Using 'Refinancing Platform' for Mortgage Loans... Gradual Implementation of 'Stress DSR'

Low-Interest Refinancing Extended Until May 2023

Insurance Comparison Platform Launched... Enhanced Mobile Convenience for Savings Banks

Relaxation of 'Post-Report' for Financial Firms' Overseas Direct Investment

New 'Penalty Surcharge' Doubled for Stock Manipulation Cases

On the 9th, officials were busy moving in the corridor of the Financial Services Commission at the Government Seoul Office in Jongno-gu, Seoul, where the financial authorities decided to include mortgage loans (Judaemae) in the 'debt refinancing' infrastructure scheduled to be launched in May by the end of the year. The financial authorities explained that they aim to reduce the interest burden on mortgage loans by establishing a debt refinancing platform that allows users to compare financial sector loan interest rates at a glance and switch loans easily. Photo by Dongju Yoon doso7@

On the 9th, officials were busy moving in the corridor of the Financial Services Commission at the Government Seoul Office in Jongno-gu, Seoul, where the financial authorities decided to include mortgage loans (Judaemae) in the 'debt refinancing' infrastructure scheduled to be launched in May by the end of the year. The financial authorities explained that they aim to reduce the interest burden on mortgage loans by establishing a debt refinancing platform that allows users to compare financial sector loan interest rates at a glance and switch loans easily. Photo by Dongju Yoon doso7@

The government will reduce the financial burden on users by expanding the scope of refinancing infrastructure and low-interest refinancing support. It will launch a comparison and recommendation platform service that allows easy comparison and subscription of insurance products, enhance the convenience of mobile transactions at savings banks, and computerize claims for indemnity insurance.

Additionally, to assist financial companies in overseas expansion, the government will switch to post-reporting and implement the 'Stress DSR' system for household debt management. It will strengthen responses to unfair capital market transactions such as stock price manipulation and tighten accounting and disclosure regulations for virtual asset issuing companies. For banks, a system requiring annual disclosure of management status including profits, costs, and dividends will also be implemented.

The Financial Services Commission will gradually promote these improved financial systems in the new year.

First, the scope of users of the 'refinancing infrastructure' service, which started in May last year, will be expanded. From January, the refinancing infrastructure will extend from existing unsecured loans to apartment mortgage loans and jeonse (key money deposit) loans. To support youth asset formation, the Youth Leap Account will allow lump-sum payments upon maturity of the Youth Hope Savings, and parental leave benefits will be recognized as income requirements for the account.

The low-interest refinancing program will also be expanded and reorganized. The Financial Services Commission plans to extend the program, which was initially limited to loans first handled by May 31, 2022, to May 31, 2023, during the first quarter. Financial costs will be reduced by exempting a 0.7 percentage point (p) guarantee fee for one year and lowering interest rates by up to an additional 0.5%p, reducing the total financial cost burden by 1.2%p.

In addition, the enforcement decree will be revised in January to rename the Credit Guarantee Fund's factoring service for small and medium enterprises to factoring for small and medium-sized enterprises and mid-sized companies, expanding the scope to mid-sized companies with sales under 300 billion KRW.

Launch of Insurance Comparison Platform... 'Easy Mode' in Banking Sector Expanded to Savings Banks

Measures to enhance financial convenience will also be promoted step-by-step. In January, the Financial Services Commission will launch an insurance product comparison and recommendation service to help consumers easily compare multiple insurance products and subscribe to suitable ones. During the first quarter, the 'Financial App Easy Mode' introduced in the banking sector will be extended to savings banks to improve users' convenience in mobile financial transactions. In October, a system will be implemented allowing hospitals, clinics, and pharmacies to electronically send insurance claim documents to insurance companies upon consumer request.

Furthermore, the dividend system will be improved so investors can invest with knowledge of dividend amounts. Previously, companies confirmed shareholders eligible for dividends at year-end first and then finalized dividend amounts at the next year's shareholders' meeting. The plan is to improve the dividend procedure by first confirming the dividend amount and then determining the shareholders who will receive the dividends.

To protect investors and consumers, the Financial Services Commission will closely monitor operators' obligations and regulatory compliance under the Virtual Asset User Protection Act and impose fines, penalties, and criminal sanctions as necessary. Additionally, in September, the Financial Services Commission plans to expand supervision of prepaid service providers in regulatory blind spots and strengthen exemption criteria to enforce stricter regulations.

Relaxation of Post-Reporting for Financial Companies' Overseas Direct Investment... Gradual Implementation of 'Stress DSR'

While easing unnecessary regulations, the government will gradually strengthen household debt management by implementing the 'Stress Debt Service Ratio (DSR)' system.

From January, the Financial Services Commission will improve regulations to allow financial companies to transfer foreign currency loan claims acquired during overseas infrastructure investments to foreign financial companies as needed. Currently, the Lending Business Act limits the transfer of loan claims to lenders, credit finance institutions, and public institutions, which could raise legal issues. This measure aims to resolve such concerns. Furthermore, the requirement for prior notification for offshore financial company investments and overseas branch establishments will be relaxed to post-reporting.

To manage increasingly threatening household debt, the 'Stress DSR' will be gradually implemented from February. This policy adds the difference between the highest interest rate over the past five years and the current rate (with upper and lower limits of 1.5?3.0%) as an additional interest rate when calculating the DSR limit to reduce loan limits. It will apply to all variable, mixed, and periodic loan products in the financial sector.

However, considering user inconvenience and preparation status by sector, the Financial Services Commission will first implement it for mortgage loans in the banking sector in February and gradually expand it to all loans across the entire financial sector. The plan is to apply 25% of the stress interest rate in the first half of the year, 50% in the second half, and 100% from 2025.

New Penalties for Unfair Capital Market Transactions and Enhanced Bank Management Transparency

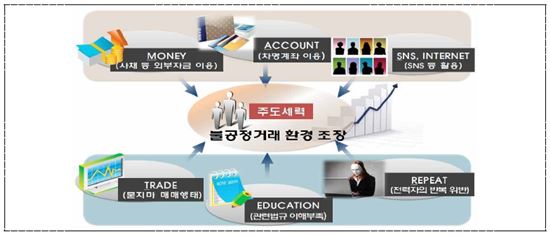

The government will raise penalties for unfair transactions such as stock price manipulation and promote policies to enhance transparency in virtual assets and management. The Financial Services Commission will introduce a new penalty that recovers up to twice the unfair gains obtained from unfair capital market transactions to effectively reclaim illegal profits. It will also specify the standards for calculating unfair gains in law to enable penalties commensurate with the crime.

Accounting and disclosure regulations for virtual asset issuing companies will be strengthened. From January, the Financial Services Commission will prohibit arbitrary recognition of revenue and assets by issuing companies and require external auditor-reviewed footnote disclosures of key whitepaper contents such as circulation volume.

Additionally, the Financial Services Commission will implement a voluntary disclosure system for banks' management status, including profits, costs, and dividends, in the second quarter to make this information easily accessible to the public. From the second half of the year, it will also apply strengthened internal control measures, including the introduction of a 'responsibility structure chart' clarifying internal control responsibilities by executives of financial companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.