Domestic Cereal Market Dominated by Dongseo-Nongshim Duopoly

Nongshim Kellogg Holds 45.8% Market Share

Rises to No.1 Surpassing Dongseo Foods

Market Shifts from Sweetness to Nutrition Focus

Competition in the cereal market this year is expected to be fiercer than ever. As demand for cereal as a "healthy and convenient meal" increases, the related market is rapidly reorganizing around "healthy cereals" that emphasize good ingredients and nutrients.

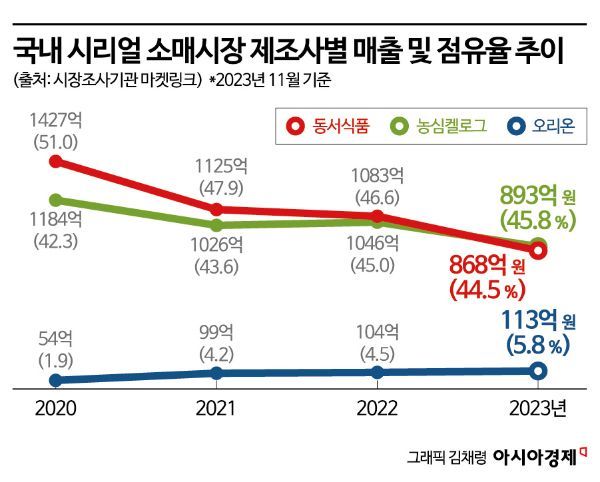

According to market research firm Market Link on the 8th, as of November last year, Nongshim Kellogg's offline retail cereal sales in Korea amounted to 89.3 billion KRW, securing the top spot with a market share of 45.8%. On the other hand, Dongseo Food, which held the number one position in 2022 with a 46.6% share, saw its share drop to 44.5% (sales of 86.8 billion KRW), falling to second place.

The domestic cereal market has been clearly dominated by the duopoly of Dongseo Food and Nongshim Kellogg's. With the two companies accounting for about 90% of the market share, food and confectionery companies, large supermarket private brands, and imported brands are competing for the remaining 10%. However, the leading position had consistently been held by Dongseo Food. Yet, subtle changes have been detected in recent years. Dongseo Food's market share, which was 51.0% with sales of 142.7 billion KRW in 2020, declined to 47.9% in the following year, 46.6% in 2022, and fell below 45% last year. Conversely, Nongshim Kellogg's increased its share from 42.3% in 2020 by 3.5 percentage points over three years to seize the top spot.

The industry estimates that Nongshim Kellogg's aggressive marketing, including the successive launch of new products last year, was effective. Starting with 'Dundunhan Bran Granola,' a mix of flakes made from bran (wheat bran) and oat granola?the first of its kind in Korea?Nongshim Kellogg's introduced products such as 'Dark Choco Protein Delight,' '100% Belgian Granola,' and 'Rice Krispies Unicorn' consecutively last year. Additionally, they renewed 'Chex Choco,' the number one chocolate cereal product, for the first time since its launch in 1995, and re-released the discontinued 'Honey Chex,' refurbishing existing products.

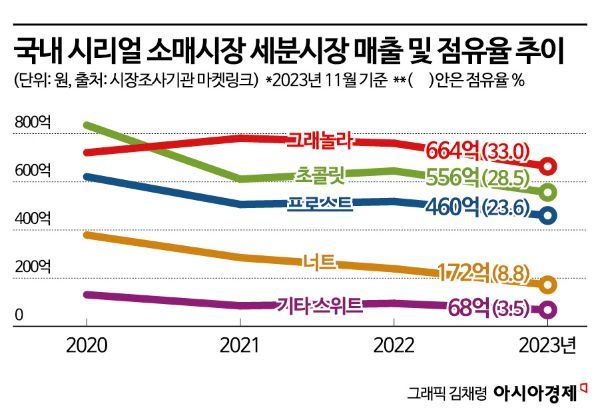

With the once-solid leading position of Dongseo Food shaken, competition in the cereal market is expected to intensify further this year. Recently, the cereal market has been reorganizing around products emphasizing whole grains, protein, low sugar, and nutrients rather than traditional sweet cereals like corn flakes or chocolate cereals, in line with demographic changes due to declining birth rates and health-conscious consumer trends. As a result, various companies are entering the market.

Moreover, with the release of various home meal replacement (HMR) products, the alternative meal market, which was centered on cereals, is shifting toward HMR. In response, the cereal industry is adapting to market changes by adding nutritional components such as protein and dietary fiber to target health-conscious consumers.

A representative company is Orion, which leads with its convenient meal replacement brand 'Market O Nature.' On the 2nd, Orion launched two new oat-specialized products, 'Oh! Granola Oat,' expanding the 'Oh! Granola' product line to 12 items. Additionally, by marketing cereal bars as 'easy to eat,' they have targeted niche markets, increasing their market share from 1.9% in 2020 to 5.8% last year. Pulmuone has also been focusing on the cereal market by recently introducing three types of 'Whole Granola.' A Pulmuone official said, "Reflecting consumer trends that pursue both taste and health, we launched products that are nutritionally excellent with low sugar and high protein and enjoyable to eat. We plan to increase consumer touchpoints by releasing additional granola products with differentiated flavors."

As cereals satisfy consumer demands with a healthy image derived from ingredients such as whole grains, dried fruits, and nuts, as well as a variety of price ranges and product lines tailored to consumer needs, the cereal market is expected to continue its growth trend. According to market research firm Verified Market Research, the global cereal market, which was about 39.2 billion USD (approximately 51 trillion KRW) in 2020, is projected to grow at an average annual rate of 3.4%, reaching 51.2 billion USD (approximately 67 trillion KRW) by 2028.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.