Construction Companies Next After Taeyoung Face Increasing Difficulties with Financial Institutions

Since Last Year, Banks Have Tightened Loan Screening for Construction Firms

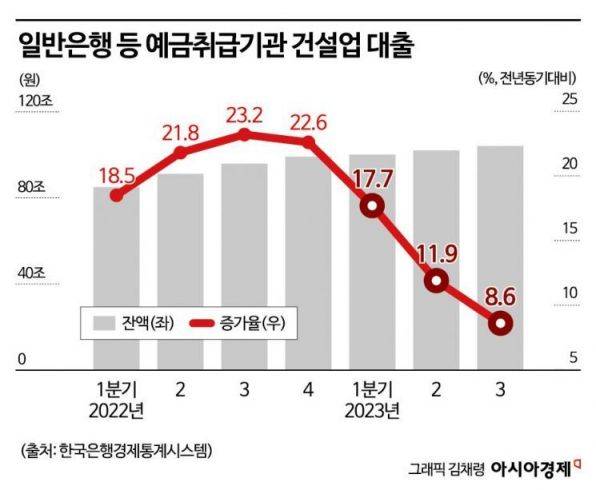

Construction Loan Growth Rate Falls to Single Digits

Funding for Construction Companies Expected to Become More Challenging This Year

"Since Taeyoung Construction was identified as the next target with high PF risk, it has become more difficult to engage with banks than before. Because the PF guarantee scale is large relative to their equity capital, interest rates have increased and loans have become harder to obtain. Negotiations with financial institutions related to PF have also become disadvantageous." (A representative from a major construction company, Mr. A)

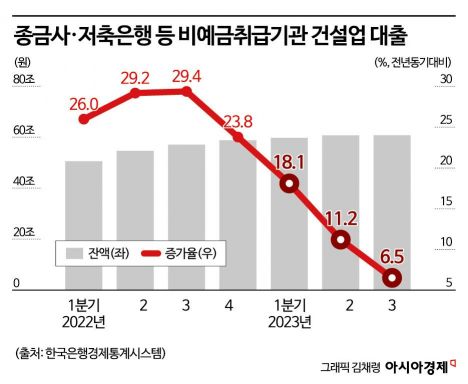

Since Taeyoung Construction applied for corporate restructuring (workout), the funding difficulties in the construction industry have worsened. These signs have been clearly evident since last year when the real estate market began to slump. Not only general banks but also savings banks have started to lock the doors against construction companies seeking loans. The growth rate of construction loans, which fluctuated between 20-30% until 2022, dropped to 6-8% in the third quarter of last year.

Financial Institutions Tightening the Screws on Construction Companies

According to the Bank of Korea Economic Statistics System on the 3rd, the outstanding construction loans from deposit-taking institutions, including general banks, reached 104.0924 trillion won as of the third quarter of last year. The outstanding balance exceeded 100 trillion won for the first time in the first quarter of last year (100.1187 trillion won). Although the balance itself is increasing, the speed of loan growth has significantly slowed. This can be seen from the year-on-year growth rates. The quarterly growth rate two years ago was as high as 23.2% (third quarter). However, it fell to 17.7% in the first quarter of last year and further dropped to 8.6% in the third quarter. This is the lowest level in five years since the third quarter of 2018 (7.6%).

A loan officer at a commercial bank said, "As the construction market worsened, banks have been more conservative in reviewing construction company loans since the second half of last year compared to other industries," adding, "With the Taeyoung Construction incident, it will be even more difficult for construction companies to secure loans this year."

The situation is the same for non-deposit-taking institutions such as savings banks, credit unions, and comprehensive financial companies. The total outstanding balance exceeded 60 trillion won in the second quarter of last year. However, the growth rate sharply declined compared to two years ago. The growth rate, which rose to 29.4% in the third quarter of 2022, fell to 6.5% in the third quarter of last year. This is the lowest in seven years and six months since the first quarter of 2016 (5.2%).

Credit Rating Downgrades, This Year Will Be Even Tougher

The decline in credit ratings of construction companies is also expected to worsen their funding conditions. In a report released on the 29th of last month, Korea Ratings stated, "There is a possibility of principal and interest losses on corporate bonds due to rapid financial sector-led restructuring in some construction companies," and added, "We will comprehensively assess creditworthiness by considering PF contingent liabilities, liquidity response situations, unsold units, and unpaid construction payments, especially for construction companies with reduced economic resilience since the beginning of the year."

Among about 20 construction companies evaluated by Korea Ratings, four have a 'negative' outlook on their long-term credit ratings: GS Construction (A+), Lotte Construction (A+), HDC Hyundai Development Company (A), and Shinsegae Construction (A). These companies are expected to be the first subjects for credit rating review.

Korea Ratings noted, "The aversion to construction and real estate PF-related sectors within the financial market has intensified," and predicted, "Accordingly, construction companies will face difficulties not only in raising new funds but also in refinancing existing borrowings and PF securitization bonds for the time being."

Construction Industry Faces Critical Shortage of Funds

The construction industry is currently in a state of emergency. There are talks that across the industry, workforce restructuring and business downsizing will take place as part of business structure reorganization. Some construction companies have recently reduced their head office staff while increasing on-site personnel and reorganized their organizations focusing on strengthening their bidding competitiveness.

A representative from a construction company said, "The overall atmosphere in the industry is uneasy," adding, "Although no construction company is expected to officially conduct voluntary retirement, there are rumors that several companies are preparing for workforce reductions."

Meanwhile, as instability in the real estate PF market grows, the Ministry of Land, Infrastructure and Transport has launched a 'Construction Industry Rapid Response Team,' led by First Vice Minister Jin Hyun-hwan. The ministry explained, "Although the construction market has been managed stably through ongoing market stabilization and rationalization of real estate regulations, it was judged necessary to strengthen monitoring and rapid response for Taeyoung Construction’s construction sites and the overall construction and PF market to prepare for excessive anxiety."

The response team will monitor the construction and PF markets and swiftly respond in case of construction delays or damages to buyers and partner companies. It also plans to collect difficulties faced by the construction industry and promote institutional improvements. First Vice Minister Jin Hyun-hwan stated, "We plan to announce support measures for the construction industry soon and will closely communicate with the construction sector centered on the rapid response team to address PF market instability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)