Kim Tae-hyun, National Pension Service Chairman, Criticizes POSCO Chairman Appointment Process

Active Involvement in Private Company CEO Appointments Since Current Chairman's Inauguration

"Active Use of Stewardship Code" "Unfair Pressure, Decline in Corporate Value" Mixed Views

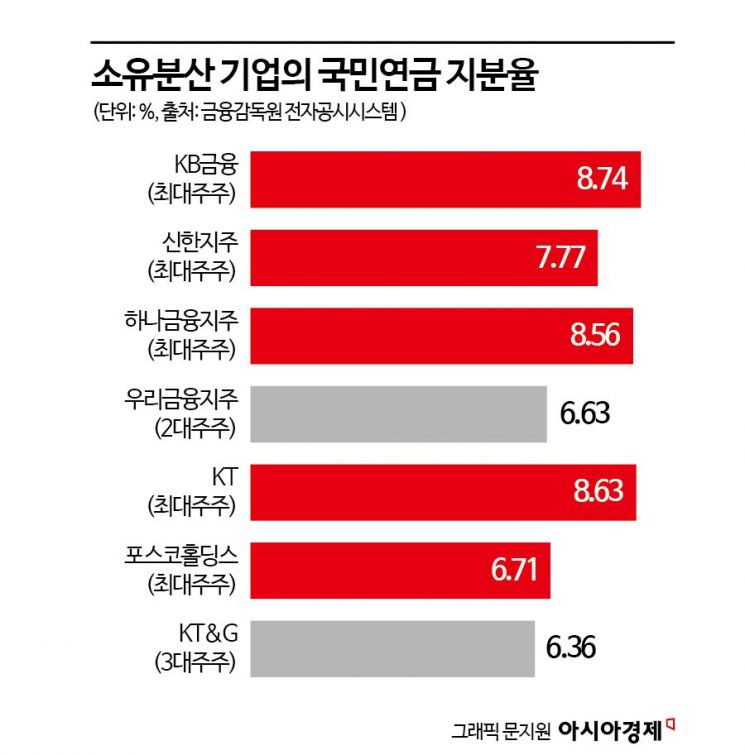

Widely referred to as "ownerless companies," dispersed ownership firms are those that were formerly government-invested or public enterprises and became dispersed in ownership following privatization. Representative examples include KT, POSCO Holdings, and various financial holding companies. Since these companies lack a dominant controlling shareholder, or so-called owner, their CEOs gain extensive control, leading to criticism of inappropriate long-term reappointments. This is why the National Pension Service (NPS) demands governance improvements based on the Stewardship Code (guidelines for institutional investors' exercise of voting rights) for these companies. The NPS has publicly raised concerns about the next chairman selection process at POSCO Holdings, following its actions with KT.

Kim Tae-hyun, Chairman of the National Pension Service, is reporting on business operations at the National Assembly Health and Welfare Committee's audit on the 20th. Photo by Kim Hyun-min kimhyun81@

Kim Tae-hyun, Chairman of the National Pension Service, is reporting on business operations at the National Assembly Health and Welfare Committee's audit on the 20th. Photo by Kim Hyun-min kimhyun81@

Chairman Kim Taehyun: "Questions Raised Over Fairness of POSCO CEO Appointment Process"

Kim Taehyun, Chairman of the National Pension Service, told Asia Economy in a phone interview that his concerns about the fairness of the ongoing POSCO Holdings CEO appointment process reflect "thoughts on the desirable structure of dispersed ownership companies that I have expressed since 2022," adding, "As chairman representing the NPS and fund management, I simply spoke what was appropriate." The NPS is the largest shareholder of POSCO Holdings.

Earlier, in an interview with a media outlet, Chairman Kim stated, "The appointment of the CEO of POSCO Holdings, a dispersed ownership company, should provide equal and fair opportunities to both internal and external candidates to maximize shareholder value, as I mentioned in the KT case." Regarding the POSCO CEO Candidate Recommendation Committee (CRC), he said that the market, shareholders, and investors would appropriately judge whether a body composed solely of existing outside directors can fairly represent shareholder interests. Since these remarks came from the chairman representing the largest shareholder, the impact was significant. Some even interpreted this as a brake on the third term of current POSCO Chairman Choi Jungwoo.

