Semiconductor Market Recovery Optimism Spreads

Qualitas, Aicland, and Others Rally in Stock Prices

"Meaningful Growth Expected in AI Semiconductor Ecosystem"

As expectations for a recovery in the semiconductor industry grow, the market capitalization of Qualitas Semiconductor and Aiceland, which newly entered the KOSDAQ market in the fourth quarter of last year, is rapidly increasing. The stock price of Padu, which suffered from an inflated IPO price, has also rebounded about 50% from its low point.

According to the financial investment industry on the 3rd, Qualitas Semiconductor, which was listed on October 27 last year at an IPO price of 17,000 KRW, rose 174.4% in just over two months.

Many newly listed companies experience a sharp rise only in the early days after expanding volatility on the first day of listing, followed by a decline in stock price. Qualitas Semiconductor also rose to 30,900 KRW on the first day but closed at 20,650 KRW, down 33.2% from the peak. The downward trend continued, and on November 13 last year, the stock price fell below the IPO price to 16,760 KRW.

The stock price of Qualitas Semiconductor began to rebound with expectations of increased demand for artificial intelligence (AI) semiconductors. Qualitas Semiconductor is a developer of ultra-high-speed interface design intellectual property (IP). It is strengthening its competitiveness based on the largest IP development workforce in Korea. In the case of system semiconductors, semiconductor IP that can reduce design time and development costs is important because high design technology is required.

Chaemin-sook, a researcher at Korea Investment & Securities, explained, "Qualitas Semiconductor is a fabless company that provides interface IP, an ultra-high-speed interconnect solution necessary for complex and massive data computations such as AI, autonomous driving, and data centers," adding, "With the development of AI, data traffic is rapidly increasing, and the need for high-speed communication between chips is growing, leading to increased demand for ultra-high-speed interface IP." She continued, "There are only about 20 IP suppliers worldwide, so supply will be insufficient compared to market growth," and added, "They are diversifying their portfolio based on stable sales to Samsung Foundry."

Since hitting its lowest point after listing, Qualitas Semiconductor has continued to rebound and surpassed the 46,000 KRW level.

Qualitas Semiconductor plans to invest the funds raised through its initial public offering (IPO) in research and development (R&D). It raised 29.9 billion KRW and plans to invest more than 10 billion KRW to recruit experienced development personnel. More than 10 billion KRW will also be used to secure equipment and semiconductor design software necessary for IP development.

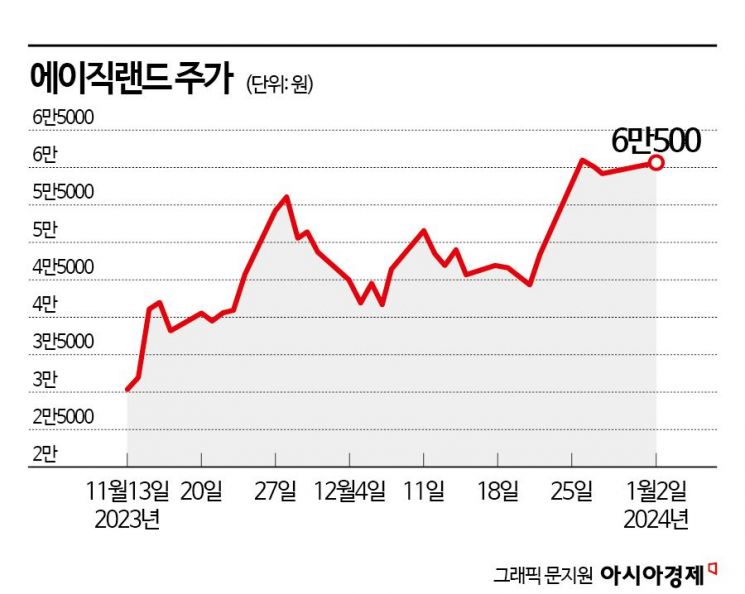

The stock price of Aiceland, an official partner (VCA) of TSMC, the world's largest semiconductor foundry, has also steadily risen since its listing on November 13 last year. The stock price surpassed 60,000 KRW within two months of listing, rising more than 140% from the IPO price of 25,000 KRW. Founded in 2016, Aiceland acts as a bridge between foundry (production specialist) and fabless (design specialist) companies. It provides optimized design services to adapt fabless-designed products to each foundry's production process. Based on its key partnership with TSMC, Aiceland has secured major customers in the fourth industrial revolution sectors such as AI semiconductors and 5G.

Park Jong-sun, a researcher at Eugene Investment & Securities, analyzed, "They have secured fabless customers who want to outsource system semiconductor production using TSMC foundry processes," and "They are expected to benefit from the increasing demand for system semiconductors."

After disclosing results below expectations in the third quarter of last year, Padu's stock price fell to 16,250 KRW but recovered to around 25,000 KRW within two months. Padu recorded sales of 320 million KRW in the third quarter of last year, a 97.6% decrease compared to the same period the previous year. Ryu Young-ho, a researcher at NH Investment & Securities, explained, "Padu manufactures controllers that act as the brain in SSDs," adding, "To recover performance, investment from major customers and securing new customers are necessary."

The recent rebound in Padu's stock price over the past month appears to be driven by low-price buying and expectations of a semiconductor industry recovery. Kim Dong-won, a researcher at KB Securities, predicted, "The core theme of the world's largest home appliance and IT exhibition 'CES 2024' will be AI," and "Demand for AI semiconductors will surge across all industrial sectors." He expressed expectations that "while leading the increase in memory semiconductor demand for companies like Samsung Electronics and SK Hynix, it will also be the inaugural year for meaningful growth in the AI semiconductor ecosystem, including fabless, design houses, and interface companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.