Bank of Korea Announces 'November Export and Import Price Index'

Largest Drop This Year at 4.1%

Export Prices Also Negative for First Time in 5 Months

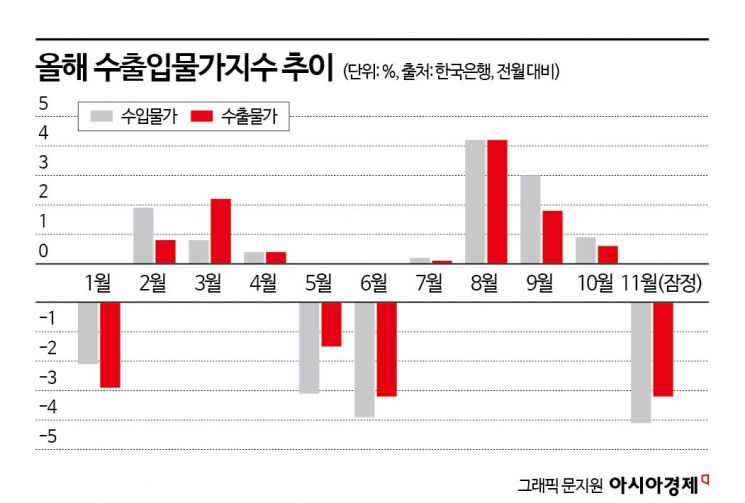

International oil prices and the won-dollar exchange rate both fell, causing import prices to drop by 4.1% month-on-month last month. This marks a negative turnaround after five months and represents the largest decline so far this year.

According to the 'November Export and Import Price Index' released by the Bank of Korea on the 13th, the import price index (based on the Korean won) fell 4.1% month-on-month last month due to the decline in international oil prices, with minerals, coal, and petroleum products leading the decrease. This is the largest drop since a 6.5% decline in December last year.

The downward trend in the average won-dollar exchange rate also contributed to the fall in import prices. Last month, the average won-dollar exchange rate was 1,310.39 won, down 3% from the previous month (1,350.69 won). Compared to the same month last year, it decreased by 3.9%.

By item category, raw materials centered on minerals fell 6.6%, intermediate goods centered on coal, petroleum products, and chemical products dropped 3.1% month-on-month. Capital goods and consumer goods also declined by 2.2% and 1.9%, respectively, compared to last month. Yoo Sung-wook, head of the Price Statistics Team at the Bank of Korea’s Economic Statistics Bureau, explained, "Minerals fell 7.1%, coal and petroleum products dropped 6.2%, and chemical products decreased 3.7% due to the impact of falling oil prices, while capital goods and consumer goods declined due to the exchange rate drop."

The monthly average price of Dubai crude oil was $89.75 per barrel in October, down from $93.25 in September, and further declined by 6.9% to $83.55 in November. Compared to the same month last year, the price fell by 3.1%.

Import prices based on contract currency, which limits the effect of exchange rates, fell 1.4% month-on-month and 5.1% year-on-year.

As the exchange rate fell, the export price index (based on the Korean won) also dropped 3.2% month-on-month and 7.2% year-on-year. Along with import prices, this marks a return to negative territory after five months. Based on contract currency, it fell 0.5% month-on-month and 3.6% year-on-year.

By item, agricultural, forestry, and fishery products rose 0.7% month-on-month, but manufactured goods fell 3.2% compared to the previous month, mainly due to coal and petroleum products (-8.3%) and chemical products (-3.8%).

Supported by the stabilization of international oil prices and the won-dollar exchange rate, the export and import price indices are likely to continue their downward trend for the time being. Professor Seok Byung-hoon of Ewha Womans University’s Department of Economics explained, "Oil prices are falling due to reduced demand from the Chinese economic slowdown and increased U.S. crude oil production, and the end of the U.S. Federal Reserve’s tightening cycle is almost certain, so the exchange rate is expected to decline overall. The downward trend will continue to some extent going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)