Interest Rate Cut, Bitcoin Spot ETF Expectations Drive Surge

Halving Scheduled for April Next Year Also a Positive Factor

Institutional Interest in Coin Investment Rises... "Increased Possibility of Upward Trend"

During the crypto winter, the price of Bitcoin, the representative virtual asset of the crypto spring, is showing a sharp upward trend. Multiple positive factors, including expectations of interest rate cuts and the approval of Bitcoin spot exchange-traded funds (ETFs), have combined to push the price above the $44,000 mark. Unlike in the past, not only individual investors but also institutional investors have shown interest, leading to forecasts of a sustained upward trend.

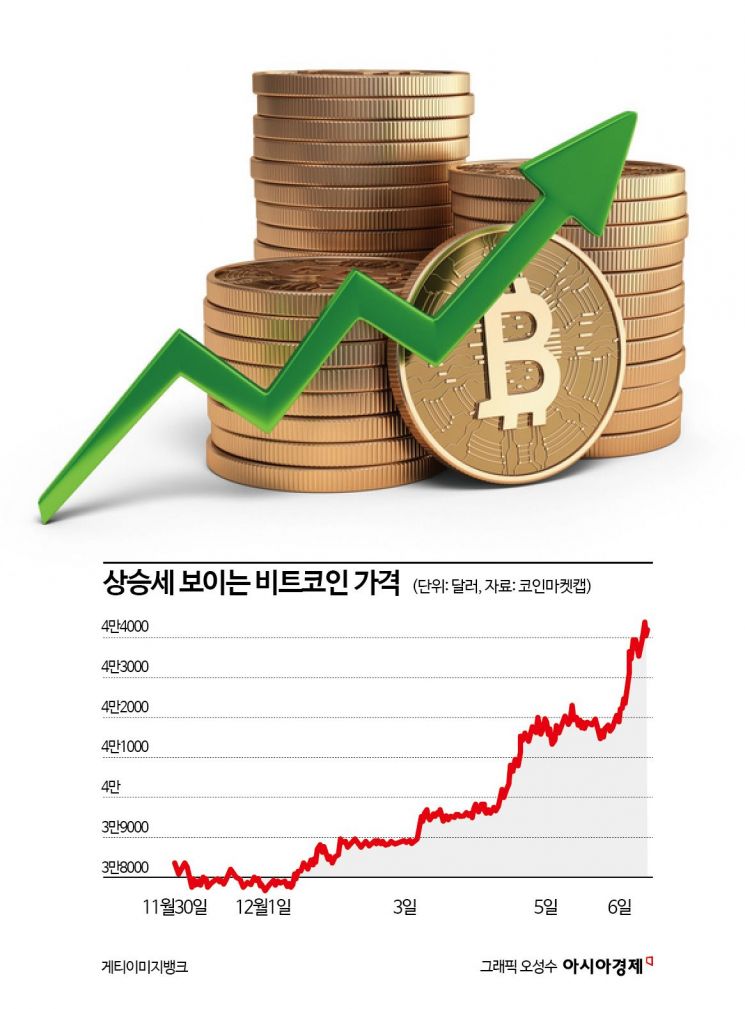

According to the global virtual asset market tracking site CoinMarketCap, as of 10:03 AM on the 6th, Bitcoin's price rose 5.20% from the previous day to $44,058 (approximately 57.85 million KRW). Around 7:30 AM on the same day, it surpassed $44,400, marking the highest level since April last year. Although the price slightly declined in the afternoon, hovering around the $43,700 range, it still increased by more than 15% and 25% compared to one week and one month ago, respectively.

The sharp rise in Bitcoin's price is due to several positive factors coinciding. First, alongside expectations of interest rate cuts, the U.S. Securities and Exchange Commission (SEC) is anticipated to approve the listing of Bitcoin spot ETFs, which has fueled the price increase. In particular, if Bitcoin spot ETFs are approved, it is expected that large-scale funds from institutions will flow into the virtual asset market. Since asset management companies operating these ETFs must hold underlying assets roughly equivalent to the amount under management, it is also expected that Bitcoin purchases will increase.

Moreover, the upcoming halving event, expected in April next year, is positively influencing the price. The Bitcoin halving refers to the point when the number of Bitcoins rewarded for block mining is cut in half. This event occurs when 210,000 blocks have been generated.

The Bitcoin halving is not set to a specific date but happens when 210,000 blocks are mined. The industry generally expects a Bitcoin halving every four years. Bitcoin's total supply is capped at 21 million, and it is projected that no more Bitcoins will be mined after 2140. When the halving occurs, the reward for mining a block is halved, reducing the supply of Bitcoins entering the market. After the halving expected in April next year, the block reward will decrease to 3.125 Bitcoins.

Thanks to these positive factors, rosy forecasts are emerging for Bitcoin's price. Standard Chartered predicted in a report that Bitcoin's price will surpass $100,000 by the end of next year. Sisi Lu McCalman, founder of blockchain advisory firm Ben Link Partners, said, "If there are no major corrections due to the halving and Federal Reserve (Fed) interest rate cuts, Bitcoin could run toward $50,000."

Jung Seok-moon, head of the research center at Korbit, explained, "The recent sharp rise is believed to be a combined effect of the possibility of interest rate cuts and expectations for the approval of Bitcoin spot ETFs." He added, "There is a possibility of slight price corrections in some segments, but this is common to most assets. Even if slight corrections occur, the medium- to long-term trend is likely to remain upward."

Furthermore, increased interest from institutions in virtual asset investments marks a difference from past bull markets. With the approval of Bitcoin spot ETFs, institutional funds are expected to flow in, and the perception of virtual assets as a type of asset is spreading, leading to optimistic expectations that the market could be reorganized and expanded around institutions. However, in South Korea, institutional investment in virtual assets is currently not permitted. Jung said, "As can be seen from the growing expectations for Bitcoin spot ETF approval, institutional investors' interest is currently quite significant."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)