW per 3.3㎡, nearly doubling in five years. Considering the rising trend in knowledge industry center prices, office sale prices are likely to be even higher.

Riding this trend, existing office facilities are gaining attention. Contrary to concerns about supply reduction, the office rental market is maintaining a stable flow based on solid demand.

In fact, according to the Korea Real Estate Board, the overall vacancy rate in Seoul in the third quarter of last year was 5.5%, steadily decreasing since the first quarter of last year. In Gyeonggi Province, the vacancy rate in Bundang-gu, a major business district, dropped from 3.3% in the first quarter to 2.7% in the third quarter of last year. This is interpreted as a result of more people returning to offices following the end of COVID-19 and the cessation of remote work.

In particular, demand is increasing to establish hub offices in major metropolitan areas connected by key business districts. Amid this, ‘Hyundai Terra Tower Siheung City Hall Station’ located in Janghyeon District, Siheung City, Gyeonggi Province, is once again attracting attention.

‘Hyundai Terra Tower Siheung City Hall Station’ is a complex office facility comprising office spaces, neighborhood living facilities, and sports facilities. It is being developed on business facility site 10BL in Janghyeon District, Siheung City, Gyeonggi Province, with 5 basement floors and 10 above-ground floors, covering a total floor area of 67,488㎡.

This office facility is designed as a new-concept office maximizing space utilization. All office units feature lofts, and most units include balcony spaces, allowing for flexible use of space. Additionally, storage furniture is provided to enable efficient use of indoor space.

It also offers a high-quality office community that enhances work quality. Facilities include meeting rooms such as large and small conference rooms, a business lounge caf?, private shower rooms, and a creative studio. Furthermore, comfortable eco-friendly relaxation spaces such as a small park in front of the complex, a rooftop garden, and a sunken garden are provided, along with ample parking space for 600 vehicles.

Accessibility to major business districts in Seoul, including Yeouido, the main commuting hub, is another advantage of ‘Hyundai Terra Tower Siheung City Hall Station’.

With the opening of the Daegok~Sosa Line of the Seohae Line in July 2023, transfers are now possible at Siheung City Hall Station to other subway lines such as Daegok Station (Line 3, Gyeongui Line, GTX-A planned), Gimpo Airport Station (Lines 5, 9, Airport Railroad, Gimpo Gold Line), Wonjong Station (Daegang~Hongdae Line planned), Bucheon Sports Complex Station (Line 7, GTX-B planned), and Choji Station (Suin-Bundang Line, Line 4), significantly enhancing rail transport convenience.

When the Sinansan Line (scheduled for completion in 2025) opens, accessibility between Siheung City and the southwestern Gyeonggi region and Yeouido, the main commuting hub, will improve. According to the Ministry of Land, Infrastructure and Transport, it will take approximately 25 minutes from Siheung City Hall Station to Yeouido via the Sinansan Line.

The future Wolpan Line, which will connect the southwestern metropolitan area east-west, is expected to enhance accessibility to major business districts in the metropolitan area by linking to the Suin Line in the west, providing access to the Incheon Songdo Bio Cluster, and to the Pangyo IT Valley in the east.

The ‘Hyundai Terra Tower Siheung City Hall Station’ promotional centers are currently operating in two locations: Gwangseok-dong, Siheung City, Gyeonggi Province, near Siheung City Hall Station, and Cheolsan-dong, Gwangmyeong City, Gyeonggi Province.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)