Price Stability Target Operation Status Report

"The Pace of Inflation Slowdown Will Be Gradual"

The Bank of Korea (BOK) expects the consumer price inflation rate in December to be similar to or slightly lower than that of November, gradually approaching around 2% by the end of next year. Although the consumer price inflation rate significantly slowed to 3.3% in November due to declines in oil and agricultural product prices, it is anticipated that such a rapid decrease will be difficult to sustain going forward.

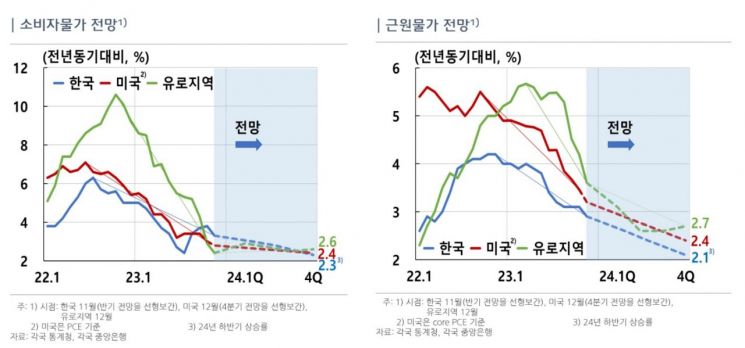

In its December 20 report titled ‘Price Stability Target Operation Status Review,’ the BOK stated, "If oil prices do not rise sharply again, inflation is expected to continue slowing as demand-side pressures weaken and the impact of supply shocks gradually diminishes, but the pace will be moderate." Specifically, the projected consumer price inflation rates are 3.0% in the first half of next year, 2.3% in the second half, and 2.1% in the first half of 2025.

Consumer Price Inflation Forecast: 2.3% in the Second Half of Next Year

The consumer price inflation rate clearly decelerated after peaking at 6.3% in July last year, then rebounded sharply from August this year due to rising international oil prices, exchange rates, agricultural product prices, and the fading base effect. However, in November, oil and agricultural product prices declined, bringing inflation down to the low-to-mid 3% range.

Core inflation (excluding food and energy) has steadily slowed since the end of last year as the effects of the pandemic and war gradually dissipate and domestic demand weakens. However, the accumulated cost pressures continue to have a lingering impact, resulting in a gradual slowdown. Monthly data show that core inflation remained rigid between 3.8% and 4.0% until May, dropped significantly to 3.3% in June, and then eased gradually to 2.9% in November.

In the second half of this year, consumer price inflation was pushed upward by agricultural products and petroleum compared to the first half, while non-petroleum industrial products and services continued to slow, acting as downward factors. The BOK explained, "Agricultural, livestock, and fishery products and petroleum raised the consumer price inflation rate by 0.4 percentage points in the second half compared to the first half, whereas services, non-petroleum industrial products, and electricity, gas, and water lowered it by about 1.1 percentage points."

The BOK expects inflation to continue a moderate deceleration trend as demand-side pressures weaken and cost pressures gradually ease, provided there are no additional supply shocks. Inflation is projected to approach 2% toward the end of next year. However, uncertainties remain high regarding the future path, including international oil price trends, domestic and global economic conditions, and the impact of cost pressures.

Looking at global inflation, major countries’ inflation rates have been trending downward since the second half of last year. The United States saw a slight rebound in the third quarter of this year due to sharp oil price fluctuations and the fading base effect but resumed a slowing trend in the fourth quarter. In the Eurozone and the United Kingdom, where the inflation peak occurred relatively later, the deceleration trend has continued recently. Core inflation has steadily declined in most major countries, though at a slower pace than overall consumer prices.

Choi Chang-ho, Director of the BOK’s Research Department, said, "Inflationary pressures from domestic demand, such as private consumption, are expected to be limited going forward." He added, "From a government policy perspective, gradual increases in electricity and city gas rates and reductions in fuel tax cuts may somewhat slow the deceleration of inflation next year."

On the same day, BOK Governor Lee Chang-yong warned in his opening remarks at a press briefing, "The last mile to bring inflation back to the target level may not be easier than before."

Governor Lee stated, "Although the impact of interest rate hikes is expected to continue and inflation is likely to slow, inflation remains significantly above the target level, so it is still too early to ease vigilance against inflation."

Lee Chang-yong: "We Need to Watch Whether Powell’s Remarks Are an Overreaction by the Market"

He expressed concern, saying, "There is great uncertainty about the future trajectory of commodity prices such as international oil prices, cumulative cost-push pressures persist, and labor costs remain high. Considering these factors, the last mile to bring inflation back to the target level may not be easier than before."

He continued, "Last week, the U.S. Federal Reserve (Fed) and the European Central Bank lowered their inflation forecasts reflecting the recent slowing trend but still maintain vigilance against inflation. I believe this also reflects the difficulty of the last mile."

Regarding market expectations about Fed interest rate cuts, Governor Lee said, "Fed Chair Jerome Powell’s comment that there was discussion about rate cuts is not a significant departure from expectations or a change in stance. Since it may not indicate the start of serious discussions on rate cuts, we need to observe whether the market is overreacting."

He added, "It is true that the likelihood of Fed rate cuts next year has increased, but international financial markets have stabilized due to expectations that the U.S. will no longer raise rates decisively. For South Korea, the easing of constraints on monetary policy decisions, such as exchange rates and capital flows, allowing policy to be conducted based on domestic factors, is a positive development."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.