Limited Sale to KAMCO·SPC Allowed Without Debtor's Debt Adjustment Application

Savings Banks "Advantageous for Financial Soundness Management"

The financial authorities announced that they will expand the scope of non-performing loan (NPL) sales to manage the increasing delinquency rates of savings banks. This is expected to improve the financial soundness of savings banks and reduce the debt burden on small business owners who faced difficulties due to debts incurred during the COVID-19 pandemic.

In the '2024 Economic Policy Direction' announced on the 4th, the government stated, “To manage delinquency rates, the scope of NPL sales for small business owners and self-employed individuals will be expanded within the range where illegal debt collection is not a concern.” The key point is that sales will be allowed not only to the New Start Fund under Korea Asset Management Corporation (KAMCO) but also, on a limited basis, to other special purpose companies (SPCs) even without the debtor’s debt adjustment application. Until now, savings banks could only sell delinquent loans to the New Start Fund under KAMCO when borrowers applied for debt adjustment. The New Start Fund, established in October 2022, is a system that reduces the principal of long-term delinquent loans (over 90 days) by up to 80% (up to 90% for vulnerable groups).

Special purpose companies include dedicated distressed asset investment firms such as United Asset Management (UAMCO) and Woori Financial F&I. A KAMCO official said, “From the savings banks’ perspective, the range of choices has widened, so they will sell to companies offering favorable conditions,” adding, “Since purchasing distressed loans is a routine task for KAMCO, negotiations will be conducted based on general standards.”

The savings bank industry welcomed the measure, saying it will help manage financial soundness. An industry insider said, “In a difficult market environment, delinquency rates and soundness indicators are gradually rising,” and added, “It is encouraging that loans, which previously could only be sold if borrowers applied, can now be sold to multiple companies.” Another official cited the example of the Korea Federation of Savings Banks selling 120 billion KRW worth of non-performing loans to the private company Woori Financial F&I last month, saying, “Expanding the scope of loan sales beyond such temporary measures will help manage delinquency rates.”

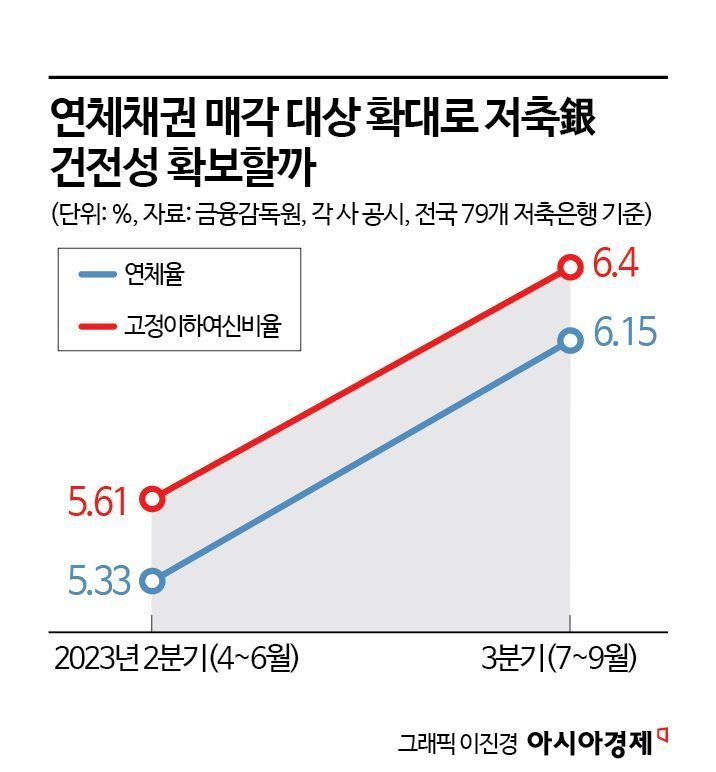

In fact, the financial soundness of savings banks is deteriorating. First, delinquency rates are rising. According to data from the Financial Supervisory Service, as of September last year, the delinquency rate of 79 savings banks nationwide was 6.15%, up from 5.07% in the first quarter and 5.33% in the second quarter. The NPL ratio is also increasing. A higher ratio indicates weaker soundness. It recorded 6.4% in the third quarter last year, up 0.79 percentage points from 5.61% in the second quarter. The scale of losses is also growing. The cumulative net loss of 79 savings banks in the third quarter this year was 141.3 billion KRW, an increase of 45.3 billion KRW from the first half (96 billion KRW net loss).

Regarding this measure, a plan was also prepared for small business owners and self-employed individuals who were unable to repay debts due to business difficulties during the COVID-19 pandemic. Until last year, the New Start Fund support condition included “COVID-19 damage.” In other words, support was only available if the delinquency occurred during the COVID-19 period. Now, this condition has been removed, allowing all distressed small business owners who operated until November last year to receive support regardless of COVID-19.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)