Real Estate Market Downturn and High Interest Rates Lead to Rising NPLs

'Year-End Asset Soundness Ratio Management' Drives Increase in Sales and Securitization

Trend Expected to Continue Due to Rising Financial Company Delinquencies

As high interest rates and a downturn in the real estate market have led to an increase in non-performing loans (NPLs) held by financial companies, the sale and securitization of NPLs are also on the rise. With delinquency rates rising among banks, capital companies, and savings banks, related transactions are expected to grow rapidly.

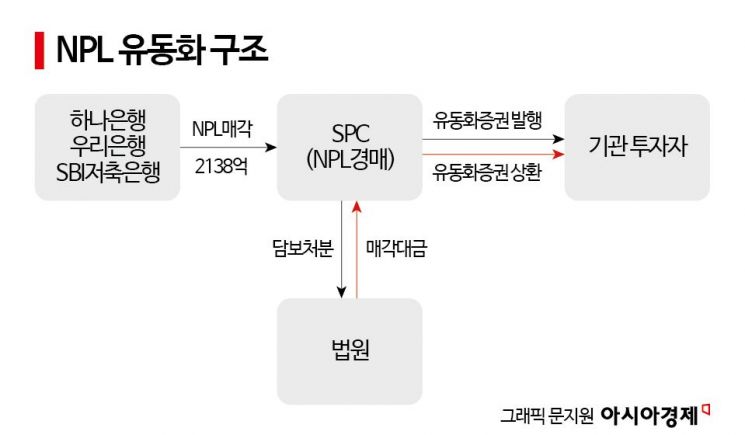

According to the investment banking (IB) industry on the 4th, Hana Bank, Woori Bank, and SBI Savings Bank recently securitized NPLs worth 213.8 billion KRW, with Eugene Asset Management acting as the lead manager. The process involves transferring NPLs to a special purpose company (SPC) established by Eugene Asset Management and then issuing securitized bonds backed by these assets (serving as collateral).

NPLs refer to credit assets such as loans that have been overdue for more than three months and carry potential risks in principal and interest recovery. They are also called Non-Performing Loans, meaning credit that does not generate income or performance. Financial companies classify loans based on delinquency periods into normal loans, loans requiring attention (1-month delinquency), fixed loans (3-month delinquency), doubtful recovery, and estimated loss stages. Among these, fixed, doubtful recovery, and estimated loss are all classified as fixed delinquent loans, included in NPLs.

The loan receivables sold as NPLs by Woori Bank, Hana Bank, and SBI Savings Bank consisted of 171.3 billion KRW in general secured loans and 42.5 billion KRW in special bonds. Most of the loans were related to real estate, with collateral primarily consisting of factories, apartments, and neighborhood commercial buildings, in that order. By region, the largest proportions were in Gyeonggi Province, Seoul, Sejong City, and Chungcheongnam-do. Currently, a total of 174 collateral properties have been put up for auction. Funds recovered through real estate auctions are mainly used to repay principal and interest to investors in the securitized bonds.

An IB industry official stated, "We understand that financial companies disposed of a large number of problematic NPLs at the end of last year to maintain asset soundness ratios at a certain level," adding, "Accounting firms, NPL investment specialists such as United Asset Management Company (UAMCO), and asset management companies are the main players participating in the NPL market."

With the continuation of high interest rates and a downturn in the real estate market, NPL transactions are expected to keep increasing. Following the deterioration of real estate project financing (PF), household debt delinquency rates are also on the rise due to sustained high interest rates. The decline in real estate prices purchased through 'Yeongkkeul' (borrowing to the maximum) and the sharp increase in interest costs have resulted in more household borrowers failing to make timely repayments. Delinquency on loans secured by small factories and commercial buildings in provincial areas is also reportedly significant.

A financial company official said, "While selling NPLs has the advantage of lowering delinquency rates, there is the burden of having to confirm losses on those loans," and added, "If the volume of NPLs in the market increases, the price at which financial companies sell NPLs to investors may fall, increasing the financial companies' losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)