Financial Supervisory Service Revises External Audit and Accounting Regulations

Priority Application to Construction and Finance in 2024... Sequential Expansion

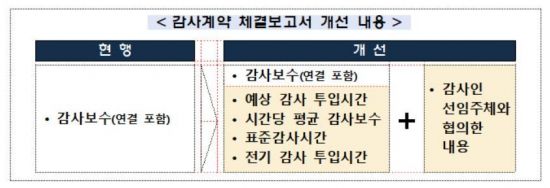

Starting next year, auditors (accounting firms) must provide detailed information on the expected audit hours and average hourly fees to the target companies before concluding audit contracts.

The Financial Supervisory Service (FSS) announced on the 29th that it has established a basis for reporting the results of audit time consultations in the enforcement rules of external audit regulations, reflecting improvements to the accounting system and amendments to the "Regulations on External Audit and Accounting."

Previously, sufficient information on expected audit hours and average hourly fees was not provided at the time of audit contract conclusion, making it difficult for companies to assess the appropriateness of audit fees.

Going forward, detailed information on the calculation of audit hours by stage, hourly audit fees, and audit personnel involved must be provided before concluding the audit contract, and the results of consultations with the company must be submitted to the FSS. This will apply to audit contracts concluded from the 29th onward.

The FSS also allowed listed companies to designate auditors with industry expertise if they wish. Currently, if auditors who lack deep understanding of the company or industry are assigned, it can lead to increased audit hours or excessive document requests, causing difficulties for companies.

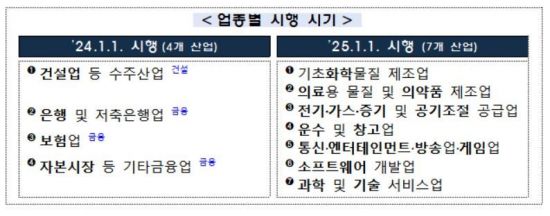

The FSS selected 11 industries requiring industry expertise for designated auditors by gathering opinions from listed companies and accounting firms. Considering the time needed for accounting firms to secure specialized personnel, the policy will first apply to the construction and financial sectors in 2024, and then gradually expand to other industries starting in 2025.

The FSS anticipated that "consultations between auditors and companies will be more substantive, leading to more rational audit contract conclusions," and that "listed companies will be able to appoint auditors with expertise in their respective industries, enhancing the efficiency of designated audits and reducing the burden of inspections."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)