The average satisfaction score of budget phones emphasizing 'cost-effectiveness (performance relative to price)' (695 points) has surpassed the average score of the three major telecom companies (670 points). KB Livemobile (KB Live M) has maintained the highest user satisfaction among budget phone users since the second half of 2021, while Iyagi Mobile, Pretty, and the latecomer Toss Mobile, which promote '0 won plans,' are closely trailing behind.

Market research firm Consumer Insight announced on the 20th that these results came from their 'Mobile Communication Planning Survey.' This survey measured the perceived satisfaction of users aged 14 and older with their mobile carriers.

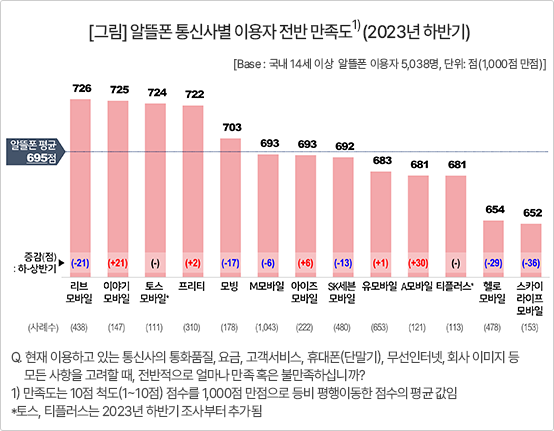

In the survey conducted in the second half of this year, the top-ranked company in satisfaction was Live M (726 points). Live M has been the leader for five consecutive surveys since it was first included in the second half of 2021, but its score dropped by 21 points compared to the previous survey (748 points in the first half of 2023). Following closely were Iyagi Mobile (725 points), Toss Mobile (724 points), and Pretty (722 points).

Mobing (703 points) barely entered the 700-point range, securing the fifth spot with a noticeable gap from the leaders. M Mobile and Eyes Mobile (each with 693 points), SK Seven Mobile (692 points), and U Mobile (683 points) followed behind.

Live M has maintained its top position by introducing groundbreaking plans linked with banking products, backed by Korea's largest financial institution (KB Kookmin Bank), and by receiving high scores in promotions, events, brand image, and customer service. Consumer Insight analyzed that the sudden change in the second half of this year was due to the counterattack from established budget phone players like Iyagi Mobile and Pretty, who promote '0 won plans,' as well as the emergence of the financial sector newcomer Toss Mobile.

Iyagi Mobile, which ranked second, surpassed Live M in satisfaction with pricing. It also received higher scores than Live M in promotions, events, and data services. Fourth-ranked Pretty also achieved high satisfaction in the same categories. This shows the effectiveness of the traditional budget phone companies' aggressive pricing strategies.

Toss Mobile, which newly entered the market earlier this year, received somewhat lower scores in pricing satisfaction but earned the highest evaluations in promotions, events, advertising, brand image, and customer service. Thanks to Toss's brand recognition and launch promotions, it successfully gained momentum. Consumer Insight evaluated that Toss Mobile quickly rose to a threatening position as the second financial sector budget phone operator following Live M.

Budget phone users prioritized pricing plans (65%) as the most important factor when choosing a carrier, followed by promotions and benefits (18%). Consumer Insight stated, "Live M experienced the largest drop in satisfaction in pricing, which consumers consider absolutely critical, and this was the main reason it slipped from an overwhelming first place to a narrow first place."

Budget phone satisfaction has surpassed the average of the three major telecom companies since the first half of 2020 and overtook SK Telecom since the second half of 2021. This time as well, with an average score of 695 points, it surpassed not only the three major telecom companies' average (670 points) but also SK Telecom (693 points). Consumer Insight said, "The reason for the satisfaction surpassing is, of course, cost-effectiveness, and Live M played a leading role. Now, many early and late entrants have joined using similar methods. While this is positive in terms of market diversity, there are concerns it might end up being just a price competition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)