Hankyung Association 'National Consumer Spending Plan Survey' Results

5 out of 10 Plan to Reduce Spending Next Year

Higher Proportion of Lowest Income Group Expects Spending Increase

Economy Expected to Remain Similar This Year and Next

Following this year, high interest rates and high inflation are expected to continue next year, making it difficult for household consumption to improve significantly. However, the degree of consumption sluggishness is expected to be somewhat alleviated compared to last year.

On the 13th, the Korea Economic Association announced these findings based on the results of the '2024 National Consumption Expenditure Plan Survey' conducted by polling firm Mono Research on 1,000 citizens aged 18 and over nationwide.

Tightening Belts Due to High Inflation and Income Reduction

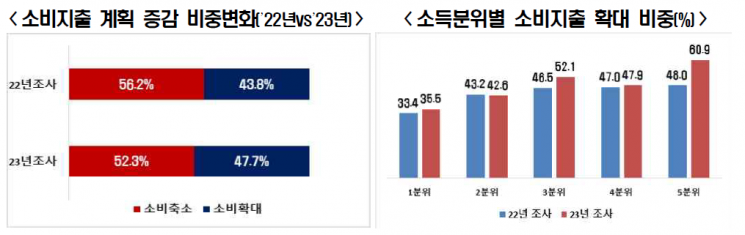

The survey results showed that the proportion of respondents planning to reduce consumption expenditure next year (52.3%) was higher than those planning to increase it (47.7%). However, compared to the same survey last year (56.2%), the share of respondents intending to reduce consumption decreased by 3.9 percentage points.

Those who said they would increase consumption expenditure next year mainly belonged to higher income groups. When dividing respondents by income quintiles, the order was ▲5th quintile (60.9%) ▲3rd quintile (52.1%) ▲4th quintile (47.9%) ▲2nd quintile (42.6%) ▲1st quintile (35.5%).

Income quintiles are divided from the 1st quintile (lowest 20%) to the 5th quintile (highest 20%). In last year’s survey, 48.0% of respondents in the 5th quintile said they would increase consumption expenditure. This represents a 12.9 percentage point increase in just one year. The proportion of 1st quintile respondents planning to increase consumption also rose by 1.1 percentage points from last year’s 33.4%.

Those who said they would reduce consumption expenditure next year cited reasons such as ▲continued high inflation (43.5%) ▲concerns about unemployment or income reduction (13.1%) ▲increased tax and utility burdens (10.1%) ▲decrease in asset income and other income (9.0%). By category, respondents planned to cut spending on ▲travel, dining out, and accommodation (20.6%) ▲leisure and cultural activities (14.9%) ▲clothing and footwear (13.7%).

Conversely, respondents planning to increase consumption cited reasons such as ▲increased demand for certain items due to changes in living environment, values, and awareness (22.1%) ▲need to replace aging or out-of-fashion products (electronics, clothing, household goods) (20.1%) ▲increased tax and utility burdens (10.1%) ▲income growth (18.7%). By category, they planned to increase spending on ▲food and groceries (22.7%) ▲housing costs (21.7%) ▲daily necessities (11.8%).

Price and Exchange Rate Stability Needed to Improve Consumption Environment

Regarding consumption capacity next year, 45.7% of respondents said it would be similar to this year. This was higher than those who said it would be insufficient (42.1%) or sufficient (12.2%). To secure additional consumption capacity, respondents cited methods such as ▲side jobs or part-time work (42.2%) ▲cashing out savings or deposits (22.2%) ▲selling financial assets like stocks (15.4%).

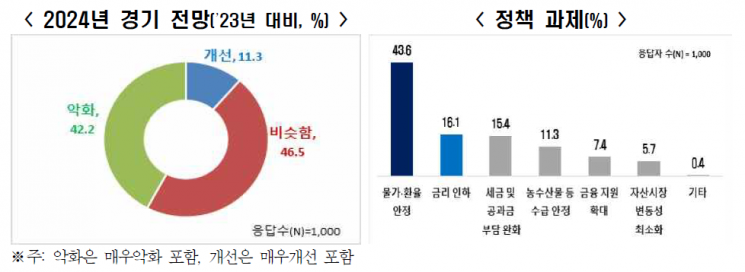

When asked about the economic outlook for next year, 46.5% answered it would be similar. Those who expected deterioration or improvement accounted for 42.2% and 11.3%, respectively. As policy tasks to improve the consumption environment, respondents pointed to ▲price and exchange rate stability (43.6%) ▲interest rate cuts (16.1%) ▲relief of tax and utility burdens (15.4%).

Choo Kwang-ho, head of the Economic and Industrial Headquarters at the Korea Economic Association, said, "Household consumption fundamentals are weak due to excessive debt burdens and high interest rates and inflation," adding, "It is expected to be difficult for consumption expenditure to improve significantly next year." He also argued that to improve this situation, "efforts to ease financial burdens along with expanding job creation through increased corporate investment are necessary to enhance household consumption capacity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)