Hana Bank Launches Group Account Service on the 5th

Kookmin and NongHyup Implement, Shinhan and Woori Under Review

Aimed at Securing Customers and Low-Cost Deposits

Lower Interest Rates and Service Restrictions Compared to 'Strong' Internet Banks

Internet Banks Have Already Secured Market Lead

Commercial banks have jumped into the "Group Account Competition" to attract customers and deposits. However, compared to internet banks, which have been the dominant players in group accounts, their competitiveness in interest rates and services is weaker, making it uncertain whether they will achieve their goals.

Hana Bank launched its 'Group Account Service' on the 5th. This is a mobile-only service that allows users to collect and manage group membership fees through the mobile banking application (app) 'Hana One Q.' The treasurer (group leader) can create a group and invite members using an existing Hana Bank deposit account without opening a separate account. It automatically notifies payment dates and overdue payments, and the group's unique account number remains unchanged even if the treasurer or account changes, enhancing management convenience. A group-specific check card that can be used for offline payments can also be issued under the treasurer's name.

Earlier, KB Kookmin Bank introduced the group account feature called 'KB Kookmin Treasurer Service' in May. This is also a mobile-only service that allows the treasurer to use an existing deposit account as a group account and invite members. NongHyup Bank has been operating a separate group account product called 'NH MoyeoRa Account' since March 2019. Shinhan Bank, which launched a dedicated group account app called 'Kim Treasurer' in 2011 but has since discontinued the service, stated that it plans to consider re-launching if there is customer demand. Woori Bank, which previously operated the 'Woori U Group Account,' is also reviewing the reintroduction of group account services.

The main reason commercial banks are re-entering the group account service market is that they can raise large sums of money at a low cost. The basic interest rate for deposit accounts used as group accounts is around 0.1% per annum, which is lower than the 3-4% applied to savings and installment savings accounts. Another reason is that inviting many users to the app through group accounts makes it easier to attract customers. A representative from a commercial bank explained, "The launch of group accounts is aimed at expanding useful financial services for customers, ultimately broadening the customer base."

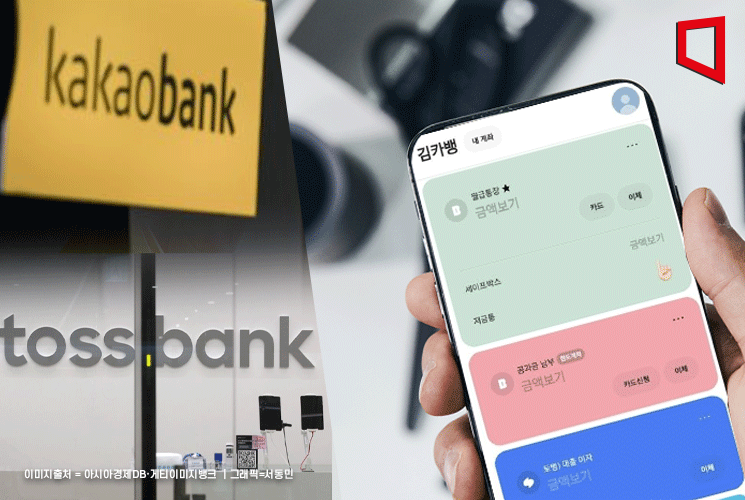

However, there are doubts about whether these objectives can be achieved. First, the interest rate competitiveness is inferior compared to internet bank group accounts. KakaoBank, which was the first among internet banks to launch group accounts in December 2018, offers a basic interest rate of 0.1%, but applies an annual interest rate of 2.0% when using its parking account product 'Safe Box.' Toss Bank's group account offers 2.0% per annum, and K Bank offers 2.3% per annum (for balances under 3 million KRW) and up to 10% per annum when using the 'Group Fee Plus' service.

Service limitations are also cited as challenges. Commercial banks assign limited accounts when opening new accounts due to concerns about voice phishing abuse, which causes inconvenience when using them as group accounts that collect large sums. Limited accounts restrict daily withdrawal and transfer limits to between 300,000 and 1,000,000 KRW until the purpose of the financial transaction is verified. A banking industry official said, "The reason commercial banks discontinued this service in the past was due to low customer usage caused by service restrictions."

Another hurdle is that internet banks have already established a fierce competitive landscape and secured market dominance. As of the end of September, KakaoBank had 9.5 million subscribers and a balance of 6.2 trillion KRW, showing an annual growth rate of 40%. Toss Bank, which launched its group account in February, secured 1 million subscribers within five months of launch.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)