KIDI, 10th Revision of Experience Life Table

In the 10th revised experience life table, updated for the first time in five years, the average life expectancy for women has surpassed 90 years for the first time in history.

The Korea Insurance Development Institute announced on the 7th that it has completed the revision of the 10th experience life table using life insurance policyholder statistics. The experience life table serves as a national indicator of mortality phenomena alongside the national life table (Statistics Korea), representing the average mortality rate in the insurance industry. Insurance companies can use the experience life table when their own experience statistics are insufficient for developing insurance products. It is also used to calculate the insurance price index disclosed for consumers to compare insurance prices.

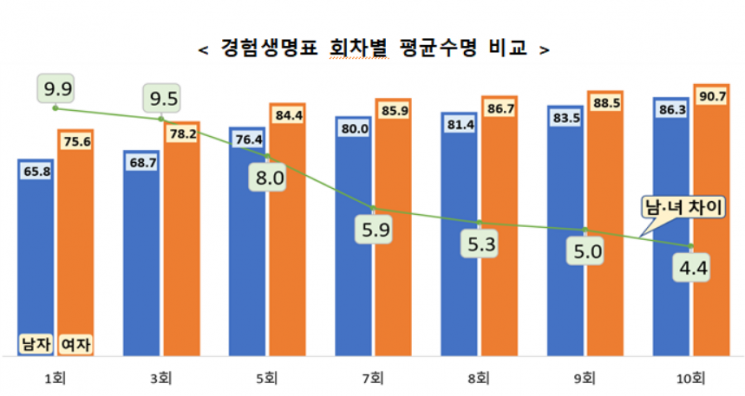

In the 10th experience life table, the average life expectancy is 86.3 years for men and 90.7 years for women, an increase of 2.8 years and 2.2 years respectively compared to the 9th experience life table. Average life expectancy refers to the expected average number of years a newborn aged 0 is anticipated to live. The improvement in mortality rates due to advances in medical technology and better living standards is analyzed as the reason for the increase in average life expectancy. However, the rate of increase in average life expectancy has slowed compared to the past, and the gap in average life expectancy between men and women is gradually narrowing.

The expected remaining life at age 65 is 23.7 years for men and 27.1 years for women, which is an increase of 2.3 years and 1.9 years respectively compared to the 9th experience life table. This suggests that insurance preparation for post-retirement medical expenses and income security will become increasingly important.

A representative from the Korea Insurance Development Institute explained, "With the increase in average life expectancy, insurance products need to be designed from a long-term perspective, covering the economic activity period through old age," adding, "There is a need to pay attention to pension insurance for old-age income security and healthcare-linked insurance products for a healthy elderly life."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)