Fed's Interest Rate Cut Forecast for First Half of Year

Narrowing US-Japan Interest Rate Gap

Timing Expected Sooner Than Anticipated

As expectations grow that the U.S. Federal Reserve (Fed) will cut interest rates in the first half of next year, forecasts suggest that the yen's value could reach the 130-yen level sooner than anticipated. It is believed that if the interest rate gap between the U.S. and Japan narrows due to the Fed's rate cuts, the yen's value will rise more than it currently is.

On the 18th, the Nihon Keizai Shimbun reported that with the Fed officially signaling rate cuts next year, the market has begun to forecast that the yen-dollar exchange rate will fall to the 130-yen range in the first half of next year. The yen-dollar exchange rate dropped to 141.38 yen around 3 p.m. on the 13th (local time), immediately after the Fed's Federal Open Market Committee (FOMC) meeting. As of 9:40 a.m. that day in the Tokyo foreign exchange market, the dollar traded at 142.33 yen.

Initially, the market expected the yen-dollar exchange rate to reach the 130-yen level in the second half of next year. However, with the Fed's dovish (monetary easing) stance strengthening market expectations for rate cuts in the first half of next year, forecasts regarding the yen-dollar exchange rate have been brought forward. According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market reflects probabilities of over 78% and 97%, respectively, that the Fed will cut rates by at least 0.25 percentage points in March or May next year. Goldman Sachs had previously anticipated rate cuts in the third quarter of next year but has moved its forecast forward to June following the FOMC meeting.

The market expects that if the Fed cuts rates in the first half of the year, the interest rate gap between the U.S. and Japan will narrow, leading to an appreciation of the yen during the same period. Koji Fukaya, senior researcher at Market Risk Advisory, a Japanese management consulting firm, explained, "Previously, it was forecasted that the yen-dollar exchange rate would be between 140 and 150 yen in the first half of next year, then fall to between 130 and 140 yen in the second half. The timing for the exchange rate to fall to the 130-yen level has been brought forward by about half a year compared to earlier expectations."

Yasuya Ueno, market economist at Mizuho Securities, also assessed, "In light of Fed Chair Powell's remarks, it is reasonable to expect the yen-dollar exchange rate to rise to the 130-140 yen range in the first half of next year."

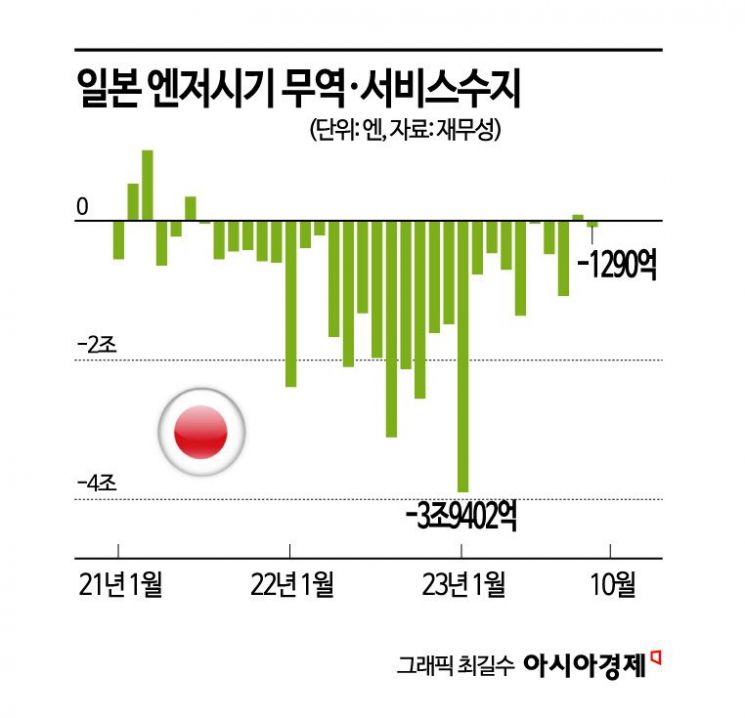

However, some predict that it will be difficult for the yen-dollar exchange rate to rise above the 130-yen level. Currently, Japan's economy is caught in a so-called "yen depreciation vicious cycle," where the expanded trade deficit caused by the weak yen encourages selling of the yen, which in turn leads to further yen depreciation. Since entering the yen depreciation period in July 2021, when the yen-dollar exchange rate fell below the 110-yen level, the combined trade and service balance of Japan has failed to recover from deficits except for September last year. Especially after the Russia-Ukraine war, the sharp rise in international raw material prices combined with an unprecedented yen depreciation has further widened the deficit. In October, the deficit narrowed somewhat as energy prices fell and tourist numbers increased.

Looking ahead, if major countries begin cutting interest rates, Japan's trade market is expected to face greater difficulties, which could restrain the yen's appreciation. The Nihon Keizai Shimbun explained, "If major countries start cutting interest rates, overseas capital is likely to move to markets with more liquidity than Japan. Since capital outflows are expected, even if the U.S.-Japan interest rate gap narrows, it will be difficult for the yen's value to exceed the 110-yen level as it did before 2021."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)