Stock Market Marred by Price Manipulation... Volatility Surges Amid Second Battery Day Trading Frenzy

Controversial Short Selling Ban Extended Until First Half of Next Year... Financial Authorities Accelerate Regulatory Reforms

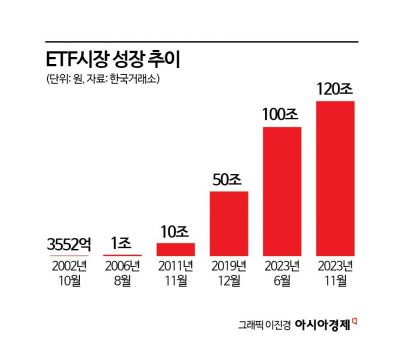

STO Market Launch and Rapid ETF Market Growth... Expectations for Broader Investment Base

This year's stock market was tumultuous to the extent that there was not a single calm day. The market was shaken by incessant stock price manipulations, and in response to criticisms of a 'tilted playing field,' financial authorities decided to impose a complete ban on short selling until the first half of next year. From the beginning of the year, the secondary battery craze swept through the stock market, and the exchange-traded fund (ETF) market rapidly expanded, growing the market size to around 120 trillion won. Regarding new listings, the price limit for newly listed stocks was expanded up to 400% of the public offering price, and due to the controversy over Pado's 'inflated listing,' financial authorities significantly strengthened the initial public offering (IPO) review process. Additionally, disciplinary actions against securities company CEOs related to the incomplete sales of Lime and Optimus funds were finalized after four years, and a wave of generational change swept through as many long-serving CEOs of securities firms were replaced. With the institutionalization of token securities (ST) gaining momentum this year, preparations for this are also underway. Asia Economy has selected the top 10 news stories that heated up the stock market and securities industry this year.

'From the La Deok-yeon Gate to Youngpoong Paper'?Unrelenting Stock Price Manipulations

This year, stock price manipulation was particularly rampant. On April 24, eight listed companies?Harim Holdings, Daesung Holdings, Sebang, Seongwang, Dow Data, Samchully, Seoul Gas, and Daol Investment & Securities?simultaneously hit their lower price limits. The mass sell-off from Soci?t? G?n?rale (SG) Securities triggered this wave of lower limits, causing these stocks to lose 8 trillion won in market capitalization within four days. La Deok-yeon, CEO of Hoan Investment Consulting, was identified as the mastermind behind the incident, and it was revealed that La Deok-yeon and his associates had been manipulating prices for an extended period using Contracts for Difference (CFD). Subsequently, in June, five stocks?Daehan Textile, Dongil Industry, Dongil Metal, Banglim, and Manho Steel?also hit their lower price limits en masse, once again rattling the market. These stocks shared the commonality of being consistently recommended on an online stock investment caf?, and it was revealed that the caf? operator and his group engaged in collusive trading to manipulate prices. In October, Youngpoong Paper and Daeyang Metal simultaneously hit their lower price limits, reviving the nightmare of stock manipulation once more.

Completion of Disciplinary Actions Against Lime and Optimus CEOs

The Financial Services Commission held a regular meeting on the 29th of last month and decided on severe disciplinary actions, including a three-month suspension and a reprimand, against Park Jung-rim, CEO of KB Securities, and Jung Young-chae, CEO of NH Investment & Securities, respectively. Yang Hong-seok, Vice Chairman of Daishin Securities, received a cautionary warning. The CEO disciplinary actions related to the private equity fund crisis triggered by Lime Asset Management's redemption suspension in October 2019 have thus been concluded after four years.

