Despite Concerns Over Strengthened Chinese Government Regulations,

Recent Increase in Game License Issuance Brings Hope

Calls for Diversification of Market Entry

The Chinese government recently announced a legislative draft for the 'Online Game Management Measures,' prompting domestic game companies to closely monitor its potential implementation. Although significant damage is expected due to excessive game usage regulations, some are focusing on the increase in approvals of the licensing permit known as 'panho,' hoping for a mitigation of legislative risks.

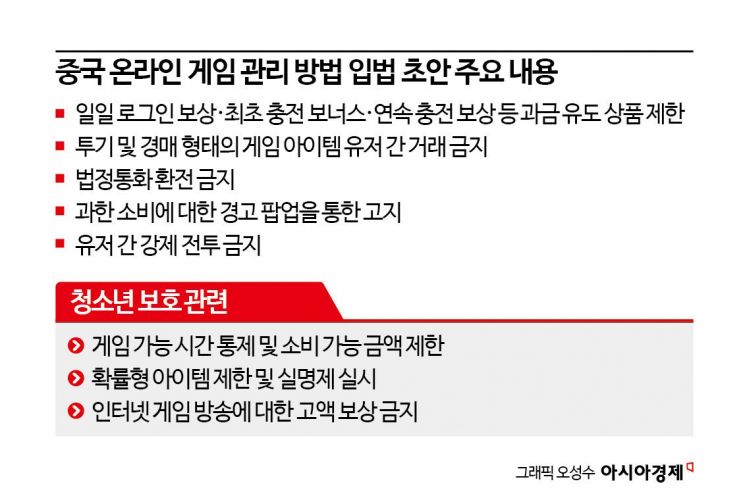

The draft of the 'Online Game Management Measures,' released by the National Press and Publication Administration (NPPA) of China at the end of last month, includes restrictions on monetization inducements such as daily login rewards, first-time recharge bonuses, and consecutive recharge rewards; bans on speculative and auction-style user-to-user trading of game items; prohibition of legal currency exchange; notifications through warning pop-ups for excessive spending; and bans on forced battles between users. Additionally, for the purpose of protecting minors, it contains regulations such as controlling game playtime and limiting spending amounts, restricting probability-based items and implementing real-name verification, and banning high-value rewards for internet game broadcasts.

Among these, domestic game companies are particularly focused on Article 18, which addresses 'restrictions on excessive game usage and spending.' It prohibits rewards that induce cash spending and limits the trading of items at high prices through speculation or auction formats. It also includes provisions to set user recharge limits. Industry insiders agree that if this content becomes law, massively multiplayer online role-playing games (MMORPGs), which generally involve higher spending, will inevitably suffer damage.

Many games currently serviced in China include attendance rewards and probability-based items. Excessive cash spending has already been pointed out as a social issue in China, leading to modifications in related business models. Nonetheless, the Chinese government's decision to reduce monetization through regulation is seen as a considerable burden for game companies operating in the Chinese market. The government's announcement to conduct a consultation process regarding restrictions on monetization inducements and the dismissal of officials responsible for game industry regulation are interpreted as reflecting a strong legislative intent.

Jung Eui-hoon, a researcher at Eugene Investment & Securities, commented, "The core of this regulatory draft is the significant limitation on monetization inducements targeting users by game companies within China," adding, "Expectations for a recovery in the Chinese game market have become uncertain."

However, despite the tightening regulatory atmosphere, the recent consecutive approvals of panho by the Chinese government are interpreted as somewhat meaningful. Panho refers to the approval number issued by the National Press and Publication Administration. To sell in-game currency, a panho is required, effectively serving as a service license. Recently, a shift in the atmosphere was sensed as domestic games such as Gravity's Ragnarok X: Next Generation, Wemade's Mir M, and NCSoft's Blade & Soul 2 received panho approvals.

Therefore, some in the industry expect that if the regulatory proposals announced by the Chinese government are properly followed, uncertainties might actually decrease. An industry insider said, "Entering the Chinese market does not guarantee success, but given its scale, it cannot be ignored, making market penetration essential," adding, "Compared to times when panho issuance was delayed without special mention, it is judged that uncertainties are being resolved."

There are also voices calling for reducing dependence on the Chinese market, which is tightening regulations under the pretext of protecting its own culture. The Chinese game industry is still influential, with an estimated size of 55 trillion won. However, given that regulation and entry into China do not necessarily guarantee success, diversification of overseas expansion is necessary. According to the '2023 Global Game Policy and Legislation Study' published by the Korea Creative Content Agency and others, among six Western European countries including the UK, Germany, France, and Spain, none require foreign operators to obtain a license equivalent to China's panho to conduct game business. Furthermore, they do not impose obligations to designate local agents or install servers in the respective countries for game exports.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)