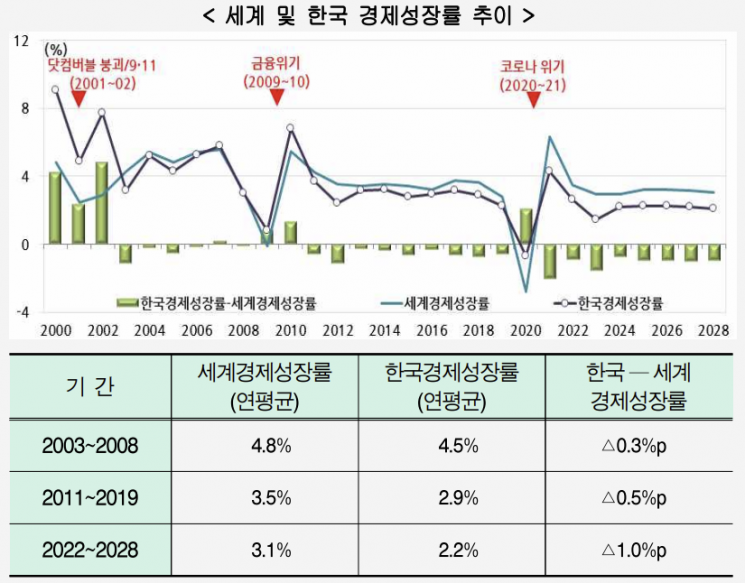

Before the Global Financial Crisis 0.3%p → After COVID-19 1%p

"Korean Economy Expected to Recover Slowly... Recession May Last Longer"

An analysis has emerged suggesting that the gap between South Korea's and the global economic growth rates will continue to widen.

According to the economic weekly report from Hyundai Research Institute on the 10th titled "Urgent Expansion of Growth Potential to Escape the Low Growth Trend," the rate of decline in South Korea's economic growth is outpacing that of the global economy, indicating that the gap between South Korea's and the world's economic growth rates is expected to expand further.

The report states that the gap between South Korea's and the global economic growth rates widened from an average of 0.3 percentage points before the financial crisis (2003?2008) to 0.5 percentage points after the financial crisis (2011?2019), and it is estimated to further increase to 1 percentage point in the future (2022?2028).

Before and after the global economic crisis, the average global economic growth rate declined. The global economic growth rate recorded a high average of 4.8% annually before the global financial crisis (2003?2008), but dropped to 3.5% after the crisis (2011?2019). Furthermore, according to IMF (International Monetary Fund) projections, the average annual growth rate is expected to be only 3.1% after the COVID-19 economic crisis (2022?2028).

South Korea's economic growth rate fell from an average of 4.5% annually before the global financial crisis (2003?2008) to 2.9% after the crisis (2011?2019). According to IMF projections, it is expected to record an average annual growth rate of 2.2% after the COVID-19 economic crisis (2022?2028).

Estimated figures by Hyundai Research Institute using IMF (International Monetary Fund) statistics. Years with economic crises and the following years are excluded from the calculation of economic growth rates. Source=Hyundai Research Institute

Estimated figures by Hyundai Research Institute using IMF (International Monetary Fund) statistics. Years with economic crises and the following years are excluded from the calculation of economic growth rates. Source=Hyundai Research Institute

"Next Year’s Economy Expected to Recover Slowly... Possibility of Prolonged L-Shaped Low Growth"

The report further expressed concerns that South Korea's economy is likely to form a bottom soon and enter a slow recovery phase, but there is also a possibility of entering a prolonged L-shaped low growth phase.

In the fourth quarter of this year, South Korea's economy appears to be in a "recession phase," where exports show a slight rebound but domestic demand remains sluggish.

The report presented two scenarios for the future domestic economy: a "U-shaped slow recovery" and an "L-shaped prolonged recession."

The U-shaped scenario envisions a turning point in the economic phase starting from the first quarter of next year, driven by improvements in exports and government policy responses that help activate domestic demand, leading to a gradual recovery. In contrast, the L-shaped scenario involves continued export weakness and consumption failing to act as an economic safety net, resulting in no clear economic bottom appearing even during next year, thereby prolonging the recession.

The report explained, "At present, the possibility of a U-shaped slow recovery path seems higher, but if the improvement in domestic and external economic conditions is insufficient compared to expectations, the possibility of a prolonged L-shaped recession path cannot be ruled out."

Risk factors determining the economic direction include ▲weak recovery resilience due to the overall weakening of global economic growth potential ▲possibility of simultaneous recessions in the US and China ▲and contraction in consumer sentiment due to high interest rates, high inflation, and economic uncertainty. The report pointed out, "As South Korea's economy has entered a low growth phase and it is difficult to find drivers for economic recovery overseas, even if a recovery phase unfolds in the future, the recovery strength is likely to be weak."

It added, "Considering South Korea's growth structure, where export performance has led economic recovery during transitions from recession to recovery phases, the prolonged low growth of the global economy may further weaken South Korea's recovery momentum."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)