In response to Chairman Kim's remarks, POSCO immediately stated that "supporting Chairman Choi Jungwoo's third term is a personal freedom," and also expressed the intention to "conduct the next chairman selection process transparently and fairly." Recently, the POSCO Holdings board abolished the rule prioritizing the review of the incumbent chairman's reappointment and launched a new CEO Candidate Recommendation Committee. Under this structure, the chairman selection process begins three months before the term expires, regardless of whether the incumbent chairman expresses intent to seek reappointment. In effect, the incumbent chairman can become a candidate even without declaring reappointment intentions. Although the 'self-reappointment system,' which prioritized reviewing the incumbent's reappointment to enhance transparency, was abolished and the CRC was formed, six of the seven outside directors were appointed during Chairman Choi's tenure, leading to a prevailing view that little has changed from the previous 'self-reappointment' system. This is why the term 'Choi's loyalist regime' is used.

NPS Takes Firm Stance Against Self-Reappointment

During the Moon Jae-in administration, the NPS strengthened the Stewardship Code and exerted influence over board appointments but had never intervened in CEO appointments. In 2019, then Minister of Health and Welfare Park Neung-hoo stated, "It is unthinkable for the NPS to intervene in the CEO appointment process of a specific company." However, the atmosphere changed after Chairman Kim's appointment. At a press conference marking his 100th day in office in December 2022, he publicly addressed governance issues in dispersed ownership companies. Around the same time, Seo Wonju, head of the Fund Management Headquarters, also stated, "Governance must change to prevent concerns about emperor-style management and self-reappointment," implying that the Stewardship Code could extend to CEO personnel decisions.

KT is a representative company where the NPS actively intervened in governance issues. KT is also the largest shareholder. In early 2023, when the board decided to reappoint then-CEO Ku Hyunmo, the NPS expressed opposition under the name of the head of the Fund Management Headquarters, stating that the process did not meet principles of transparency and fairness. Ultimately, due to NPS opposition, both CEO Ku Hyunmo and KT President Yoon Kyunglim, who was close to the former CEO, were ousted. Subsequently, KT formed a governance improvement task force and, after 17 intensive discussions, improved the CEO and outside director appointment procedures. KT experienced an unprecedented CEO vacancy in its history, and the management gap lasted for five months before resolution.

The "Kim Taehyun-style NPS" recently established a separate organization to improve governance in dispersed ownership companies. This is the Governance Improvement Advisory Committee, composed of 10 external members appointed by the chairman. Its roles include ▲ proposing desirable governance directions for dispersed ownership companies, ▲ reviewing the appropriateness of voting rights exercise standards and making rational improvements, and ▲ monitoring, advising, and improving Stewardship Code implementation.

Realizing Shareholder Interests VS Unfair Pressure 'Shaking Corporate Value'

Opinions on the NPS's actions are divided. Some view the active use of the Stewardship Code to realize shareholder interests positively, while others worry that undue pressure to replace CEOs or interference in vested interests could destabilize corporate value. Although there is recognition that CEOs in ownerless companies forming boards with close associates to create a kind of stronghold is problematic, there is also concern that government intervention in CEO decisions should not become a recurring precedent. This is because the NPS's messages are often interpreted as government intentions.

Moon Sung, a lawyer at Yulchon Law Firm and former head of the NPS Shareholder Rights Exercise Team, said, "It is undesirable for the chairman to publicly comment on CEO personnel decisions as is happening now," adding, "Many people are skeptical about opposing the reappointment of a CEO with good performance for unclear reasons." Both KT and POSCO, where the NPS has intervened or is intervening in CEO appointments, recorded record-high performances last year.

With just over a month remaining until the final selection of the next POSCO Holdings chairman, the prevailing view is that the NPS's involvement will not lead to a repeat of KT's experience, where executives resigned one after another. Unlike KT, where Hyundai Motor Company, the second-largest shareholder after the NPS, publicly expressed that executives should step down, BlackRock, the second-largest shareholder of POSCO Holdings, has not made any significant statements. Individual investors holding 75.86% of POSCO Holdings shares are generally supportive of the current management. This is because POSCO Holdings' stock price surged 80.6% last year, leading the secondary battery boom and generating substantial profits for most investors. Even in an extreme 'vote battle,' it would be difficult for the outcome to go entirely according to the NPS's wishes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)