82 New Listings This Year... 17.1% Increase Compared to Last Year

Signs of Recovery... Absence of Mega IPOs Exceeding 1 Trillion Won Continues

Urgent Need to Introduce Cornerstone Investor System Amid Increased Volatility

The domestic stock market closed its IPO market for the year with the listing of DS Danseok. Although a downturn was expected as several major IPOs withdrew their listings from the beginning of the year, the market revived after the implementation of expanded price fluctuation limits on the first day of listing. However, issues such as the predominance of small and mid-cap listings and speculative funds flocking on the first day of listing were noted as areas for improvement.

IPO Market Recovery... Disappointment Over Lack of Major Listings

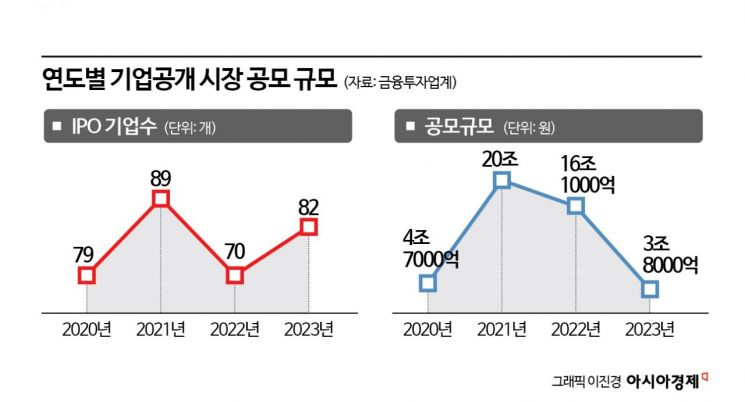

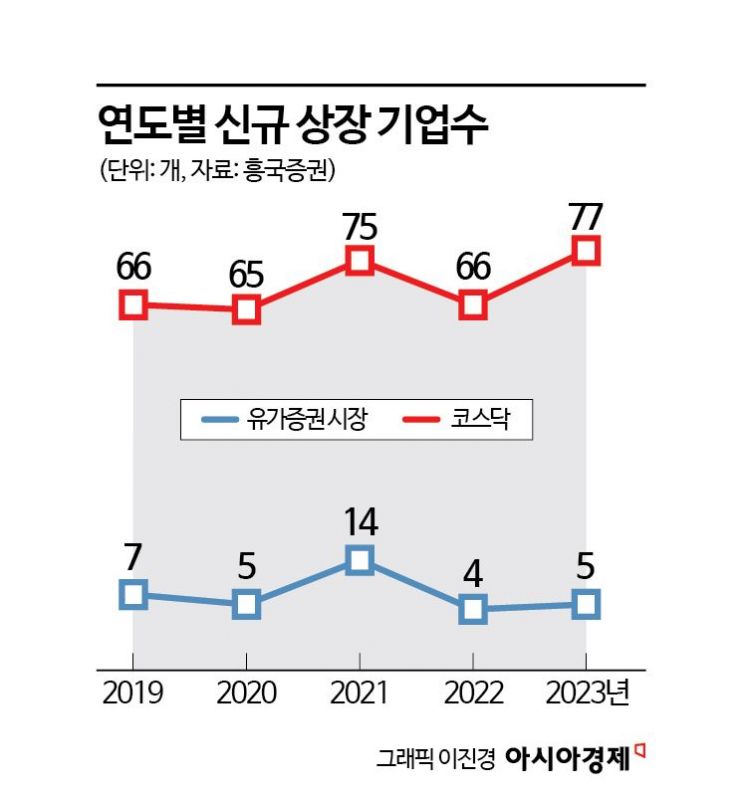

According to the financial investment industry on the 26th, a total of 82 new listings (excluding SPACs, REITs, and relistings) entered the KOSPI and KOSDAQ markets this year. By market, direct listings included 5 companies on the KOSPI and 70 companies on the KOSDAQ. Seven companies transferred their listings from KONEX to KOSDAQ. This represents a 17.1% increase compared to the 70 new listings last year. It also exceeds the five-year average of 76 new listings per year from 2018 to 2022.

The total public offering size this year was 3.8 trillion KRW, down from 16.2 trillion KRW last year. Excluding LG Energy Solution’s IPO in January last year (12.8 trillion KRW), the amount increased by 14% compared to 3.4 trillion KRW.

Although the IPO market generally revived, the absence of major IPOs that began in the second half of last year continued into this year. With central banks in the US and other major countries raising benchmark interest rates, investors have been avoiding IPOs exceeding several trillion KRW. Early in the year, Curly, Oasis, and K-Bank withdrew their listings, and in October, Seoul Guarantee Insurance postponed its IPO. However, the successful listing of EcoPro Materials, a quasi-major company with an expected market capitalization between 500 billion and 2 trillion KRW, has raised expectations for next year’s market.

