SPACs Scheduled for Merger Listings Hit Consecutive Record Highs

Hanbit Laser, the First SPAC Merger Listing This Year, Shows Strong Stock Performance

Expectations for Increased KOSDAQ IPOs Due to SPAC Merger Activation

Since the beginning of the year, stocks related to Special Purpose Acquisition Company (SPAC) mergers have continued to show strength, drawing attention to whether the SPAC merger boom will persist this year as well.

According to the Korea Exchange on the 9th, IBKS No.19 SPAC, KB No.22 SPAC, Hana Financial No.23 SPAC, and Kyobo No.11 SPAC all recorded 52-week intraday highs. IBKS No.19 SPAC reached 3,715 KRW intraday, setting a new 52-week high. KB No.22 SPAC also rose to 3,275 KRW intraday, breaking its 52-week high. Hana Financial No.23 SPAC and Kyobo No.11 SPAC climbed to 3,895 KRW and 3,500 KRW respectively, marking new highs. These stocks have maintained an upward trend for three consecutive days.

All these SPACs share the common feature of being scheduled for merger listings. The anticipation of merger listings appears to be a driving factor behind the stock price increases. IBKS No.19 SPAC is set to merge and list with SPSoft, KB No.22 SPAC with Catis, Hana Financial No.23 SPAC with LaserOptech, and Kyobo No.11 SPAC with J2K Bio. All have received preliminary listing examination approval from the exchange for SPAC dissolution mergers. LaserOptech is scheduled to be listed on the 1st of next month, and SPSoft on the 14th of next month. J2K Bio and Kyobo No.11 SPAC will hold a shareholders' meeting on the 1st of next month to approve the merger, with the merger date set for March 6 and the new shares listing scheduled for the 25th of the same month.

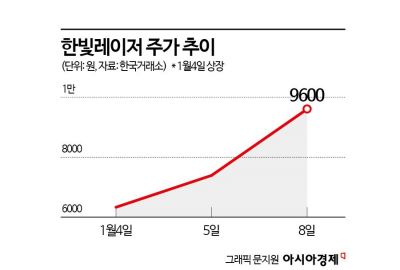

The strong performance of Hanbit Laser, the first SPAC merger listing company this year, also raises expectations for the SPAC merger boom in 2024. Hanbit Laser, which entered the KOSDAQ market on the 4th, hit the daily price limit on its first day of listing, rose 16% on the second day, the 5th, and surged again to the daily price limit on the 8th. Hanbit Laser was listed through a SPAC dissolution merger with DB Financial SPAC No.10.

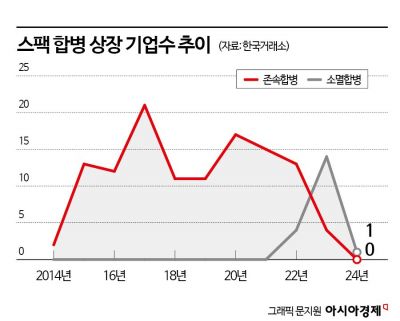

With SPAC merger-related stocks showing strength from the start of the year, the enthusiasm for SPAC mergers is expected to remain strong this year. Last year, there were 18 SPAC merger listings, the second highest after 2017.

The activation of SPAC merger listings is due to increasing demand for simpler public offering procedures. Park Jong-sun, a researcher at Eugene Investment & Securities, explained, "The recent activation of the SPAC market is due to increased demand for SPAC listings and mergers with simple public offering procedures. Especially, since the introduction of 'SPAC dissolution mergers' in February 2022, which allows the merged company (unlisted company) to maintain its corporate status after the merger, corporate preference for SPAC merger listings has increased." The number of companies choosing the SPAC dissolution merger method was only four in 2022 when it was introduced, but increased to 14 last year. Most of the companies that have received preliminary listing approval are also expected to list via the SPAC dissolution merger method.

The activation of SPAC merger listings is also expected to increase the number of companies listed on the KOSDAQ market this year. Park said, "The expected number of KOSDAQ initial public offerings (IPOs) this year is around 110 to 120 companies, which is a slight increase compared to the past average of 84 companies per year and the five-year average of 102 companies. The reason for this expected increase is that listings of companies related to new growth engines and technology-specialized companies continue, and SPAC listings have also turned to an upward trend."

However, the recent tightening of listing examinations poses a burden. The Financial Supervisory Service has decided to strengthen its review process, including enhancing disclosure requirements such as accounting firm evaluation history, and closely examining whether sufficient grounds are provided for future business performance estimates, in response to concerns that companies listing through SPAC mergers are excessively overvalued.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)