Financial Services Commission Prepares 2024 Work Report

Short Selling System Improvements Remain Key Policy Next Year

Focus on Strengthening Internal Controls and Ongoing Treasury Stock System Enhancements

The financial authorities will continue to prioritize improving the short-selling system as a key policy next year, just as they did this year. They plan to pass legislation after gathering market participants' opinions through a forum by early next year. Strengthening internal controls and improving the treasury stock system will also be included in major capital market policies.

According to the Financial Services Commission on the 21st, preparations for the 2024 work report are underway, centered on the Financial Policy Division. The division chief is selecting the main policies to be pursued next year. The Financial Policy Bureau plans to finalize the selection and report to the Chairman of the Financial Services Commission by early next year.

Goal to Legislate Short-Selling Computerization in the First Half of Next Year

The biggest issue in the capital market next year is 'improving the short-selling system.' The financial authorities plan to prepare related legislation by the first half of next year after holding forums on short-selling system improvements. Earlier, the 'Short-Selling Civil-Government-Political Council' announced improvements including △building a system to block illegal short-selling (computerization) △eliminating an uneven playing field (resolving discrimination between lending and borrowing) △strengthening sanctions against illegal short-selling. The related bills are currently under discussion in the National Assembly's Legislation and Judiciary Committee.

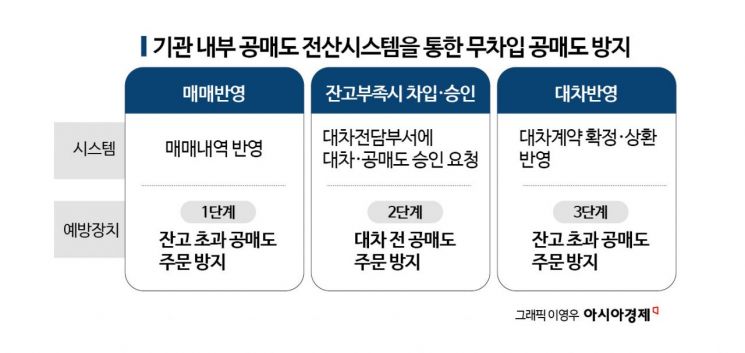

The core of the improvement plan is building a system to block illegal short-selling. The computerization will be implemented through a two-track approach involving related institutions and securities firms. Related institutions will build internal systems to electronically manage the available short-selling balance. Securities firms will only allow short-selling orders if they confirm that the mandatory institutions have established internal computerized short-selling systems.

However, the consensus is that a real-time system to block illegal short-selling, as demanded by individual investors, is impossible due to the structure of foreign and institutional (lending) short-selling transactions. Foreign and institutional short-selling follows the sequence of lending-order-balance. Lending transactions refer to contracts where stock borrowers and lenders mutually borrow stocks. Afterward, when foreigners or institutions place short-selling orders with securities firms, the short-selling balance is recorded at the responsible bank two trading days later. Each contract process is conducted independently, so only the parties involved can verify the short-selling balance.

Song Ki-myeong, Head of the Stock Market Department at the Korea Exchange's KOSPI Market Division, said, "For individual short-selling through lending, securities firms manage both orders and balances, so it is easy to grasp the current position. However, for foreigners and institutions, securities firms receive the short-selling orders, and the balance is managed by the custodian bank, making it difficult to understand the status."

This is why the Financial Services Commission proposed a system improvement requiring foreign and institutional investors to internally manage their balance systems. Additionally, securities firms receiving short-selling orders will be obligated to verify the management system.

Eliminating the uneven playing field focuses on removing differences in short-selling conditions between foreigners/institutions (lending) and individuals (borrowing). The most controversial short-selling repayment period was standardized to 90 days. However, foreigners and institutions are allowed extensions. The short-selling collateral ratio was also adjusted. Previously, individuals had a collateral ratio of 120%, but it was lowered to 105%, the same as foreigners and institutions. However, individuals must maintain a 120% collateral ratio for KOSPI 200 stocks.

The Korea Exchange, Korea Financial Investment Association, Korea Securities Depository, and Korea Securities Finance Corporation will hold the 2nd short-selling system improvement forum at the Korea Exchange on the 27th. The topic will be building a system to block illegal short-selling.

