KOSPI Up 18.7%, KOSDAQ Up 27.6% This Year

KOSPI Ranking 13th Among 27 Countries by Fluctuation Rate, Up 12 Places from Last Year

Foreign Buying Drives Market Rise... Semiconductor and Automobile Stocks Purchased

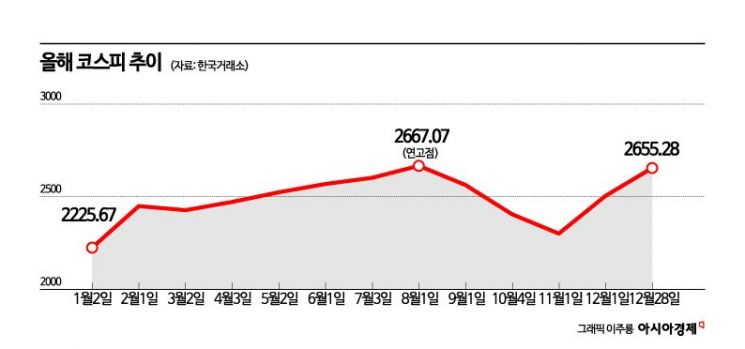

The KOSPI settled above the 2650 level on the last trading day of the year, achieving a "successful finish." The KOSDAQ also closed the year 2023 by rising above the 860 level.

According to the Korea Exchange on the 29th, the KOSPI closed at 2655.28, up 1.60% on the last trading day of the year. This figure is close to the yearly high of 2667.07 recorded on August 1. The KOSPI rose for three consecutive days recently, settling above the 2600 level and recovering to the 2650 level to close the year, boosting expectations for the stock market next year. The KOSDAQ also rose 0.79% to close at 866.57, regaining the 860 level.

The day's rally was led by foreigners and institutions. Foreign investors net bought 628.9 billion KRW in the KOSPI market and 75.2 billion KRW in the KOSDAQ market. Institutions purchased 815.8 billion KRW in the KOSPI market and 3.9 billion KRW in the KOSDAQ market, showing a slight buying advantage.

Major stocks with large market capitalizations surged, driving the index higher. All of the top 55 stocks by market capitalization in the KOSPI market closed in the red (positive). New record highs were also frequently recorded. The market leader Samsung Electronics closed at 78,500 KRW, up 0.64% from the previous session, marking a 52-week high to end the year. Kia rose 3.09% to surpass the 100,000 KRW mark, reaching an intraday high of 100,900 KRW and setting a new 52-week high. Celltrion rose 6.16% to surpass the 200,000 KRW level, reaching an intraday high of 202,500 KRW, also marking a 52-week high.

Choi Yoo-jun, a researcher at Shinhan Investment Corp., said, "On the last trading day of the year, the KOSPI expanded its gains and closed near the high recorded on August 1." He analyzed, "This was because the overall global stock market investment sentiment was positive and macroeconomic variables had little influence." He added, "Although the market was sideways in the early session due to a lack of new factors, large-scale program buying by institutions and foreigners led the market."

The KOSPI rose 18.7% this year. After reaching a yearly high on August 1, the KOSPI declined but rebounded in early November, supported by a full ban on short selling and expectations of interest rate cuts at year-end, closing higher for the first time in a year. In 2020, it rose 30.8%, in 2021 it increased 3.6%, but it fell 24.9% last year.

This year, the KOSPI's rate of change ranked 13th among 27 countries (G20 + Asia), exceeding the average of major countries' stock markets (11%). Last year, it ranked 25th. Although it ranked 13th in annual growth rate, it ranked first in growth rate since November. A Korea Exchange official explained, "Since November, the full ban on short selling and expectations of interest rate cuts by the U.S. Federal Reserve (Fed) helped the KOSPI record a 15% rate of change in November and December, ranking first among the G7 and Asian countries." The U.S. ranked second (14%), followed by Germany (13%), India (13%), and Taiwan (10%).

The KOSPI market capitalization at the end of this year was 2,126 trillion KRW, an increase of 359 trillion KRW (20.3%) compared to the end of last year. As the global stock market continued to rise, market capitalization also increased, especially in sectors with high growth rates such as steel and metals and electrical and electronics. By sector, steel and metals increased from 50 trillion KRW last year to 73 trillion KRW this year, a 45.7% increase; electrical and electronics rose from 635 trillion KRW to 877 trillion KRW, a 38.1% increase; and transportation equipment increased from 129 trillion KRW to 171 trillion KRW, a 32.2% increase. The average daily trading volume decreased by 9.2% compared to last year, but the trading value increased by 7.0%.

The KOSDAQ rose 27.6%. At the beginning of the year, innovative growth stocks such as secondary batteries led the rise, and after a correction phase in the second half, it rebounded due to expectations of interest rate cuts. Market capitalization was 432 trillion KRW, an increase of 116 trillion KRW (36.9%) compared to the end of last year. The average daily trading value increased by 45.3% compared to last year, and trading volume increased by 8.1%.

Foreign investors led the domestic stock market's rise this year by net buying 12.6273 trillion KRW. During the same period, institutions and individuals net sold 4.1342 trillion KRW and 5.8197 trillion KRW, respectively. Foreign investors focused on semiconductors and automobiles this year. They net bought 16.7348 trillion KRW of Samsung Electronics alone, exceeding the total net buying amount of foreign investors in the domestic market this year. SK Hynix followed with net purchases of 2.7683 trillion KRW, Hyundai Motor with 1.8027 trillion KRW, and Kia with 1.1801 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)