Shipbuilding Stocks Including HD Hyundai Heavy Industries Rise 15-20% Since Late October

"Shipbuilding Stocks Expected to Improve Performance Next Year"

Shipbuilding stocks, which had been declining due to concerns over a peak-out (passing the peak), have started to rebound. With abundant order volumes for domestic shipbuilders and a continued upward trend in new ship prices, shipbuilders' earnings are expected to improve.

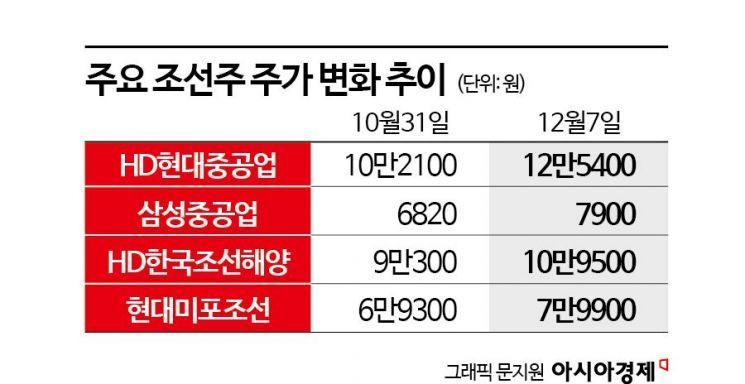

HD Hyundai Heavy Industries closed at 125,400 KRW in the stock market on the day. This is a 22.82% increase compared to 102,100 KRW at the end of October. During the same period, Samsung Heavy Industries rose 15.84%, and HD Korea Shipbuilding & Offshore also increased by 21.26%, showing a steep upward trend for most shipbuilding stocks.

Shipbuilding stocks continuously rose in the first half of the year due to improving market conditions, even reaching yearly highs in July and August. However, concerns about a peak-out arose, suggesting that order volumes and shipbuilding prices might have peaked and could decline. As of November this year, the cumulative global ship orders reached 38.09 million CGT (1,545 vessels), a 20% decrease compared to 47.77 million CGT (1,811 vessels) during the same period last year. Among these, Korea secured 9.63 million CGT (191 vessels), accounting for a 25% global order share, which is a 41% decrease compared to the same period last year. Due to this, the market showed a sluggish trend from the third quarter and declined until October.

However, the securities industry evaluated the peak-out concerns as excessive. Shipbuilding prices are showing a steady trend, and the decrease in order volumes is seen as a strategic and selective choice by shipbuilders. In fact, shipbuilding prices continue to rise. At the end of November, the Clarkson Newbuilding Price Index was 176.61, up 14.92 (9%) compared to the same period last year. At the end of January, it was 162.51.

Han Young-su, a researcher at Samsung Securities, said, "The decrease in order amounts for domestic large shipbuilders in 2024 is not a demand issue but a result of their strategic choices. Of course, orders for LNG carriers and container ships, which have led order performance for years, may slow down due to a base effect, but the expected recovery in offshore structure orders will offset concerns about a decline in merchant ship demand."

As a result, the earnings improvement trend is expected to continue through this year and next year. According to earnings forecasts for shipbuilders compiled by FnGuide, HD Hyundai Heavy Industries is expected to achieve consolidated sales of 11.7668 trillion KRW and an operating profit of 133.2 billion KRW this year. Sales are projected to increase by 30.08% year-on-year, and operating profit is expected to turn positive. Next year, sales are forecasted at 13.8029 trillion KRW with an operating profit of 666.1 billion KRW. Samsung Heavy Industries is expected to achieve sales of 9.7165 trillion KRW and an operating profit of 469.3 billion KRW next year, increasing by 23.33% and 99.03% respectively compared to the previous year.

Researcher Han Young-su emphasized, "Considering that the shipbuilding cycle is very long, concerns about a peak-out in the market are unnecessary to prove. It is an overreaction to worry that the shipbuilding market, which has been recovering since the end of 2020, will reverse downward in just three years."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)