Strengthening Internal Control Standards and Management Obligations... Enforcement of the Revised Governance Act

Strengthening internal controls will also remain an ongoing issue. On the 8th, the 'Act on the Governance of Financial Companies' (Governance Act revision), which improves internal control systems to prevent financial accidents, passed the National Assembly plenary session. Accordingly, financial companies must introduce a 'responsibility structure chart' that specifies and documents the duties of executives. This adds not only the obligation to establish internal control standards but also management obligations.

Earlier, the severe disciplinary decisions on Lime and Optimus private equity funds are interpreted as part of this effort. The Financial Services Commission held a regular meeting last month and decided on measures against seven financial companies for violations of the Governance Act. They suspended the duties of Park Jung-rim, President of KB Securities, and issued a warning to Jung Young-chae, President of NH Investment & Securities.

The Financial Services Commission emphasized strengthening management and supervision related to internal controls while disclosing the sanctions related to Lime and Optimus. A Financial Services Commission official said, "The conclusion on the severe disciplinary actions against CEOs related to Lime and Optimus means that the FSC requires financial companies to establish internal control standards for consumer protection not just formally but substantively, and clearly holds CEOs responsible for financial accidents. To fundamentally solve the problem, financial companies and their 'chief executives' need to take a keen interest in this incident, establish effective internal control standards themselves, and build a system to comply with them."

Mandating Treasury Stock Cancellation Faces Difficulties... Plan to Develop Measures via Capital Markets Act, Not Commercial Act

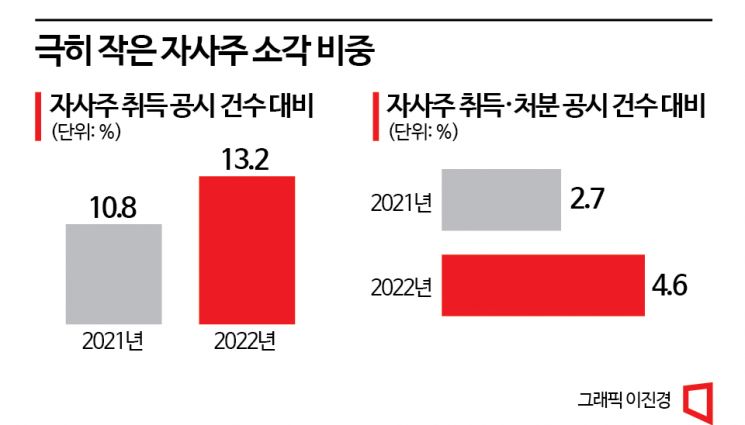

Improving the treasury stock system will also be one of the major policies next year. Although there was an initial plan to announce improvements to the treasury stock system within the year, it has been delayed. The issue of whether to mandate treasury stock cancellation is contentious. Under current law, companies have the freedom to dispose of, cancel, or hold treasury stocks they acquire. Considering this, mandating treasury stock cancellation seems difficult.

The direction of system improvement can be gauged from the 'Corporate Shareholder Rights and Management Rights Policy Seminar' jointly hosted by Korea University Corporate Governance Research Center and the Korea Capital Market Institute on the 23rd of last month. The Korea Capital Market Institute emphasized strengthening disclosure requirements significantly, such as specifying the purpose of holding treasury stocks and the status of cross-shareholdings, instead of mandating treasury stock cancellation.

Hwang Hyun-young, a research fellow at the Korea Capital Market Institute, said, "Treasury stock funds should ideally be returned to shareholders as distributable profits, but the Commercial Act does not explicitly require all treasury stocks to be distributed as dividends. If the financial authorities pursue treasury stock system improvements, they will likely seek measures through the Capital Markets Act, such as enhancing disclosure."

Existing practices of using treasury stocks for mergers or reorganizations or strengthening control through cross-shareholdings are also more likely to be regulated by strengthening disclosure rather than direct regulation. This is because overseas institutions reportedly raised concerns about domestic companies' cross-shareholdings to the financial authorities this year.

Research fellow Hwang said, "In 2023, the Asian Corporate Governance Association (ACGA) sent a letter to the Chairman of the Financial Services Commission pointing out the issue of cross-shareholdings. Although the FSC did not respond, it is possible to consider sharing related information with investors about the purpose and amount of treasury stock acquisitions when companies repurchase treasury stocks," he said.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)