CCID Report Released in China... Rapid Growth in Industry Adoption Rate

Some Predict Structural Adjustments Due to Price Competition

Analysis shows that China's generative artificial intelligence (AI) market has grown to 14 trillion yuan (approximately 2,540.86 trillion KRW) this year. Some predict that fierce price competition will unfold amid difficulties in semiconductor chip supply due to U.S. sanctions on China, resulting in only a few winners remaining in the market.

On the 14th, China’s state-run CCTV cited a report from the Information and Industrial Development Institute (CCID) under the Ministry of Industry and Information Technology, stating that the size of China’s generative AI market this year is about 14.4 trillion yuan. It also reported that the adoption rate of generative AI by Chinese companies is approaching 15%, with rapid growth observed in four major industries: manufacturing, retail, telecommunications, and healthcare. A total of 368 related companies were established this year alone.

CCID also expects the generative AI market to create an economic value of $12.5 trillion (approximately 1,616.75 quadrillion KRW) worldwide by 2035, with China accounting for more than $5.9 trillion, or 47% of the total market. Furthermore, it forecasts that by 2035, 85% of Chinese companies will adopt generative AI, reaching 100% by 2055. Adoption rates by sector are projected to expand to 82% in manufacturing, 90% in retail, 65% in telecommunications, and 53% in healthcare by 2035.

The report stated, "From startups to leading industry companies, efforts are being made to strengthen core competitiveness related to generative AI," adding, "As strategic emerging industries such as big data, Internet of Things (IoT), cloud computing, quantum computing, and AI mature, the speed of intelligent supply chains and logistics digitalization will accelerate, and generative AI technology will be more widely used in omnichannel operations and marketing."

It continued, "With the rapid development of the global digital economy, China will move toward a new era of industrialization and integration of artificial intelligence with the real economy," emphasizing, "Maximizing this potential will be the only 'magic' for success." It also explained that "thanks to this, China’s 'digital inflection point' could be brought forward by 10 years compared to the original schedule."

China’s generative AI market is driven by major IT companies such as Baidu, Alibaba, and Tencent, supported by numerous startups. In August, Baidu unveiled 'Ernie Bot,' known as the 'Chinese version of ChatGPT,' which attracted attention with 2.4 million downloads within 24 hours of its release. The number of registered questions reached 33.42 million.

In the same month, responding to U.S. export bans, Baidu ordered 1,600 units of Huawei’s self-developed 910B Ascend AI chips and received 1,000 units in less than three months. Baidu revealed that its research and development (R&D) expenses, including those for Ernie Bot, increased by 6% year-on-year to $6.1 billion. Additionally, Alibaba’s 'Tongyi Qianwen' and SenseTime’s 'SenseChat' have emerged, with Tencent and ByteDance also accelerating their development efforts.

The actual adoption speed is also rapid. Chinese courts are already experimenting with using generative AI to draft judgments. According to local media, the Suzhou Intermediate People’s Court in Jiangsu Province recently introduced a 'generative AI judgment drafting assistance system' with approval from the Jiangsu High People’s Court. In the second half of this year, the Suzhou Intermediate People’s Court reportedly piloted the use of generative AI in drafting judgments for cases involving financial loans, labor, and housing lease contract disputes. According to the court, the completeness of judgments drafted using this method reached 70%.

However, pessimistic views exist in the market that only a few of the numerous generative AI companies in China will survive. This is due to the similarity of released models and relatively high costs, which reduce competitiveness. Investment restrictions and semiconductor chip supply issues caused by U.S.-China tensions are also obstacles. Esmee Pow, head of China digital asset research at Macquarie Group, said, "Only those with the strongest capabilities will survive," and predicted that the industry may enter fierce price competition in the future.

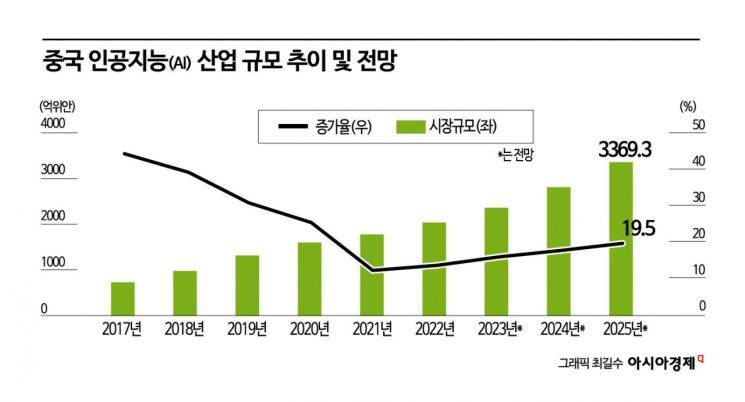

Meanwhile, according to CCID, the total size of China’s AI industry is expected to reach 336.93 billion yuan by 2025. If this forecast materializes, it would mean more than doubling in size over five years since 2020, when it was 161.43 billion yuan.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.