Workout Plan Confirmed for April 11

Temporary Possibility of Financial Structure Deterioration

As the workout (corporate financial restructuring) of Taeyoung Construction has commenced, due diligence to prepare restructuring plans has begun. An accounting firm will conduct due diligence for three months and submit the final restructuring plan for the construction company, including the handling plan for Taeyoung Construction's project financing (PF), to KDB Industrial Bank by April 11. There is also a possibility that Taeyoung Construction's financial condition may deteriorate due to large-scale contingent liabilities arising during the due diligence process.

According to financial authorities and creditors on the 12th, due diligence on Taeyoung Construction and its PF sites will be conducted from this day until April 11. The main creditor bank is responsible for the due diligence of Taeyoung Construction, while an accounting firm selected by the creditors' council will handle the PF site due diligence.

According to the guidelines for the construction company workout memorandum of understanding (MOU) revised in 2014, when a construction company workout begins, two separate accounting firms, a primary and a secondary, are selected to conduct accounting due diligence. Previously, one accounting firm conducted due diligence on both the restructuring target construction company and the PF sites, but it was pointed out that sufficient on-site due diligence at PF sites was impossible due to time constraints.

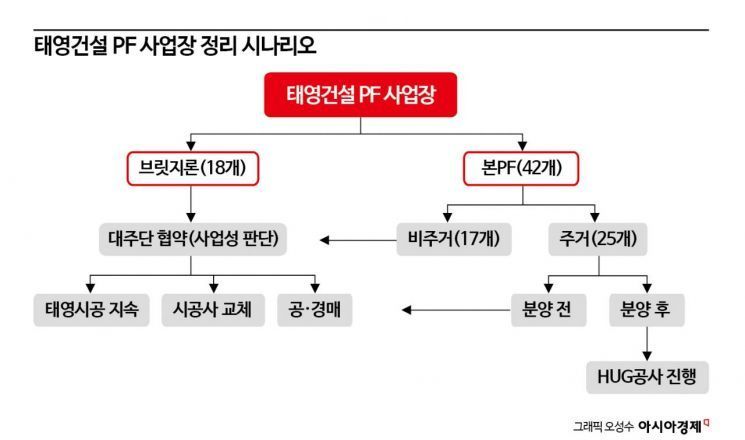

PF site due diligence is conducted focusing on sites selected by the creditors' council. The PF creditors form a creditors' council to discuss the due diligence results with Taeyoung Construction and then prepare handling plans for the sites. Earlier, financial authorities stated that for sites currently under construction, housing sites where sales have been completed or non-residential sites will be allowed to proceed as scheduled, while for housing sites where sales are ongoing, measures will be devised to improve the sales rate.

For sites where construction has not yet started (bridge loans), a comprehensive review of project feasibility and viability will be conducted to promptly finalize handling plans such as early commencement of construction, replacement of contractors, or project withdrawal.

There is also a possibility of financial deterioration for Taeyoung Construction during the due diligence period. This could occur if large losses arise at PF sites for which Taeyoung Construction has provided payment guarantees. In such cases, issues such as borrowings or impairment losses may be recognized as contingent liabilities. However, if the contingent liabilities of PF sites have the nature of financial debt, debt freezing is possible under the Corporate Restructuring Promotion Act.

As of the third quarter, Taeyoung Construction's capital stock is 20 billion KRW, retained earnings are 1.74 trillion KRW, and total equity is about 870 billion KRW. If contingent liabilities arise, they are deducted from retained earnings. If large-scale debt causes total equity to fall below capital stock, there is also a possibility of partial capital erosion.

Professor Kim Beom-jun of the Department of Accounting at Catholic University explained, "Construction companies provide payment guarantees during the PF process, but if the project feasibility is low, they may have to repay the guarantees." He added, "Usually, payment guarantees (contingent liabilities) are disclosed in the notes, but at some point, contingent liabilities must be converted into actual debt." Professor Kim further noted, "If contingent liabilities are recognized through PF due diligence at poor-performing projects, the scale of Taeyoung Construction's debt recognition could increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)