Previously, in November 2020, the Financial Supervisory Service held a disciplinary review committee and decided on severe disciplinary actions of 'reprimand' against CEO Park Jung-rim and Vice Chairman Yang Hong-seok for violations including failure to establish internal control standards related to the Lime fund incident (violation of the Financial Company Governance Act). In March 2021, CEO Jung Young-chae was also decided to receive a 'reprimand' for violations related to the sale of the Optimus fund and failure to establish internal control standards. The disciplinary action against CEO Park was upgraded by the Financial Services Commission, while Vice Chairman Yang's was downgraded by one level. The disciplinary levels for financial company executives are divided into five stages: dismissal recommendation, suspension, reprimand, cautionary warning, and caution. Among these, disciplinary actions of reprimand or higher restrict reappointment and employment in the financial sector for 3 to 5 years, thus classified as severe. CEOs Park Jung-rim and Jung Young-chae, who received severe disciplinary actions, have filed lawsuits against the Financial Services Commission seeking cancellation of the sanctions and suspension of execution.

Secondary Battery Craze Swept the Stock Market This Year

The most notable stocks in this year's stock market were those related to secondary batteries. It would not be an exaggeration to call it a craze, as secondary battery stocks showed remarkable gains in the first half of the year. EcoPro's stock price, which was in the 100,000 won range at the end of last year, soared to the 1.5 million won range by July, and POSCO group stocks also saw significant price increases amid expectations for secondary batteries. POSCO DX recorded a 727.2% increase from the beginning of the year to the 19th, ranking first in stock price growth among listed companies. EcoPro rose 611.65%, Geumyang 384.94%, and EcoPro BM surged 245.28%.

The secondary battery stock craze attracted concentrated buying from individual investors. This year, individuals net purchased POSCO Holdings the most, with 11.3663 trillion won. Following were LG Chem (1.929 trillion won), POSCO Future M (1.2251 trillion won), SK Innovation (1.1794 trillion won), EcoPro BM (964 billion won), Samsung SDI (886.3 billion won), L&F (750.5 billion won), and LG Energy Solution (664.5 billion won)?all among the top eight net purchases and all related to secondary batteries.

Short Selling Banned Until First Half of Next Year

Short selling, which had long been criticized as a 'tilted playing field,' has been completely banned until the first half of next year.

The Financial Services Commission announced on the 5th of last month that it decided to impose a complete ban on short selling until the first half of next year, judging that the habitual illegal naked short selling could undermine fair price formation in the market. This is the fourth time a complete ban on short selling has been imposed, following the 2008 global financial crisis, the 2011 European debt crisis, and the 2020 COVID-19 pandemic.

Financial authorities have also initiated improvements to the short selling system to fundamentally resolve the tilted playing field issue. According to the improvement plan, the short selling repayment period for foreign and institutional investors will be changed to 90 days, the same as for individual investors, and the collateral ratio for individual short sellers will be adjusted to 105%, equal to that of foreign and institutional investors. Additionally, the feasibility of a real-time system to block naked short selling will be reviewed.

Foreign Investor Registration System Abolished After 30 Years

The foreign investor registration system, which had been cited as a factor for the 'Korea discount,' was abolished after 30 years.

Previously, foreign investors wishing to invest in domestic listed securities were required to register in advance with the Financial Supervisory Service. The registration process was time-consuming and required many documents, acting as a significant barrier for foreigners investing in the Korean stock market. From the 14th of last month, with the enforcement of the Capital Market Act's enforcement decree abolishing the foreign investor registration system, foreign investors can now invest in domestic listed securities without separate prior registration procedures.

Along with this, the reporting frequency for integrated accounts (where multiple investors' trades are processed in a single account) has been relaxed from 'immediate' to 'once a month,' facilitating the operation of integrated accounts by foreign securities firms, and the scope of post-reporting for over-the-counter transactions by foreign investors has also been expanded.

Expansion of Price Limits for Newly Listed Stocks

From June 26, the price limit on the first day of listing for newly listed companies was expanded to 60?400% of the public offering price, up from the previous 63?260%. This expansion aims to improve the method of determining the reference price for newly listed stocks and enhance the rapid discovery of equilibrium prices on the first day of listing by expanding the price limit range.

