One Week Before Service Launch

Tension Between Fintech and Non-Life Insurers

Ultimately Raising Consumer Insurance Premium Concerns

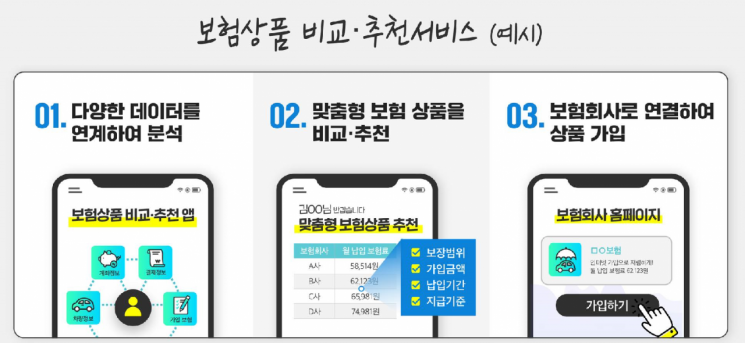

Example of insurance comparison and recommendation platform service. [Photo by Financial Services Commission]

Example of insurance comparison and recommendation platform service. [Photo by Financial Services Commission]

The tug-of-war over commission fees between fintech (finance + technology) companies and non-life insurance companies is intensifying just about a week before the launch of an insurance product comparison and recommendation platform. Outwardly, the service is justified as enhancing consumer benefits, but behind the scenes, there is a fierce battle for dominance between big tech firms (large information technology companies) and the Big 4 non-life insurers aiming to maximize their own profits. There are also concerns that the introduction of the platform will ultimately lead to higher insurance premiums.

The insurance comparison and recommendation platform is a service that allows consumers to compare and receive recommendations for online products from various insurance companies and connect to the insurers’ websites to complete contracts. The products handled include automobile insurance, savings insurance (excluding pension insurance), credit insurance, actual expense medical insurance, overseas travel insurance, pet insurance, and short-term insurance. Starting with automobile insurance on the 19th, products will be sequentially serviced. The platform was designated as an innovative financial service by the Financial Services Commission last July, with participation from 22 life insurers, 17 non-life insurers, and 11 fintech companies. Among the fintech participants are Naver Financial, Kakao Pay, Toss, Finda, Fink, and Habit Factory.

From the early stages of preparation, commission fee issues between insurers and fintech companies have surfaced. The commission is taken on the premise that when each insurer uploads insurance products to the platform, the platform compares and recommends premiums, benefits, and actual paid insurance claims to consumers. As negotiations on commission rates did not progress, financial authorities initially capped the maximum rate at 4%.

The Big 4 non-life insurers (Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, and KB Insurance), which hold an 85% market share in automobile insurance, currently want commissions below 3%. They argue there is no reason to bear high commissions when insurance subscriptions are smoothly conducted through their own websites and direct channels (CM). Some speculate that if the Big 4 insurers fail to secure appropriate commissions, they might not partner with any fintech companies for automobile insurance and refuse to list their products on the platform.

Large insurers are currently setting separate platform marketing (PM) premium rates and calculating the commission ceiling. The premium rate is the ratio of the insurance premium to the insured amount. Insurers set different premium rates for the same product depending on the sales channel, such as face-to-face, CM, and telemarketing (TM). CM premiums are the cheapest. Large insurers plan to set PM rates about 3-5% higher than CM rates, reflecting commissions and other factors. This strategy is based on the expectation that consumers will pay higher premiums when using the insurance comparison and recommendation platform, which will automatically drive them to their own CM channels.

Most fintech companies want a 4% commission. They worry that if they accept the large insurers’ PM rates, the platform’s price competitiveness will decline, leading to failure in gaining popularity. However, since it would be problematic if large insurers boycott the platform, fintech companies are weighing accepting some demands. The day before, big tech proposed to the Big 4 non-life insurers to agree on a 3.5% commission (excluding VAT) in exchange for recognizing the PM rates.

The perspectives of small and medium insurers and fintech startups watching this situation differ significantly. Small and medium insurers are less inclined than large insurers to lower commissions. They plan to maintain the CM premium rates as is. A representative from a small insurer said, "In a situation where even increasing market share by 1% is difficult, gaining price competitiveness compared to large insurers would be an opportunity for us," adding, "We have high expectations for the service launch, especially since big tech companies like Naver and Kakao will also support customer inflow."

Fintech startups worry that big tech’s excessive commission greed might cause them to lose consumer trust. Most fintech companies, excluding big tech, believe partnerships are possible with commissions in the high 2% range. A fintech startup representative said, "High commissions will ultimately lead to higher insurance premiums, which will only create a negative perception of the industry," and added, "Both big tech and large insurers must prioritize consumer benefits above all."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.