Choi Jong-kyung, a researcher at Heungkuk Securities, explained, "The average market capitalization of newly listed companies was in the low 200 billion KRW range," adding, "It is regrettable that the trend was mainly small and mid-cap listings and that there was no true 'major' IPO with a single offering size exceeding 1 trillion KRW."

By industry, the electric and electronics sector, including secondary batteries and semiconductors, showed strength. The number of companies increased by 27%, from 18 last year to 22 this year. Interest in artificial intelligence (AI) has grown, and the service sector, including software and content, increased by 28%, from 16 to 23 companies.

Increased Volatility on First Day of Listing Spurs Speculative Trading

The biggest issue in this year’s IPO market was the expanded price fluctuation range on the first day of listing. As part of regulatory improvements to enhance the soundness of the IPO market, the financial authorities expanded the price limit on the first day of listing for newly listed companies to 60%?400% of the offering price starting June 26. For example, if the offering price is 10,000 KRW, the stock price can trade between 6,000 KRW and 40,000 KRW on the first day. The Korea Exchange expects that expanding the fluctuation range on the first day will strengthen the rapid price discovery function.

After the implementation of the expanded fluctuation range, three companies?KNS, LS Materials, and DS Danseok?recorded a 'ttattabul' (four times the offering price) on their first day of listing.

Founded in April 2006, KNS is a manufacturer of automated current interruption device (CID) equipment for secondary batteries. Starting with secondary batteries for smartphones in 2010, it developed cylindrical battery CID equipment for electric vehicles in 2015. It also successfully diversified its products by developing welding equipment for prismatic batteries. From November 16 to 22, it conducted demand forecasting targeting domestic and foreign institutional investors and finalized the offering price at 23,000 KRW, exceeding the expected range of 19,000 to 22,000 KRW. The general public subscription attracted 3.13 trillion KRW in deposits. On December 6, the stock opened at 71,000 KRW, 208.7% above the offering price, and closed at 92,000 KRW. It became the first company in Korean stock market history to record a 'ttattabul' on the first day of listing.

Following KNS, LS Materials also achieved a ttattabul, and the last listing of the year, DS Danseok, surged on its first day, intensifying competition for IPO subscriptions. DS Danseok received subscriptions from the general public over two days starting the 14th, attracting 15 trillion KRW in deposits and recording a competition rate of 984.1 to 1. DS Danseok operates in bioenergy production and secondary battery and plastic recycling businesses. LS Materials, an ultracapacitor manufacturer, also attracted deposits worth 12.77 trillion KRW during its subscription.

Even before KNS’s listing, several newly listed companies surged well above their offering prices. Doosan Robotics, which recorded subscription deposits of 33.11 trillion KRW, surpassed a market capitalization of 7 trillion KRW three months after its October 5 listing. Its current stock price is 112,300 KRW, up 331.9% from the offering price of 26,000 KRW. EcoPro Materials, which listed at an offering price of 36,200 KRW on November 17, rose 420.7% in two months. LS Materials increased 682.5% in just nine trading days.

With increased volatility on the first day of listing, speculative funds aiming for short-term gains are flocking in. Looking at the stock price trends of newly listed companies entering the domestic market in the second half of this year, it is still insufficient to say that the rapid price discovery function has been strengthened. Some voices of concern have also emerged within the financial investment industry. A financial investment industry official explained, "Many companies surge on the first day of listing but then fall back to the offering price level after one to two months," adding, "Speculative funds behave like locusts, moving from one newly listed company to another, causing volatility." He continued, "Although efforts are underway to introduce a cornerstone investor system, progress has been sluggish. Efforts are needed to attract institutional investors who want to invest in new stocks for the long term."

The cornerstone investor system is a mechanism where issuers and underwriters secure investors before submitting the securities registration statement during the IPO process and allocate part of the offering to them in advance. Cornerstone investors are those who receive a portion of the offering before the offering price is finalized, on the condition of underwriting the offering price when a company conducts an IPO. Introducing this system is expected to bring stable capital inflows and attract other investors during IPOs. However, to implement the cornerstone investor system, amendments to the Capital Markets Act prohibiting 'pre-offering activities' are necessary.

Hong Ji-yeon, a senior researcher at the Korea Capital Market Institute, said, "To introduce the cornerstone investor system domestically, regulations should be prepared that suit domestic conditions by referring to overseas systems," adding, "Along with the advantages of enhancing the stability and reliability of the IPO market, it is necessary to establish regulations concerning lock-up obligations, conflict of interest prevention, and disclosure enhancement to minimize fairness issues related to preferential allocation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)