US SEC Approves ETF Listing and Trading

Market Recognizes Asset Value

Expecting Additional Inflow of 26 Trillion Won Funds

"Today is Bitcoin Day."

The biggest topic in the virtual asset market this year, the U.S. Securities and Exchange Commission's (SEC) approval of Bitcoin spot exchange-traded funds (ETFs), was decided on the 10th (local time). This marks a significant milestone as Bitcoin, the leading virtual asset, has been recognized for its asset value to some extent, while a legitimate channel for global institutional funds to flow in has been established. Some estimate the additional capital inflow to be around 26 trillion won.

On the day, the U.S. SEC announced in a statement that it had approved 11 Bitcoin spot ETFs applied for by Grayscale Investments, Bitwise, and others. SEC Chair Gary Gensler referred to a case where the federal appeals court judged that the SEC had insufficient explanation for not approving Grayscale's proposed ETF, stating, "I believe the most sustainable path is to approve the listing and trading of Bitcoin spot ETFs." Previously, the commission had rejected more than 20 applications related to spot Bitcoin exchange-traded products (ETPs), including Grayscale's application, from 2018 to March 2023, but the situation reversed as the court found the reasons for rejection insufficient.

Chairman Gensler emphasized, "The commission will evaluate whether it is designed to protect investors and the public interest and whether it complies with the Securities Exchange Act and related regulations," adding, "Today's action will include specific protective measures for investors." Regarding Bitcoin, he maintained the existing negative stance, noting, "It is a speculative and highly volatile asset that is also used for illegal activities such as ransomware, money laundering, sanctions evasion, and terrorist financing."

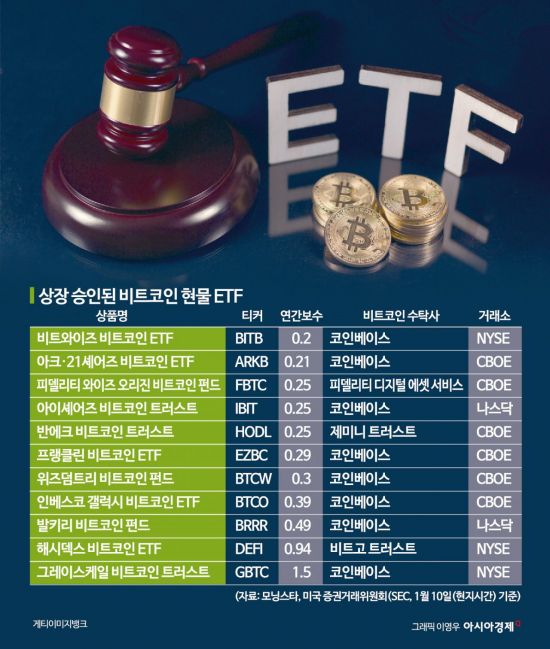

Among the 11 approved ETFs, six will be listed on the Chicago Board Options Exchange (CBOE). Three will be traded on the New York Stock Exchange (NYSE), and two on Nasdaq. CNBC predicted that the Grayscale Bitcoin Trust would be the first to launch. BlackRock Asset Management and Fidelity are also expected to introduce competing products. The first fund is expected to begin trading on the 11th (local time). Recently, CBOE's notice included that the ARK Invest Bitcoin ETF and Franklin Templeton Bitcoin ETF are scheduled to start trading on the 11th (local time).

According to CoinMarketCap, as of 10:27 a.m., Bitcoin's price is around 61.5 million won, up 2.08% from the previous day. It has risen 9.33% compared to seven days ago and 167.14% compared to a year ago. The price volatility is relatively moderate as expectations for ETF approval were priced in early this year. Bitcoin's price, which surged once due to fake news about ETF approval caused by the SEC's X (formerly Twitter) account hacking the previous day, dropped to the low 60 million won range but quickly rebounded and is approaching 62 million won.

The market expects liquidity to increase and prices to rise upon ETF approval. Institutional investors, who had been cautious about investing in Bitcoin due to accounting issues, may now bring in funds. The Korbit Research Center estimated that the additional capital inflow could reach $20 billion (approximately 26 trillion won). Exchanges responsible for distribution are also expected to benefit. Kim Min-seung, a research analyst at Korbit, said, "Institutional funds entering the virtual asset market due to Bitcoin spot ETF approval will prefer exchanges that comply with regulations," adding, "The virtual asset distribution market is likely to be reorganized mainly around the U.S. market, which complies with regulations."

In the securities industry, there is also an expectation that this will serve as an opportunity to increase interest in the technology innovation cycle beyond the simple impact on financial markets. Park Sang-hyun, a researcher at Hi Investment & Securities, said, "This will be a turning point for Bitcoin to be recognized as an asset," noting, "If the rally continues after Bitcoin ETF approval, it indicates that risk asset preference sentiment is alive." He also said, "Market confidence in the technology innovation cycle has been strengthened," interpreting that "the reason policy authorities recognize Bitcoin as a regulated asset is because virtual assets represented by Bitcoin are closely related to various technology innovation cycles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)