Micron's Sales Rebound After 6 Quarters

Impact of Memory Industry Production Cuts and Price Increases

Focus on Samsung Electronics and SK Hynix Earnings

Market Outlook for Q4 Sales Rises

Samsung Electronics announced its earnings one month earlier than SK Hynix, and the sales of US-based Micron, known as the 'memory semiconductor industry barometer,' turned to an upward trend for the first time in six quarters. This confirms Micron's diagnosis that the industry is showing signs of gradual recovery in the second half of the year. Expectations for improved fourth-quarter earnings of Samsung Electronics and SK Hynix have gained momentum.

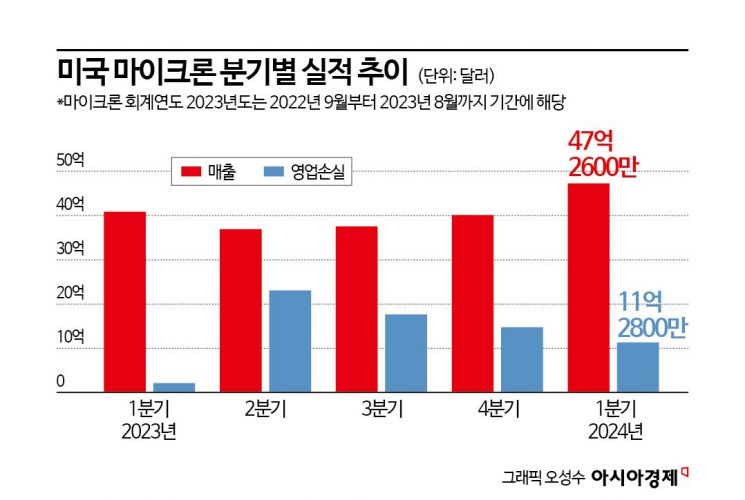

According to the first quarter results of fiscal year 2024 (September to November 2023) announced by US memory company Micron on the 20th (local time), sales recorded $4.726 billion, an increase of 15.69% compared to the same period last year ($4.085 billion). Although sales had declined compared to the same period in the previous five quarters, they rebounded this quarter. Sales also exceeded the forecast of $4.4 billion presented at the previous quarter's earnings announcement. Operating loss was $1.128 billion, which is more than halved compared to the second quarter of fiscal year 2023.

Micron's earnings recovery was largely influenced by production cuts in the memory industry and rising semiconductor prices. As inventory in the market decreased, Micron's average selling price (ASP) of DRAM rose by up to 10% compared to the previous quarter, and NAND ASP increased by about 20%.

The overall market prices have also been on the rise since October. According to market research firm DRAMeXchange, the fixed transaction price of general-purpose PC DRAM products last month was $1.55, up 3.33% from the previous month. This marked the first price increase in two years and three months since July 2021, followed by two consecutive months of growth. Prices for general-purpose NAND products for memory cards and USBs also rose for two consecutive months, reaching $4.09 last month.

Sanjay Mehrotra, CEO of Micron, explained, "Most customers across markets such as PC, mobile, and automotive have inventory levels that are normal or close to normal." He also said, "Inventory for data center customers is improving and is expected to approach normal levels in the first half of 2024."

The semiconductor industry views Micron's earnings improvement as an indicator of the recovery trend in the semiconductor market. Kim Yang-peng, a senior researcher at the Korea Institute for Industrial Economics & Trade, said, "Semiconductor sales began to decline sharply from October last year and continued into this year, but recently industry earnings have improved," adding, "Currently, prices have risen due to production cuts on the supply side, and if demand also turns to an upward trend in the future, prices could skyrocket due to supply shortages."

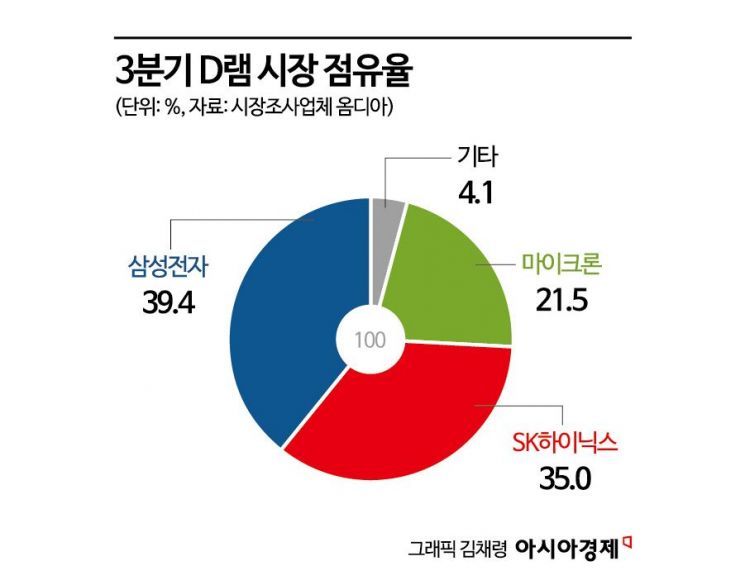

Market expectations for improved fourth-quarter earnings of Samsung Electronics and SK Hynix are also growing. BNK Securities recently revised its sales forecast for Samsung Electronics' DS Division (semiconductors) for the fourth quarter from 18.871 trillion KRW to 20.014 trillion KRW. The fourth-quarter sales forecast for SK Hynix compiled by financial information provider FnGuide is 10.3095 trillion KRW. This is an average of securities firms' forecasts made within three months, and when narrowed down to one month, it increases to 10.3341 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)