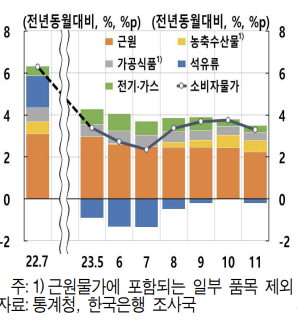

The Bank of Korea forecasts that the consumer price inflation rate will gradually slow down in the future, citing oil prices as a key variable. Since last year, fluctuations in consumer prices have been mainly driven by petroleum products. Although international oil prices have recently fallen to the mid-$70 range and are expected to remain generally stable going forward, upside risks such as additional production cuts by OPEC+ still exist.

On the 20th, the Bank of Korea released this inflation outlook in its "Price Stability Target Operation Status Review Report." The Bank stated, "If oil prices do not rise sharply again, the consumer price inflation rate is expected to continue a gradual slowing trend. However, due to the impact of successive adverse weather conditions, some agricultural product prices are expected to remain at high levels for a while, which may slow the pace of decline in the consumer price inflation rate somewhat."

Factors Affecting Consumer Price Changes. Data from Statistics Korea and the Bank of Korea Research Department

Factors Affecting Consumer Price Changes. Data from Statistics Korea and the Bank of Korea Research Department

Core Inflation Likely to Slow Down More Slowly in the Short Term

The consumer price inflation rate (year-on-year) peaked at 6.5% in July last year and then sharply declined over the course of a year, dropping to 2.4% in July this year. However, it rebounded from August, rising to 3.8% in October, before falling significantly to around 3.3% in November, similar to the level six months earlier.

Regarding core inflation, the Bank of Korea expects the slowing trend to proceed somewhat more slowly than before due to the spillover effects of cost pressures and persistent price pressures in the labor market. The core inflation rate peaked at 4.2% in November last year and has since followed a gradual slowing trend, falling to 2.9% last month.

The Bank explained, "Since price increases tend to be concentrated around the year-end and beginning of the year, inflationary pressures may spread again during this period. It is necessary to carefully monitor developments with attention to this possibility."

The Bank also forecasts that short-term inflation expectations among the general public will continue to decline, although at a slower pace compared to the actual slowing of inflation.

The Bank stated, "Recently, short-term inflation expectations among the general public have fluctuated sensitively in response to movements in the consumer price inflation rate. Over the past two to three years, prices of frequently purchased and high-expenditure items by general consumers have risen sharply. As a result, despite the underlying slowing of actual inflation recently, inflation expectations may be adjusting more slowly."

Inflation Slowdown Delayed if Labor Productivity Does Not Improve

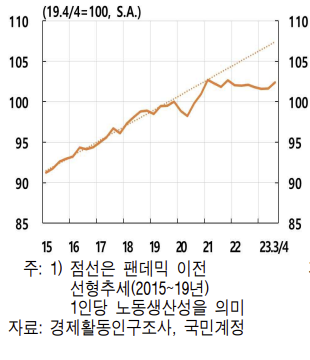

The Bank of Korea assessed that nominal wages adjusted for productivity, i.e., unit labor costs, have risen compared to the COVID-19 pandemic period, which may slow the deceleration of the inflation rate.

According to the Bank, the growth rate of unit labor costs (nominal wages adjusted for productivity changes) has continued to slow since last year but remains at a relatively high level compared to the pre-pandemic period. The unit labor cost growth rate surged to 5.3% last year, then slowed to 2.7% this year, but still significantly exceeds the pre-pandemic level of 1.9%.

The Bank explained, "The productivity growth rate has significantly slowed since 2021 during the labor market's recovery from the pandemic shock, with labor productivity per person falling below the pre-pandemic trend. This is mainly due to recent employment expansion centered on older workers with relatively low productivity and service sector workers."

It added, "Considering that the unit labor cost growth rate remains high compared to the pre-pandemic period, inflationary pressures in the labor market appear to persist."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.