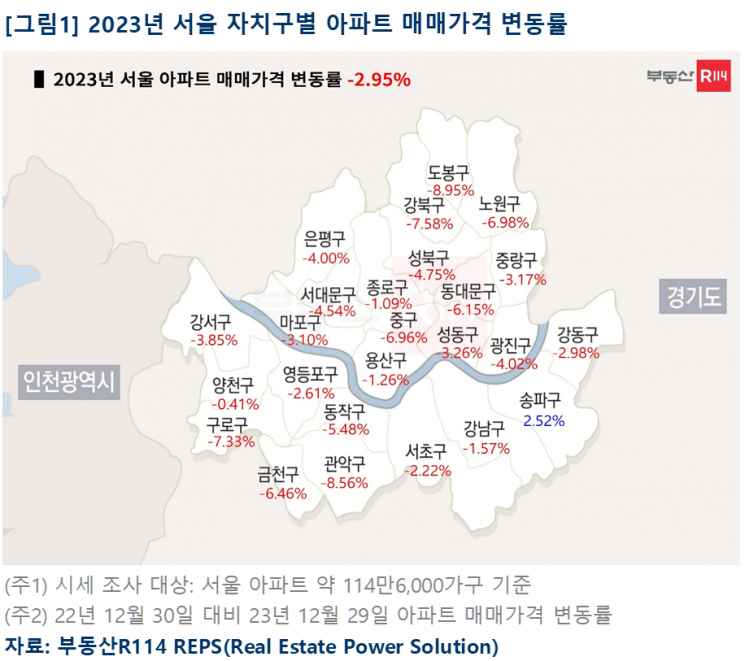

2023 Seoul Apartment Sale Price Change Rate -2.95%

Dobong, Gangbuk, Gwanak, Geumcheon, etc. Show Strong Decline, Growing Concerns Over Housing Price Gap

Over the past year, the gap in apartment prices across different areas of Seoul has further widened. The housing prices in the ‘Nodogang (Nowon, Dobong, Gangbuk)’ and ‘Geumgwan-gu (Geumcheon, Gwanak, Guro)’ areas fell more than twice as much as the average apartment price fluctuation rate in Seoul, increasing the price disparity between the Hangang Belt region and the high-end market in Gangnam.

Last Year’s Seoul Price Fluctuation Rate -2.95%: Decline Evident in Northeastern and Southwestern Outskirts

According to a survey by Real Estate R114 on Seoul apartment price fluctuations last year, the apartment price fluctuation rate compared to the end of 2022 was -2.95%. The decline was larger than in 2022 (-1.45%), with the downward trend particularly noticeable in the northeastern and southwestern outskirts, which are mainly areas densely populated with mid- to low-priced apartments. By region, the largest drops were in Dobong (-8.95%), Gwanak (-8.56%), Gangbuk (-7.58%), Guro (-7.33%), and Nowon (-6.98%).

Songpa-gu recorded a price fluctuation rate of -7.62% in 2022, making it the area with the steepest price drop in Seoul. However, last year it showed a rapid price recovery and was the only district to turn positive with a 2.52% increase.

Leading the market prices were representative apartments in Jamsil such as Jamsil Els, Rescentz, and Trizium, while the ‘Olympic Big Three’ apartments (Olympic Athlete Village, Olympic Family Town, Asia Athlete Village) passing safety inspections and reconstruction projects like Jamsil Jugong Complex 5 applying the ‘2040 Seoul Plan’ supported the price rise.

Price Gap Widens Between ‘Nodogang, Geumgwan-gu’ Apartments and High-End Market

In the northeastern and southwestern regions, which experienced large declines last year, the price gap with the Hangang Belt areas such as Mapo, Yongsan, and Seongdong-gu, as well as the Gangnam 3 districts, deepened compared to 2022. The average apartment price in the mid- to low-priced ‘Nodogang’ area widened from 1,672.36 million KRW in 2022 to 1,691.13 million KRW in 2023 compared to the Gangnam 3 districts. Similarly, the price difference between ‘Geumgwan-gu’ and the Gangnam 3 districts increased from 1,571.16 million KRW to 1,609.7 million KRW.

In the ‘Nodogang, Geumgwan-gu’ areas, the proportion of sales at reduced prices was higher than in other regions last year due to an increase in urgent sales caused by interest repayment burdens. Additionally, the end of 50-year mortgage loans and special Bogeumjari loans led to a contraction in transactions in the fourth quarter and an expansion of the price decline.

Baek Saerom, lead researcher at R114, stated, "The high-end real estate market is already tightly regulated with loan restrictions, so even if loan requirements are strengthened, it has less impact on sales prices. In contrast, the mid- to low-priced market reacts more elastically to deteriorating financing conditions, which acts as a factor intensifying polarization."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.