Recently, stocks achieving 'ttatabble' (a fourfold increase compared to the public offering price) have been appearing one after another. KNS, which debuted on the KOSDAQ market on the 6th, closed trading at 92,000 won, which is 400% of its public offering price of 23,000 won. LS Materials, listed on the 12th of this month, also succeeded in achieving 'ttatabble,' closing at 24,000 won, a 400% increase from its public offering price of 6,000 won on the first day.

With stocks rising 400% consecutively after the expansion of price limits, investor interest in IPOs is expected to grow further.

Opening of the STO Market

With the institutionalization of token securities issuance (STO) gaining momentum this year, expectations for the token securities market are rising. The Financial Services Commission announced a plan to organize the regulatory framework for token securities issuance and distribution in February, and in July, amendments to the Electronic Securities Act and Capital Market Act for the institutionalization of token securities were proposed.

In response, securities firms are actively building platforms to secure market leadership. Hana Securities has signed business agreements with major companies such as Pinnacle, Oasis Business, Print Bakery, ITCEN, and Danal Entertainment to collaborate on securities-type token businesses and fractional investment platforms based on various underlying assets including real estate, artworks, gold and silver, and mobile content. Korea Investment & Securities built the industry's first token securities issuance infrastructure in September together with internet-only banks KakaoBank and Toss Bank, and technology partner Kakao Enterprise, completing a pilot issuance. Mirae Asset Securities formed the token securities consortium 'Next Finance Initiative (NFI)' with SK Telecom and is currently selecting platform construction companies.

Generational Change of CEOs in the Securities Industry

In the second half of this year, a strong wave of generational change swept through the Yeouido securities industry. CEOs of Mirae Asset Securities, Meritz Securities, Korea Investment & Securities, Kiwoom Securities, and Samsung Securities were successively replaced, with many long-serving CEOs stepping down. Amid ongoing concerns about real estate project financing (PF) defaults and poor performance of securities firms, along with continuous incidents and accidents, the need for reform grew. In this atmosphere, more CEO replacements are expected in securities firms whose CEO terms expire early next year.

Pado's 'Inflated Listing' Controversy

Pado, which was listed in August, hit the lower price limit after announcing its third-quarter earnings this year. Pado's third-quarter sales were 321 million won, a 97.6% decrease compared to 13.592 billion won in the same period last year, and its operating loss expanded to 14.8 billion won. The problem arose as Pado's projected sales for this year stated in the securities registration statement differed significantly, sparking controversy over an 'inflated listing.' Pado had presented expected sales of 120.294 billion won for this year in the registration statement. However, cumulative sales up to the third quarter were 18 billion won, with second-quarter sales only 59 million won. Pado was considered a major player in the IPO market in the second half of this year, with a corporate value recognized at 1.5 trillion won. After steadily rising post-listing and surpassing 40,000 won, Pado's stock price has now fallen to the 20,000 won range.

Investors are preparing a class-action lawsuit over the inflated listing controversy, and financial authorities have decided to significantly strengthen IPO reviews.

Rapid Growth of the ETF Market... Net Assets Surpass 120 Trillion Won

This year, the ETF market grew rapidly, expanding the market size to around 120 trillion won. According to the Korea Exchange, as of the end of last month, the total net assets of ETFs surpassed 120 trillion won. This came five months after surpassing 100 trillion won in net assets in June this year. The domestic ETF market started on October 14, 2002, with four products and net assets of 355.2 billion won, exceeded 10 trillion won in net assets in November 2011, and surpassed 50 trillion won in December 2019. The average daily trading volume was 2.9 trillion won as of the end of last month, ranking third globally after the United States and China.

ETFs have grown rapidly due to advantages such as diversified investment, low costs, and trading convenience, combined with the industry's efforts to supply various new products. New products suited to changes in the investment environment, such as direct investment, overseas investment, pursuit of stable returns, and increased demand for retirement pensions, have been continuously launched, expanding the market size.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.