Last Year SPAC Merger 추진... Controversy Over Overvaluation of Corporate Value at 78 Billion Won

Market Capitalization Based on IPO Price Range 63.7 Billion to 72.5 Billion Won

Plan to List on KOSDAQ by End of January Next Year

As funds flood into the initial public offering (IPO) market recently, Studio Samik, which failed to go public through a SPAC merger last year, is once again pursuing a listing on the KOSDAQ market. The company expressed a strong intention to go public by proposing an offering price lower than the corporate value suggested last year.

According to the Financial Supervisory Service's electronic disclosure system on the 19th, Studio Samik plans to issue 850,000 new shares for its KOSDAQ listing. The proposed price range is 14,500 to 16,500 KRW per share. The offering size is between 12.3 billion and 14 billion KRW, with an expected market capitalization of 63.7 billion to 72.5 billion KRW. From January 5 to 11 next year, demand forecasting will be conducted targeting institutional investors, after which the offering price will be finalized. Subscription will take place over two days starting January 15, and the company is scheduled to list on the KOSDAQ market by the end of January. DB Financial Investment is the lead underwriter for the listing.

Founded in 2017, Studio Samik is an online furniture distribution company. It produces furniture reflecting market trends through over 50 domestic and international partner companies and sells them through various online distribution channels. It supplies products from the 40-year-old traditional furniture manufacturing brand 'Samik Furniture,' the Nordic-style solid wood specialist brand 'Scandia,' and 'Juksan Woodworks,' known for supplying wooden tables to Starbucks. In October last year, it also launched 'Studio Sleep,' a premium mattress brand, marking its full-scale entry into the mattress market.

When attempting a merger with IBKS No.13 SPAC in April last year, the proposed corporate value was 112 billion KRW. Due to overvaluation controversies and opposition from SPAC shareholders, the merger ratio was adjusted twice in August and September, lowering the corporate value to 90 billion and then 78 billion KRW. The merger between IBKS No.13 SPAC and Studio Samik was ultimately canceled due to the contraction of the IPO market in the second half of last year.

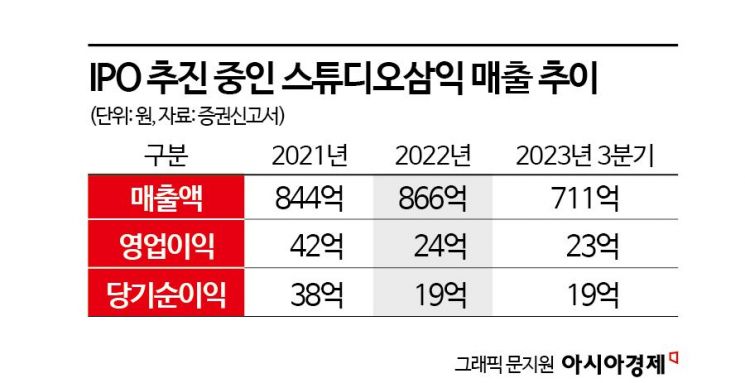

Studio Samik recorded sales of 86.6 billion KRW and operating profit of 2.4 billion KRW last year. Sales increased by 2.5%, but operating profit decreased by 43.4%. Up to the third quarter of this year, sales reached 71.1 billion KRW and operating profit 2.3 billion KRW, up 10.3% and 12.8% respectively compared to the same period last year.

Following the COVID-19 pandemic, the online furniture market grew, benefiting Studio Samik. From 2018 to 2021, it achieved an average annual growth rate of 45.6%. However, last year, profitability deteriorated due to the impacts of the Russia-Ukraine war, logistics disruptions, and rising raw material prices. The gross profit margin declined from 19.5% in 2020 to 17.9% in 2021 and 16.5% in 2022. Since the second half of last year, as raw material prices fell, profitability partially recovered. The gross profit margin for the third quarter of this year was 18.4%.

Although Studio Samik’s profits increased compared to the previous year, it lowered its appropriate corporate value by about 6 billion KRW from last year. Experts view the reason for lowering the valuation and rushing the listing as related to the growth of the online home furnishing market. Home furnishing refers to decorating personal spaces according to individual tastes using furniture and interior accessories. Interest in home furnishing has grown with aging housing and an increase in single-person households. The COVID-19 pandemic expanded the age groups purchasing home furnishing products through online channels.

In the growing market, major home furnishing companies such as Coupang, Today’s House, Hanssem, and Hyundai Livart have been strengthening their service competitiveness. Studio Samik also needs investment funds to keep up with the competition. Of the funds raised through the IPO, excluding 2.3 billion KRW allocated for debt repayment, the remainder will be used for attracting talented personnel, enhancing brand awareness, and improving work automation programs.

Lowering the valuation and the relatively small volume of shares available for trading immediately after listing are also considered factors for a successful IPO. Of the 4,225,498 shares planned for listing, 25.5% (1,078,548 shares) will be available for trading immediately after listing. Excluding the 850,000 shares offered in the IPO, only about 230,000 shares held by existing shareholders can be sold. CEO Choi Jeong-seok, the largest shareholder, and second-largest shareholder Lee Jae-woo have agreed not to sell their shares for two years and six months after listing. Most shares held by venture capital investors who invested before listing cannot be sold for at least one month.

Choi Jeong-seok, CEO of Studio Samik, said, "We are a company equipped with all the success capabilities needed in the online home furnishing industry," adding, "We will solidify Studio Samik’s competitive advantage through the listing and become a leading overseas online home furnishing company."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)